You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tradesmart

Experienced member

- Messages

- 1,286

- Likes

- 22

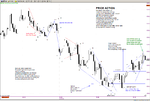

Lookin’ quite bullish for a bear flag then……?...... 😎

See the depth of the current consolidation? – about 45 points…..

Add that to the top price today, 10835, and what do you get…….?

10880………!

(Lucky I had my calculator handy…… 😉 )

See the depth of the current consolidation? – about 45 points…..

Add that to the top price today, 10835, and what do you get…….?

10880………!

(Lucky I had my calculator handy…… 😉 )

tradesmart

Experienced member

- Messages

- 1,286

- Likes

- 22

Arhhhhh plop... 🙂

Well, it's never a one-way ticket.....!. 😆

790 here we come.....

10880………!

I didn't mean to imply today.....!

tradesmart

Experienced member

- Messages

- 1,286

- Likes

- 22

Oh well, looks like my Dow Comp entry has missed by a mere couple of points....

You have to get used to these little disappointments in trading.....!...... 😆

You have to get used to these little disappointments in trading.....!...... 😆

Bigbusiness

Experienced member

- Messages

- 1,408

- Likes

- 23

I enjoyed watching the online videos about the ACD method by Mark Fisher. He is a bit loud and American but he knows his stuff. http://www.trade2win.com/boards/showthread.php?t=12695

I noticed he is in the list of 100 top traders, earning $10-15 million a year. I spent some time last week looking at how the ACD method would work on the mini dow (YM) and I think it is a good method to use when there is a low risk trade setup.

I noticed he is in the list of 100 top traders, earning $10-15 million a year. I spent some time last week looking at how the ACD method would work on the mini dow (YM) and I think it is a good method to use when there is a low risk trade setup.

Bigbusiness said:I enjoyed watching the online videos about the ACD method by Mark Fisher. He is a bit loud and American but he knows his stuff. http://www.trade2win.com/boards/showthread.php?t=12695

I noticed he is in the list of 100 top traders, earning $10-15 million a year. I spent some time last week looking at how the ACD method would work on the mini dow (YM) and I think it is a good method to use when there is a low risk trade setup.

Fisher is a class act. He is loud and obnoxious like all other NYC oil traders. But a good guy. He is an AMAZING floor trader. Maybe one of the best in the history of the business. I have been in his office at MBF in Nymex. We have a mutual friend. If you are ever in New York. Go to one of his free seminars at Nymex.

Many of the NY floor traders use the ACD method on the floor and he has upstairs traders using it as well. FWIW, it is an approach that has been duplicated by several floor traders. I do not personally know anyone who trades the method in a computer. Although, there are some in his office.

I have been using the same aproach for too long to use another and I am not a floor trader. :cheesy:

TraderTony

Active member

- Messages

- 180

- Likes

- 1

9:59 1) S 10728. It is moving down but force lacking. Stops quickly to b/e. Sharp pullback. And down again. But could be reversing at 710 level. Yep - back it comes.

10:28 EXIT: B/e. Here we go again.

[Alternative hypothetical exits: Trailing stop = +10. Target at +6 hit, +12 hit, (average +6 from 3).]

11:04 2) L 10746. And strsight up. Nice. Stops to b/e.

11:13 EXIT: +30. At last. Sweet!

[Alternative hypothetical exits: Trailing stop = +30. Target at +6 hit, +12 hit, +30 hit (average +15 from 3).]

11:26 3) L 10792. This is where I get nervous - high, just below 800 level. But it is trending hard so I'm back in. Stops to b/e. Wow.

11:29 EXIT: +30. Unreal.

[Alternative hypothetical exits: Trailing stop = +30. Target at +6 hit, +12 hit, +30 hit (average +15 from 3).]

Ok - I probably should do this but I'm away this evening for a week so will cash in there and call it quits.

+60 from 3

+57 for the day after comms.

+144 for February so far after comms. (9 trading days)

Hypothetical alternative exits:

Using +6/+12/+30 targets = +36 average

Using swing high/low trailing stop = +70

Turned out to be a good decision!

10:28 EXIT: B/e. Here we go again.

[Alternative hypothetical exits: Trailing stop = +10. Target at +6 hit, +12 hit, (average +6 from 3).]

11:04 2) L 10746. And strsight up. Nice. Stops to b/e.

11:13 EXIT: +30. At last. Sweet!

[Alternative hypothetical exits: Trailing stop = +30. Target at +6 hit, +12 hit, +30 hit (average +15 from 3).]

11:26 3) L 10792. This is where I get nervous - high, just below 800 level. But it is trending hard so I'm back in. Stops to b/e. Wow.

11:29 EXIT: +30. Unreal.

[Alternative hypothetical exits: Trailing stop = +30. Target at +6 hit, +12 hit, +30 hit (average +15 from 3).]

Ok - I probably should do this but I'm away this evening for a week so will cash in there and call it quits.

+60 from 3

+57 for the day after comms.

+144 for February so far after comms. (9 trading days)

Hypothetical alternative exits:

Using +6/+12/+30 targets = +36 average

Using swing high/low trailing stop = +70

Turned out to be a good decision!

Attachments

Similar threads

- Replies

- 0

- Views

- 1K

- Replies

- 0

- Views

- 2K