You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

I would trade futures on an EOD basis, but the idea of switching over to hourly or smaller TFs is looking more and more attractive. I just want to get a feel for the sort of stats that come out of an hourly trading system run before I make a final decision on it.

To run my system on an hourly timeframe, the only data from disktrading that I'd be happy with is the forex data, so I wouldn't trade futures.

To run my system on an hourly timeframe, the only data from disktrading that I'd be happy with is the forex data, so I wouldn't trade futures.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Judging from what I know of your systems Travis, you won't be affected much by gaps. But I'm running moving averages and they will go haywire.

I'm certainly going to trade those 3 - I understand that even CAD and AUS are deep and liquid enough for decent trading. Funnily there isn't even one currency in the top 20 contracts by volume:

Code:[FONT=Courier New] [SIZE=3] Kospi 200 Index Options KRX 2127.98 Eurodollar Futures CME 348.2 Euro-Bund Futures Eurex 254.1 TIIE 28-Day Interbank Rate Futures Mexder 85.3 Eurodollar Options CME 160.52 E-mini S&P 500 Index Futures CME 174.5 10-Year T-Note Futures CBOT 181.27 DJ Euro Stoxx 50 Index Futures Eurex 118.1 Euribor Futures liffe 137.79 Euro-Bobl Futures Eurex 131.01 Euro-Schatz Futures Eurex 116.15 One-Day Interbank Deposit Futures BM&F 94.4 DJ Euro Stoxx 50 Index Options Eurex 76.89 5-Year T-Note Futures CBOT 102.89 S&P 500 Index Options CBOE 58.45 Taiex Index Options Taifex 62.92 30-Year T-Bond Futures CBOT 73.72 Sterling Futures liffe 56.7 E-mini Nasdaq 100 Index Futures CME 62.16 TA-25 Index Options TASE 50.14[/SIZE] [/FONT]

Great link on volume:

http://www.futuresmag.com/Issues/2010/March-2010/PublishingImages/2010TradersViewChart.pdf

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

8 weeks and counting down

Just discovered that I could get TradeStation to make an optimisation report - I always thought it was broken or a bug but I just reinstalled and it works. This should make optimisation a little easier.

I'm going to finish off optimising this futures basket on this system, but then I'm moving over to forex intra-day data for my systems.

This will involve huge amounts of work, I definitely need all 8 weeks to code up my java app to work on an hourly basis and submit orders robustly.

I need a new project plan.

Just discovered that I could get TradeStation to make an optimisation report - I always thought it was broken or a bug but I just reinstalled and it works. This should make optimisation a little easier.

I'm going to finish off optimising this futures basket on this system, but then I'm moving over to forex intra-day data for my systems.

This will involve huge amounts of work, I definitely need all 8 weeks to code up my java app to work on an hourly basis and submit orders robustly.

I need a new project plan.

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

same old same-old

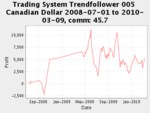

Canadian Dollar - more frustration.

-$396 per trade in the basket. (basket of futures in #90 above)

Reoptimised it on its own to -$6 per trade, bit of a drawdown admittedly.

The walk-forward though was -$0.50 per trade. Hmm, actually that is an improvement on the optimisation, but the basket's walk-forward for CD was +$1050

I suppose it looks like a more robust result. Is that good or bad or just meaningless?

Canadian Dollar - more frustration.

-$396 per trade in the basket. (basket of futures in #90 above)

Reoptimised it on its own to -$6 per trade, bit of a drawdown admittedly.

The walk-forward though was -$0.50 per trade. Hmm, actually that is an improvement on the optimisation, but the basket's walk-forward for CD was +$1050

I suppose it looks like a more robust result. Is that good or bad or just meaningless?

Attachments

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Hello, I didn't pay more than 100 dollars but I wasn't happy with the data they gave me at DT this time (usually I am). Three symbols were perfect:

Sugar (NYBOT)

Natural Gas (NYMEX)

AUD (CME - GLOBEX)

The other 4 symbols I bought weren't satisfactory for the following reasons:

CME'S:

CAD CADA0-15min.txt (they gave me the forex data, which is inverted to the USD, and not the future's data, which is what I need)

CHF CHFA0-15min.txt (they gave me the forex data, which is inverted to the USD, and not the future's data, which is what I need)

ECBOT'S:

ZC CK0-15min.txt (5 hours vs the 20 hours it trades on IB's TWS)

ZS SK0-15min.txt (5 hours vs the 20 hours it trades on IB's TWS)

I won't complain to Disktrading, because I only spent 50 dollars on the bad data, and they don't got the good data anyway, so no point in arguing.

