In the past I have been able to determine the potential trend moves using fibonacci clusters on medium to long-term charts. However, I seem to be struggling to identify the correct points where corrections usually tend to end with fibonacci clusters. In terms of corrections the fibonacci expansion tool which has been particularly useful in trends does not seem to provide much help with the 1.0 and 1.618 levels when combined with the retracement tool to create clusters of potential support or resistance zones. Could someone please suggest what a good way to identify strong support and resistance levels in a correction would be. I also tend to use volume for confirmation but would need to identify solid end of correction zones first I believe.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BuddieBuddiee

Active member

- Messages

- 150

- Likes

- 7

have you tried Danielcode ?

www.thedanielcode.com

www.thedanielcode.com

Danielcode Futures & Forex | Trading & Training

Do you know if it is free?have you tried Danielcode ?

Danielcode Futures & Forex | Trading & Training

www.thedanielcode.com

Rufus_Leakey

Established member

- Messages

- 739

- Likes

- 535

One month delayed charts claim to be free.Do you know if it is free?

Just a bit of context.

The first thing one needs to make use of Depth of Market

is a quality data feed. Don't bother with anything else until you

have that in place. Now back to my original comment below

-------------------

I have pointed this out a couple of times previously

Reading order flow is fine IF you have the skills and can keep up

with fast market conditions. Few (if any) retail traders have the skills

or the talent. I have been doing this for many years and still find it

challenging to keep up and make good decisions. What makes it

easier to is to consolidate the data using CVD (once you learn how

to set it up to achieve the proper granularity for your target market)

Then it is a matter of watching the price action at specific points in time

and matching what you see to the volume coming onto your screen.

Nothing work perfectly of course. But in my opinion it is a easier and

more accessible way to trade (for amateurs).

I will attach a chart, but without the proper background it will probably not

make much sense at first. Reading up on the subject of Cumulative Volume

Delta might be a good idea. As I have mentioned I will be LiveStreaming my

own trading in the coming days on Twitch and YouTube. I don't plan to do

that for very long, so it might be a good idea to visit and take a look. It might

help you

Postscript

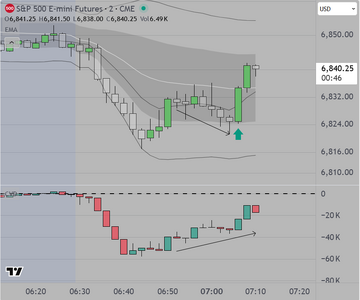

The chart shows the S&P 500 Futures Market (NY session). CVD at the bottom

setup to provide max granularity. Price action shows a breakout (B/O above a key

reference) The CVD updates at intervals that align with the B/O so (eventually) the

trader learns to see whether the breakout has legs or is stalling on low volume.

Learning to identify the components (price action & volume) accurately is what

is required for success.

PostScript

It was called to my attention that my CVD settings were incorrect.

I have removed that chart, replacing with a chart with corrected settings

I apologize for the inconvenience.

Good luck

The first thing one needs to make use of Depth of Market

is a quality data feed. Don't bother with anything else until you

have that in place. Now back to my original comment below

-------------------

I have pointed this out a couple of times previously

Reading order flow is fine IF you have the skills and can keep up

with fast market conditions. Few (if any) retail traders have the skills

or the talent. I have been doing this for many years and still find it

challenging to keep up and make good decisions. What makes it

easier to is to consolidate the data using CVD (once you learn how

to set it up to achieve the proper granularity for your target market)

Then it is a matter of watching the price action at specific points in time

and matching what you see to the volume coming onto your screen.

Nothing work perfectly of course. But in my opinion it is a easier and

more accessible way to trade (for amateurs).

I will attach a chart, but without the proper background it will probably not

make much sense at first. Reading up on the subject of Cumulative Volume

Delta might be a good idea. As I have mentioned I will be LiveStreaming my

own trading in the coming days on Twitch and YouTube. I don't plan to do

that for very long, so it might be a good idea to visit and take a look. It might

help you

Postscript

The chart shows the S&P 500 Futures Market (NY session). CVD at the bottom

setup to provide max granularity. Price action shows a breakout (B/O above a key

reference) The CVD updates at intervals that align with the B/O so (eventually) the

trader learns to see whether the breakout has legs or is stalling on low volume.

