You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Evening trading US shares

- Thread starter Mr. Charts

- Start date

- Watchers 80

tafita

Guest

- Messages

- 191

- Likes

- 23

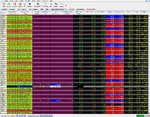

Just 4 trades today, all losers for various reasons as per attached screen shot of executed orders. The first trade, a short on ADI, was alerted to me by the rules as per strategy 1 i.e. Market direction, sector outperforming market, stock outperforming, or in this case, the sharpest falling stock in the sharpest falling sectors after the 1st 30 mins. Did not use MACCI as an entry but placed on the short on the basis of low risk, i.e. if it breaks the line indicated on the chart at 36.66 it should go lower based on market/sector direction. Low risk because market stop was tight set at 36.85. Too tight since this was the reason for the loss. If the stop had been a few ticks higher, woulda/coulda/shouda etc, etc. It's hard to say where I would of got out if it had run, probably around 36.34 i.e just above the grey crucifix on the following candle. The next two trades on Nem were classic newbie errors: buying the stock ON the breakout/test of resistance instead of waiting for confirmation with volumes. Twice. If someone could let me know how to trade these properly, I would appreciate that. 🙄

The last trade on AAPL was a case of inexperience. I shorted just after the break of the opening candle as indicated with the downarrow and watched as the stock hit rock bottom at 130.00. I say rock bottom because the level two screen clearly showed resitance as the freefall on T&S slowed down and the bid never once went below 130.00 but did show it, fleetingly. This is when I should have covered but hesitated due to inexperience. I did manage to get the stop to breakeven where I was stopped out. I am now wondering if I should in the future use the matrix window in TS to manage open positions as this seems to be a quicker way of managing them and you can see at what price sales are printing. Any thoughts on this and any of the above would be appreciated. -$36.00

Tafita

PS I also shorted the DOW pre market on a virtual spreadtrading account which resulted in 46 pips based purely on sentiment and the collapse of the YM just after 1.30PM

The last trade on AAPL was a case of inexperience. I shorted just after the break of the opening candle as indicated with the downarrow and watched as the stock hit rock bottom at 130.00. I say rock bottom because the level two screen clearly showed resitance as the freefall on T&S slowed down and the bid never once went below 130.00 but did show it, fleetingly. This is when I should have covered but hesitated due to inexperience. I did manage to get the stop to breakeven where I was stopped out. I am now wondering if I should in the future use the matrix window in TS to manage open positions as this seems to be a quicker way of managing them and you can see at what price sales are printing. Any thoughts on this and any of the above would be appreciated. -$36.00

Tafita

PS I also shorted the DOW pre market on a virtual spreadtrading account which resulted in 46 pips based purely on sentiment and the collapse of the YM just after 1.30PM

Attachments

Last edited:

timsk

Legendary member

- Messages

- 8,837

- Likes

- 3,538

Hi Tafita,

Well done on posting your trades and accompanying notes. My comments should be taken with a pinch of salt as they are based on observation rather than practical experience as I'm not (yet) actively day trading.

1. ADI

Your notes say that "it breaks the line indicated on the chart at 36.66 it should go lower based on market/sector direction". According to your TS order tab you went short @ $36.72 at 3.20pm - NOT $36.66. Your proposed entry point would have been very good had you stuck to your game plan and waited for the breach of the $36.66 line and gone short on the 3.35pm candle. I don't know what your exit criteria are but, as the chart shows, there was a good 30 cent profit on the table had you got out when the momentum slowed up and price consolidated around the low of the day at $36.30 ish. The narrow range doji on increased volume at 4.05 might have set the alarm bell ringing for many traders. I know, easy to say in hindsight!

2. NEM

I think you were a little unlucky in these trades. However, neither of the two 'indicators' on your chart - volume and the EMA - support long positions (or short ones come to that either). Interpreting volume is something of a minefield and I'm not qualified to offer advice on the subject. All I can say is that if I were in your shoes, I would have been a lot more comfortable and confident about the prospects of both trades had they been accompanied by an increase in volume. As it is, volume had, more or less, been dropping right from the off. In fact, volume was substantially lower on your second attempt than it was on the first - not a good sign at all in my book; others might disagree. The EMA up to this point is pretty flat to choppy. Not really what you want for a strong breakout directional trade. Like I said earlier, I think you were a tad unlucky and I accept completely that my comments are easy and obvious with the benefit of hindsight.

3. AAPL

You say that you're inexperienced. A fast moving high priced stock isn't the sort of instrument to cut your teeth on with real money in the market, IMO. If I were you, I'd play stocks like these for fun in your demo SB account until you've got a bit more experience. The attraction to AAPL and stocks like it is obvious, but the associated risks for the inexperienced trader are huge.

Anyway, good on you for posting your trades and good luck in the future.

Tim.

