EnergyLegger

Junior member

- Messages

- 13

- Likes

- 0

Hi

A family member recently approached me to 'set him up' to trade. Reluctantly I have spent about 10 hours with him getting him started swing trading Energy Spreads. He is now up and running and demo trading whilst I talk him through some trade ideas.

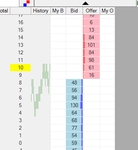

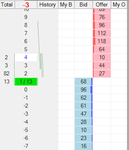

Although energy spreads sound complicated they are actually a great space to be in. The margins are very cheap and on the longer time frames H4, D, W, M they behave very differently to trading outrights. You also dont need a huge account (can start with $5k after demoing). 1st order spreads can trend very well and 2nd order spreads have useful mean reverting strategies. I have attached a chart example of a 2nd order fly spread. As you can see even while commodities have had huge volatility in the last month, this spread has been in a tight range. The name of the game has been buying 0.00s and selling 0.08s rinse and repeat, very simple and straight forward if you know what you are doing.

Anyways the point of this post is that I am thinking of producing a short video course (approx 10 hours long) which will be a 'Getting Started in Energy Spreads'. The course would be coupled with personal or group instruction from me via skype.

If you go looking for training in Energy Spreads online you wont find much if any. This is because many institutional/prop traders keep their methods closely held for obvious reasons.

Is there any interest in this here? otherwise I wont bother putting together the videos lol.

Thanks

energylegger

A family member recently approached me to 'set him up' to trade. Reluctantly I have spent about 10 hours with him getting him started swing trading Energy Spreads. He is now up and running and demo trading whilst I talk him through some trade ideas.

Although energy spreads sound complicated they are actually a great space to be in. The margins are very cheap and on the longer time frames H4, D, W, M they behave very differently to trading outrights. You also dont need a huge account (can start with $5k after demoing). 1st order spreads can trend very well and 2nd order spreads have useful mean reverting strategies. I have attached a chart example of a 2nd order fly spread. As you can see even while commodities have had huge volatility in the last month, this spread has been in a tight range. The name of the game has been buying 0.00s and selling 0.08s rinse and repeat, very simple and straight forward if you know what you are doing.

Anyways the point of this post is that I am thinking of producing a short video course (approx 10 hours long) which will be a 'Getting Started in Energy Spreads'. The course would be coupled with personal or group instruction from me via skype.

If you go looking for training in Energy Spreads online you wont find much if any. This is because many institutional/prop traders keep their methods closely held for obvious reasons.

Is there any interest in this here? otherwise I wont bother putting together the videos lol.

Thanks

energylegger