Learning to identify the components (price action & volume) accurately is what

is required for success.

PostScript

It was called to my attention that my CVD settings were incorrect.

I have removed that chart, replacing with a chart with corrected settings

I apologize for the inconvenience.

Good luck

Attachments

Last edited:

Hi Steven,

Where you went long, presumably off of the EMA, I would not have taken that trade based on the CVD. Price was going up while CVD was declining. Conflicting signals. A divergence. Bullish absorption if I am correct. Plus the CVD candles in the look back period where you took the trade were noticeably smaller than the immediate previous look back period. Indicating weakening. Based on the CVD I would have been looking for a pullback or reversal which obviously did not happen. Price moved up consistent with the close above the EMA. The look back period is also quite short with CVD resetting what appears to be every 6-9 candles or so. I am missing something here. I can't quite figure it out. Can you provide more of an explanation concerning your use of CVD.

Thanks

Where you went long, presumably off of the EMA, I would not have taken that trade based on the CVD. Price was going up while CVD was declining. Conflicting signals. A divergence. Bullish absorption if I am correct. Plus the CVD candles in the look back period where you took the trade were noticeably smaller than the immediate previous look back period. Indicating weakening. Based on the CVD I would have been looking for a pullback or reversal which obviously did not happen. Price moved up consistent with the close above the EMA. The look back period is also quite short with CVD resetting what appears to be every 6-9 candles or so. I am missing something here. I can't quite figure it out. Can you provide more of an explanation concerning your use of CVD.

Thanks

BuddieBuddiee

Active member

- Messages

- 150

- Likes

- 7

no I haven't. but I know someone who has tried it. not sure if successful. I replied to your post while I was looking at my archived stuff I saved over the years and thought I'd throw it out here.Do you know if it is free?

I've read and tried some Michael S. Jenkins stuff.

also there's GANN Murrey Math

https://www.yumpu.com/en/document/view/6222165/gann-articles

https://www.yumpu.com/en/document/read/6222165/gann-articles

right now am using the "7.8125" factor -- derived from 62.5 /8 and also the .272% - 1.854% and all the stuff you'd see where I've posted re SPX. hard to articulate.

I'm not at this site during trading hours...so that's why the late reply.

BuddieBuddiee

Active member

- Messages

- 150

- Likes

- 7

ha... nothing's free, apparently.One month delayed charts claim to be free.

View attachment 344441

The pullback you mentioned did not happen because one side gave up. You call it bullish absorption. Either way is fine.Hi Steven,

Where you went long, presumably off of the EMA, I would not have taken that trade based on the CVD. Price was going up while CVD was declining. Conflicting signals. A divergence. Bullish absorption if I am correct. Plus the CVD candles in the look back period where you took the trade were noticeably smaller than the immediate previous look back period. Indicating weakening. Based on the CVD I would have been looking for a pullback or reversal which obviously did not happen. Price moved up consistent with the close above the EMA. The look back period is also quite short with CVD resetting what appears to be every 6-9 candles or so. I am missing something here. I can't quite figure it out. Can you provide more of an explanation concerning your use of CVD.

Thanks

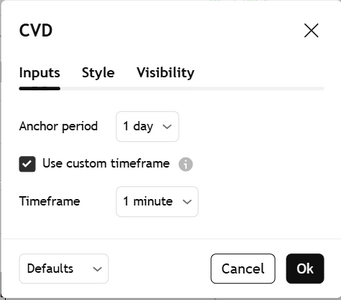

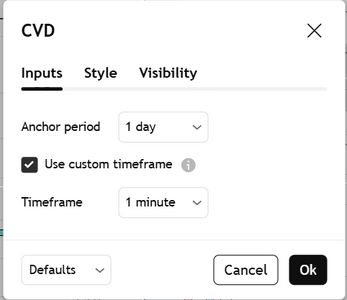

My apologies

My settings were incorrect. I should not have been posting when feeling unwell. the first attachment below shows my correct settings

The second shows the 5 min chart with the entry within the time period we spoke of.