Well done on posting your trades and accompanying notes. My comments should be taken with a pinch of salt as they are based on observation rather than practical experience as I'm not (yet) actively day trading.

1. ADI

Your notes say that "it breaks the line indicated on the chart at 36.66 it should go lower based on market/sector direction". According to your TS order tab you went short @ $36.72 at 3.20pm - NOT $36.66. Your proposed entry point would have been very good had you stuck to your game plan and waited for the breach of the $36.66 line and gone short on the 3.35pm candle. I don't know what your exit criteria are but, as the chart shows, there was a good 30 cent profit on the table had you got out when the momentum slowed up and price consolidated around the low of the day at $36.30 ish. The narrow range doji on increased volume at 4.05 might have set the alarm bell ringing for many traders. I know, easy to say in hindsight!

2. NEM

I think you were a little unlucky in these trades. However, neither of the two 'indicators' on your chart - volume and the EMA - support long positions (or short ones come to that either). Interpreting volume is something of a minefield and I'm not qualified to offer advice on the subject. All I can say is that if I were in your shoes, I would have been a lot more comfortable and confident about the prospects of both trades had they been accompanied by an increase in volume. As it is, volume had, more or less, been dropping right from the off. In fact, volume was substantially lower on your second attempt than it was on the first - not a good sign at all in my book; others might disagree. The EMA up to this point is pretty flat to choppy. Not really what you want for a strong breakout directional trade. Like I said earlier, I think you were a tad unlucky and I accept completely that my comments are easy and obvious with the benefit of hindsight.

3. AAPL

You say that you're inexperienced. A fast moving high priced stock isn't the sort of instrument to cut your teeth on with real money in the market, IMO. If I were you, I'd play stocks like these for fun in your demo SB account until you've got a bit more experience. The attraction to AAPL and stocks like it is obvious, but the associated risks for the inexperienced trader are huge.

Anyway, good on you for posting your trades and good luck in the future.

Tim.

Trader333

Moderator

- Messages

- 8,766

- Likes

- 1,030

Tafita,

From the trades you have posted it appears to me that your stops are too close to your entries. When entering a trade do you take into consideration the volatility of the stock being traded ? If not it is worth looking into and then adjusting your position size relative to the volatility.

Paul

From the trades you have posted it appears to me that your stops are too close to your entries. When entering a trade do you take into consideration the volatility of the stock being traded ? If not it is worth looking into and then adjusting your position size relative to the volatility.

Paul

tafita

Guest

- Messages

- 191

- Likes

- 23

Thanks for your contributions. Paul, I have not yet employed the ATR in determining risk yet although of course I will now! Timsk, thanks for the feedback, trading stocks like AAPL at my level should be done with caution and as you suggest not be traded at all. I will look at trading stocks below $90 mark or with some other measure such as volatility/ATR. Splitlink, not sure what you are on about my friend🙄

Back later, I'm off to watch Englands first pool game

Tafita

Back later, I'm off to watch Englands first pool game

Tafita

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

This is me for the day and I be back later to trade more ,,,

I was 2000 Short OPD over night as i took position on Friday when I got home. I was concerned about market direction @ open so I hedged SNDK against a possible spike..

The Market cycle came to the end soon ( check the 10 min INDU MACCI ) and I closed SNDK and added 1000 to OPD.. I am all out now and wont be trading till later.

SNDK , NVDA, INTL are highly correlated so technically I could have hedged any one of the above.

OPD will be oscaillating till 7 and i doubt if it is worth to be in it . I could be wrong ..

PS:__ Does any one know if i can attach a QUICKTIME MOVIE file to the POSTS as i am thinking of adding a few TIPS for traders in a VIDEO format. It is difficlut to explain every thing by TYPING ..

Grey1

I was 2000 Short OPD over night as i took position on Friday when I got home. I was concerned about market direction @ open so I hedged SNDK against a possible spike..

The Market cycle came to the end soon ( check the 10 min INDU MACCI ) and I closed SNDK and added 1000 to OPD.. I am all out now and wont be trading till later.

SNDK , NVDA, INTL are highly correlated so technically I could have hedged any one of the above.

OPD will be oscaillating till 7 and i doubt if it is worth to be in it . I could be wrong ..

PS:__ Does any one know if i can attach a QUICKTIME MOVIE file to the POSTS as i am thinking of adding a few TIPS for traders in a VIDEO format. It is difficlut to explain every thing by TYPING ..

Grey1

Attachments

Trader333

Moderator

- Messages

- 8,766

- Likes

- 1,030

Iraj,

If you ask Sharky then I am sure that it could be added. I asked for Easylanguage attachments to be able to be added and they were so I would guess the same applies to QT.

Paul

PS:__ Does any one know if i can attach a QUICKTIME MOVIE file to the POSTS as i am thinking of adding a few TIPS for traders in a VIDEO format. It is difficlut to explain every thing by TYPING

If you ask Sharky then I am sure that it could be added. I asked for Easylanguage attachments to be able to be added and they were so I would guess the same applies to QT.

