You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

Odd market, yesterday market seemed to want a breather and the SOX was on fire, today markets up for it and the SOX doesn't wanna know, real problem child. 🙂:

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

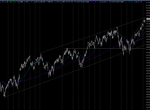

Yes Frugi, thought we might've tagged that today, maybe tomorrow Jack 🙂:Top of SPX daily channel currently 1365.

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

mark twain uk

Established member

- Messages

- 618

- Likes

- 4

Hi folks,

long time no post, have been busy losing money, am I the only one who thinks that the dow and sp are getting a bit silly and we are near a major top?

long time no post, have been busy losing money, am I the only one who thinks that the dow and sp are getting a bit silly and we are near a major top?

rav700

Senior member

- Messages

- 2,170

- Likes

- 71

mark twain uk said:Hi folks,

long time no post, have been busy losing money, am I the only one who thinks that the dow and sp are getting a bit silly and we are near a major top?

Silly is one way of putting it to me When this markets fall boy oh boy is it going to fall.....

They are saying if the GE number come out crap tommorow....the s**t will hit the fan and there will be some heavy profit taking lets wait and see have my short open for november @ 35 p.p lets see what happens my stops are at 12100 pretty far away..................

Best of luck happy trading

Rav

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

Dunno if markets are ever really anything else,they are what they are.am I the only one who thinks that the dow and sp are getting a bit silly and we are near a major top?

Dow a bit hard to guage here since it's in blue skies, if SPX clears 1366 with conviction I'd expect it to hit the .786 fib at around 1385, I think that prolly equates to about 12,150 on the Dow

mark twain uk

Established member

- Messages

- 618

- Likes

- 4

rav,

I too think that we'll see 12,000, it's such a round number they will get there by hook or by crook, the question is how nasty will be bear squeeze be? I am getting a bit tight, I was thinking about 12,100, but this too is such a predicatable stop loss, I think they will go for that as well.

I too think that we'll see 12,000, it's such a round number they will get there by hook or by crook, the question is how nasty will be bear squeeze be? I am getting a bit tight, I was thinking about 12,100, but this too is such a predicatable stop loss, I think they will go for that as well.

mark twain uk

Established member

- Messages

- 618

- Likes

- 4

rogue trader,

I am closer to your figures, I too think we'll see 1385 and 12,150, the point is, it may stop just short of that, and when it starts to drop it will spike down so heavily that if you're not in already you will miss the boat. So I've been keeping a small short just in case and kept adding to it by selling any fizzled rally with tight stop losses, only to see the stops being taken again and again. It's been a bad strategy and am in the red at the moment.

I am closer to your figures, I too think we'll see 1385 and 12,150, the point is, it may stop just short of that, and when it starts to drop it will spike down so heavily that if you're not in already you will miss the boat. So I've been keeping a small short just in case and kept adding to it by selling any fizzled rally with tight stop losses, only to see the stops being taken again and again. It's been a bad strategy and am in the red at the moment.

Considering the fact that the markets rise on good news and soar on bad news, it is safe to say that fund managers are falling over one another in order to buy. The markets will only turn when liquidity starts to dry up, one can forget psychological levels as we are in unchartered territory (at least in nominal terms) and the short sellers are unlikely to stick their heads above the parapet apart from in special situations.

That said, "THE EMPEROR HAS NO CLOTHES."

That said, "THE EMPEROR HAS NO CLOTHES."

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

That said, "THE EMPEROR HAS NO CLOTHES."

Yes he has! a very fine suit, could use a damn good ironing, but not a seam to be seen 🙂:

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

I suspect a lot of people are at that, tricky strat to employ, I have no longer term positions on, stopped out of my only long last Friday on the gap down, am only intraday now, which is predominantly what I trade anyway. You gotta watch how many points you spend in an effort to catch all the move.So I've been keeping a small short just in case and kept adding to it by selling any fizzled rally with tight stop losses, only to see the stops being taken again and again. It's been a bad strategy and am in the red at the moment.

Hats Off To Charlie !

This is what he wrote on August 29th

"The very best news that comes from this chart is that it is in perfect agreement with Ben's recent statement that the economy has now returned to "a sustainable pace of economic growth." In other words, he in effect has validated the X-Y channel for us . I had cautioned, back in the area of the B line, that the coming pull back (the green projection) would be there for a reason, and that it would be painful. So far, so good. Now for the VERY BEST NEWS.

Look at ANY trading channel. What you see is up and down movement. That's the normal, and NECESSARY market action that defines the channel. The ups are exhilarating. The downs are devastating. Remember the 1990's? Even as everything was going up, there were up and down waves. I see in chart V 305 an incoming tide on a windy day. I believe that we are done suffering through the recent trough, and headed up the next wave, as the tide carries us ever higher. Can I be more bullish? We cannot disregard the fact that we are approaching the 5th anniversary of the 9/11 attacks, as a lead in to the caveat of ",,, assuming no major negative news..." Or, I could just plain be WRONG! But, applying only good news to chart V 305, it looks like we should break Dow 12,000 before mid October."

Charlie Miller

2006-08-29

This is what he wrote on August 29th

"The very best news that comes from this chart is that it is in perfect agreement with Ben's recent statement that the economy has now returned to "a sustainable pace of economic growth." In other words, he in effect has validated the X-Y channel for us . I had cautioned, back in the area of the B line, that the coming pull back (the green projection) would be there for a reason, and that it would be painful. So far, so good. Now for the VERY BEST NEWS.

Look at ANY trading channel. What you see is up and down movement. That's the normal, and NECESSARY market action that defines the channel. The ups are exhilarating. The downs are devastating. Remember the 1990's? Even as everything was going up, there were up and down waves. I see in chart V 305 an incoming tide on a windy day. I believe that we are done suffering through the recent trough, and headed up the next wave, as the tide carries us ever higher. Can I be more bullish? We cannot disregard the fact that we are approaching the 5th anniversary of the 9/11 attacks, as a lead in to the caveat of ",,, assuming no major negative news..." Or, I could just plain be WRONG! But, applying only good news to chart V 305, it looks like we should break Dow 12,000 before mid October."

Charlie Miller

2006-08-29

leovirgo

Senior member

- Messages

- 3,161

- Likes

- 156

How's everybody doing? This time the bull season came sooner than last year. Investors feel bullish once it passed prior all time high. So this must be kind of renewed confidence among the buyers. The housing bubbles have not busted yet despite the slow down. I will start looking for short entrie over the next 2-3 weeks time.

mark twain uk

Established member

- Messages

- 618

- Likes

- 4

I hope Charlie traded according to his views, on 29th August the dow closed at 11353, that's 600 points upside

Hello all. First post on this site. Have been short on Dow from 11682. Closed it last night as I don't think anything's going to stop it going through 12000. Something a bit fishy goin' on. Bad news is not having any lasting effect. Anyway i'm out for now and will look for a short position after the Nov elections.

Similar threads

- Replies

- 3

- Views

- 2K