The anchor period is 1 day (resets every day)

and the time frame is 1 min which should provide adequate granularity for intraday trading a chart with 5 min bars

Please advise if this make the chart more readable for you

Attachments

Last edited:

Thank you. The updated settings make it easier to read.

I can see one side gave up. But it is the opposite of what I would have expected based on the CVD which is confusing me.

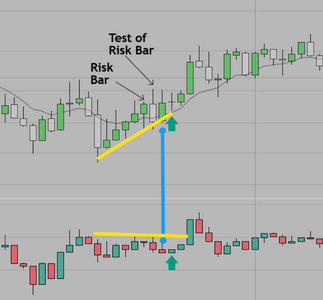

I drew a few lines on the chart. The blue line between price and the CVD shows a green bullish price candle and a red bearish CVD candle, a divergence. I am not confident with these types of divergences on low timeframes. I do like them on the daily.

The yellow lines show a second stronger divergence between price and CVD. Again, I would not have gone long here. Based only on the CVD I may have considered a short position. Looking at the close above the EMA, a long signal, with the CVD a short signal, lack of confirmation between the two would have caused me not to take this trade. I would have waited. Granted CVD divergences are common all over the charts. I only consider them when there are other reasons to take a trade. A trade was taken here.

I looked through some of your posts in different threads. You seem to use the CVD different than I do. Can you review how you use the CVD.

Hope you are feeling better.

I can see one side gave up. But it is the opposite of what I would have expected based on the CVD which is confusing me.

I drew a few lines on the chart. The blue line between price and the CVD shows a green bullish price candle and a red bearish CVD candle, a divergence. I am not confident with these types of divergences on low timeframes. I do like them on the daily.

The yellow lines show a second stronger divergence between price and CVD. Again, I would not have gone long here. Based only on the CVD I may have considered a short position. Looking at the close above the EMA, a long signal, with the CVD a short signal, lack of confirmation between the two would have caused me not to take this trade. I would have waited. Granted CVD divergences are common all over the charts. I only consider them when there are other reasons to take a trade. A trade was taken here.

I looked through some of your posts in different threads. You seem to use the CVD different than I do. Can you review how you use the CVD.

Hope you are feeling better.

Attachments

Not trading today

And for anyone interested in my opinion. Don't trade when you are impaired

I can see that I am off. So I am standing aside at this point

Posting 2 charts, the first is the Initial Read, which for me is the first possible entry

in what I call the "Buy Zone" which is near the bottom (prefer right at the edge of the 1st SD band

if possible on strong volume). A second entry would have been perfectly fine as price lifted above the

Black (9ema) on rising volume. The risk (Stop out) is below the previous bar (the tail of the previous bar).

And for anyone interested in my opinion. Don't trade when you are impaired

I can see that I am off. So I am standing aside at this point

Posting 2 charts, the first is the Initial Read, which for me is the first possible entry

in what I call the "Buy Zone" which is near the bottom (prefer right at the edge of the 1st SD band

if possible on strong volume). A second entry would have been perfectly fine as price lifted above the

Black (9ema) on rising volume. The risk (Stop out) is below the previous bar (the tail of the previous bar).

Attachments

Last edited:

To the person who started this thread, my apologies

The subject matter we are covering recently is not on topic

If you don't mind (everyone) those who are interested in my

commentary should switch over to the Thread

"A Professional Approach.....

And again I apologize I did not mean to take over this thread

The subject matter we are covering recently is not on topic

If you don't mind (everyone) those who are interested in my

commentary should switch over to the Thread

"A Professional Approach.....

And again I apologize I did not mean to take over this thread

BuddieBuddiee

Active member

- Messages

- 150

- Likes

- 7

hi again... I use GANN CIT dates...I trade SPX ( S&P 500) .. options. I ALSO enter DAILY the data on a free calendar I pick up from different companies. I know it's a crude method of doing what I'm doing...but it works (for me). am a VISUAL person -- want to see WHERE a PARTICULAR price has been -- a day low which many a times comes as a Day High and vice versa....and I look to see it in MY OWN HANDWRITING. more credible for me. right now am having some difficulty getting the snapshots onto my email and then processing it here/on other sites. ..so can't post the latest since July 2025..In the past I have been able to determine the potential trend moves using fibonacci clusters on medium to long-term charts. However, I seem to be struggling to identify the correct points where corrections usually tend to end with fibonacci clusters. In terms of corrections the fibonacci expansion tool which has been particularly useful in trends does not seem to provide much help with the 1.0 and 1.618 levels when combined with the retracement tool to create clusters of potential support or resistance zones. Could someone please suggest what a good way to identify strong support and resistance levels in a correction would be. I also tend to use volume for confirmation but would need to identify solid end of correction zones first I believe.