Paul

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

SharkyIraj,

If you ask Sharky then I am sure that it could be added. I asked for Easylanguage attachments to be able to be added and they were so I would guess the same applies to QT.

Paul

Any chance of adding the QT format to the list..

Thanks buddy

tafita

Guest

- Messages

- 191

- Likes

- 23

Sorry I'm late, had to attend to a few family matters. Anyhow, just the one trade for me today on AMGN due to the fact I'm testing the Vwap strategy in the hope to be trading it today. The strategy I employed today was that of strategy 1 i.e market, sector, stock analysis coupled with using vwap/mpd bands for enstry/exit. As will be seen on the attachments some rules were broken in that I took the trade when the MACCI on the DOW was not showing as oversold. Instead, I took the trade based on the assumption that the stock was oscillating as was the DOW at that time of day. Secondly, that the stock was oversold on the three attached timeframes of 1, 3 and 5 mintues. Thirdly, the lower MPD band was showing at 51.17 and the VWAP line (target) was showing at 51.41. I'm unable to post charts with VWAP/MPD bands as they show incorrect price information on my charts. I knew that the price would not reach this (51.41) level since the trend, in my opinion, was bearish on the DOW. I managed a tight stop by using the matrix window hence the exit at the top of the candle as indicated.

Strictly speaking, I should have pair traded this but I simply could not find a short trade to match it hence the tight stop. Unfortunately, I did not take ATR into consideration until after the trade was executed 🙄 Any thoughts on this trade would be appreciated.

Thanks

Tafita

PS, the QT movie files sound like a great idea. Members have been able to post movie files in the past http://www.trade2win.com/boards/showthread.php?t=12872&page=3

Strictly speaking, I should have pair traded this but I simply could not find a short trade to match it hence the tight stop. Unfortunately, I did not take ATR into consideration until after the trade was executed 🙄 Any thoughts on this trade would be appreciated.

Thanks

Tafita

PS, the QT movie files sound like a great idea. Members have been able to post movie files in the past http://www.trade2win.com/boards/showthread.php?t=12872&page=3

Attachments

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

Iraj,

I see that movie files with the extension of *.mov and *.avi can be posted, is this something you can use or does it have to be QT ?

Paul

I am not sure if it has to be QT ,, I try to test this out soon and if it worked then I will post the video

grey1

tafita

Guest

- Messages

- 191

- Likes

- 23

Tafita,

Do you use Tradestation as your broker and data provider ?

Paul

Yes both are provided by Tradestation. The VWAP files you have provided gave some awsome signals yesterday and when combined properly i.e. MACCI OB etc can be very powerful.

Tafita

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

Up as seen around $600. Just thought to give a small report on the market . Market opened very strongly . When I say strongly I don’t mean based on companies, sector’s fundamentals I mean based on anticipation of Bernanke possible interest cut comment which did not materialize. Hence market did not get what it wanted. Hence as I am writing this we are all confused where the market might be heading from here on wards. This includes myself. THIS IS AS FAR AS NEWS IS CONCERNED.

Technically speaking market looks very strong and at 1711 it seems a GOOD pull back for BULLS to take a long positions in stocks such as AMGN, CELG and IMCL .. I myself wont take any long postion until I am 100 % convinced TECHNCIAL factors are dominant . I much much prefer to be SHORT AAPL ( should lack of encouragement from Bernanke dominate the market ) than take a LONG position .. APPL currently down $110 Cents..

Grey1

Technically speaking market looks very strong and at 1711 it seems a GOOD pull back for BULLS to take a long positions in stocks such as AMGN, CELG and IMCL .. I myself wont take any long postion until I am 100 % convinced TECHNCIAL factors are dominant . I much much prefer to be SHORT AAPL ( should lack of encouragement from Bernanke dominate the market ) than take a LONG position .. APPL currently down $110 Cents..

Grey1

Attachments

Last edited:

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

up $1000

APPLE DOWN as I thought it would.. APPL was the best short in my view . I scalped APPL once and made around 100 ish but was not at the PC to trade the big fall .

Muchas gracias mr market ,, AN easy day considering that most of the day I was pigeoning

PS:__ All pos closed now so no over night trade.. I might miss the open 2morrow hence closing every thing ..

Grey1

APPLE DOWN as I thought it would.. APPL was the best short in my view . I scalped APPL once and made around 100 ish but was not at the PC to trade the big fall .

Muchas gracias mr market ,, AN easy day considering that most of the day I was pigeoning

PS:__ All pos closed now so no over night trade.. I might miss the open 2morrow hence closing every thing ..

Grey1

Attachments

Last edited:

Similar threads

- Replies

- 7

- Views

- 4K