Hi everyone,

I've recently created quite powerful indicator using Hitrader website community and want to share it.

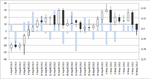

The idea is to use a portfolio of successful traders to determine a moment when to trade EURUSD. Every time if someone has EURUSD or any EUR cross long position we assign +1 to this trader and -1 in case of short one. Then we sum these numbers (50 traders) to get EURUSD Index. If it’s more than +20 we hold EURUSD long next day (one daily bar), less than -20 short. Please have a look at the attached figure. There was long on April 9, April 11, April 16, April 22, April 25 and April 30; short on April 23. So far the performance looks very good. No doubt it's just six weeks but I'm planning on getting more statistics and see how it works 🙂

Cheers. Mark

I've recently created quite powerful indicator using Hitrader website community and want to share it.

The idea is to use a portfolio of successful traders to determine a moment when to trade EURUSD. Every time if someone has EURUSD or any EUR cross long position we assign +1 to this trader and -1 in case of short one. Then we sum these numbers (50 traders) to get EURUSD Index. If it’s more than +20 we hold EURUSD long next day (one daily bar), less than -20 short. Please have a look at the attached figure. There was long on April 9, April 11, April 16, April 22, April 25 and April 30; short on April 23. So far the performance looks very good. No doubt it's just six weeks but I'm planning on getting more statistics and see how it works 🙂

Cheers. Mark