I look @ PREVIOUS months when a MONTHLY high & MONTHLY low happened ...

the price of 4835 was basically derived from approximate 1184 days from Jan 4th, 2022 MONTHLY "TOP" @ 4818.62

the 1184 days came from MICHAEL S. JENKINS --->

I won't overtake this pos/threadt started by you. am not certain if all of this is what you're asking/not.

Hi Steven,To the person who started this thread, my apologies

The subject matter we are covering recently is not on topic

If you don't mind (everyone) those who are interested in my

commentary should switch over to the Thread

"A Professional Approach.....

And again I apologize I did not mean to take over this thread

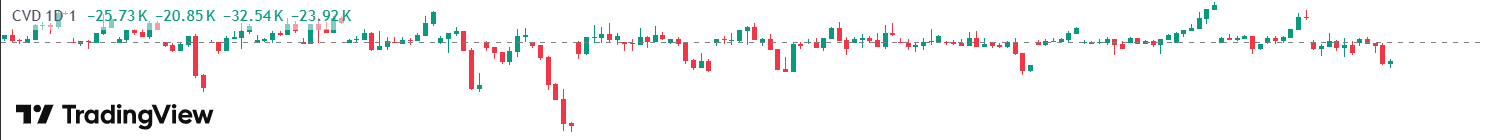

After your post about CVD I have been looking into it a little bit more. I am struggling to figure out how exactly to use it. The screenshot from below is the indicator that comes with TradingView. It does not look anything like the candlestick indicator that you are using. I did find one similar to your picture on TradingView but thought I would enquire first with you to see if you could direct me on the correct path on which indictor would be the most appropriate and how to use it. Any gudiance would be much appreciated.

Attachments

As mentioned in the previous post, please move your correspondence to

my primary thread, whose title is "A Professional Approach to Trading" so that we

can avoid hijacking this thread. As regards the Cumulative Delta Indicator I am attaching

a screen shot of my settings. If you are a trader who is struggling and want to improve

you might consider watching me trade on my LiveStream. I am working on that now and

hope to have it ready to go soon (next week). I specialize in trading the NY session of the

S&P Futures which begins in the early afternoon London time. If you monitor my thread

you will be able to obtain an invitation to join that meeting

Regarding the use of CVD (Cumulative Volume Delta), it would be a good idea to read about it

first, then to review my posts. The purpose of an indicator SHOULD be to help us improve our

result. To do that a person needs to understand what they are looking at, and how to interpret

it as it adds data to the screen. Otherwise, why use it?

Stay in touch

Good luck

my primary thread, whose title is "A Professional Approach to Trading" so that we

can avoid hijacking this thread. As regards the Cumulative Delta Indicator I am attaching

a screen shot of my settings. If you are a trader who is struggling and want to improve

you might consider watching me trade on my LiveStream. I am working on that now and

hope to have it ready to go soon (next week). I specialize in trading the NY session of the

S&P Futures which begins in the early afternoon London time. If you monitor my thread

you will be able to obtain an invitation to join that meeting

Regarding the use of CVD (Cumulative Volume Delta), it would be a good idea to read about it

first, then to review my posts. The purpose of an indicator SHOULD be to help us improve our

result. To do that a person needs to understand what they are looking at, and how to interpret

it as it adds data to the screen. Otherwise, why use it?

Stay in touch

Good luck

Attachments

Last edited:

Similar threads

- Replies

- 1

- Views

- 5K

F

- Replies

- 4

- Views

- 4K

- Article

Technical Analysis

Why Successful Traders Use Fibonacci and the Golden Ratio

- Replies

- 15

- Views

- 9K