No point in posting this stuff on the DiskTrading thread, since the "look elsewhere" expert won't tell us where the good data is.

Sugar (NYBOT)

Natural Gas (NYMEX)

AUD (CME - GLOBEX)

The other 4 symbols I bought weren't satisfactory for the following reasons:

CME'S:

CAD CADA0-15min.txt (they gave me the forex data, which is inverted to the USD, and not the future's data, which is what I need)

CHF CHFA0-15min.txt (they gave me the forex data, which is inverted to the USD, and not the future's data, which is what I need)

ECBOT'S:

ZC CK0-15min.txt (5 hours vs the 20 hours it trades on IB's TWS)

ZS SK0-15min.txt (5 hours vs the 20 hours it trades on IB's TWS)

I won't complain to Disktrading, because I only spent 50 dollars on the bad data, and they don't got the good data anyway, so no point in arguing.

No point in posting this stuff on the DiskTrading thread, since the "look elsewhere" expert won't tell us where the good data is.

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

Not a bad result from Euro

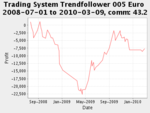

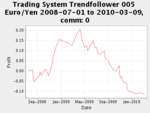

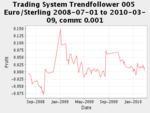

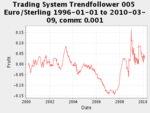

The optimisation and walk-forward for the Euro are interesting.

Again, the walk-forward wasn't profitable, because this time it lost money during the big 2008 credit crunch surge. But the rest of the walk-forward was profitable.

This should have a positive effect on the whole basket.

Although it looks too unreliable. Big drawdowns for a single contract.

The optimisation and walk-forward for the Euro are interesting.

Again, the walk-forward wasn't profitable, because this time it lost money during the big 2008 credit crunch surge. But the rest of the walk-forward was profitable.

This should have a positive effect on the whole basket.

Although it looks too unreliable. Big drawdowns for a single contract.

Attachments

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Yesterday I realized what you meant when you said that you would rather use forex than futures, as far disktrading intraday data. Forex has more hours and more data, and it doesn't have any jumps from one contract to the next. So I decided I will also use forex data when this is possible, like for the recently bought AUD data.

However, this is not possible for CHF and CAD, because the forex data is reversed with respect to the future. For example, for futures you have how many USD you need for a CAD. In forex instead you have how many CAD it takes for a USD. This would kind of screw up my testing and automation, since I trade futures and not forex.

For EUR, AUD, GBP this problem doesn't apply.

However, this is not possible for CHF and CAD, because the forex data is reversed with respect to the future. For example, for futures you have how many USD you need for a CAD. In forex instead you have how many CAD it takes for a USD. This would kind of screw up my testing and automation, since I trade futures and not forex.

For EUR, AUD, GBP this problem doesn't apply.

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

finally one walkforward is ok - gold

Gold looks alright.

Only comment is that I was cutting corners and didn't see that the bulk of the profit came from two short periods in the optimisation window, which reduces the chances of a good walk-forward, but it was good anyway.

Gold looks alright.

Only comment is that I was cutting corners and didn't see that the bulk of the profit came from two short periods in the optimisation window, which reduces the chances of a good walk-forward, but it was good anyway.

Attachments

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

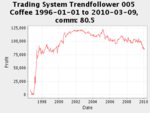

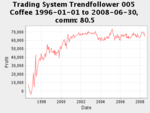

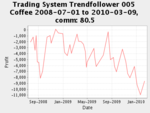

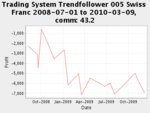

Caught out by coffee

This is what you get for trying to trade weird commodities.

I'll do it again because I never would have chosen this optimisation if I'd been patient enough to look at the equity curve. I wish there was a decent statistic that let you know that an equity curve had this shape. Maybe there is, but it's definitely not in TradeStation 4.

This is what you get for trying to trade weird commodities.

I'll do it again because I never would have chosen this optimisation if I'd been patient enough to look at the equity curve. I wish there was a decent statistic that let you know that an equity curve had this shape. Maybe there is, but it's definitely not in TradeStation 4.

Attachments

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

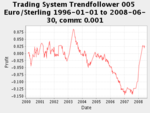

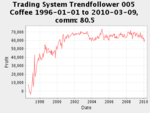

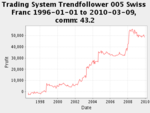

Swiss Franc

knew this walk-forward would be unprofitable. Could be OK though, fits the optimisation perhaps, could also be a bit curve-fit.

This is looking bad for the overall results for the basket.

knew this walk-forward would be unprofitable. Could be OK though, fits the optimisation perhaps, could also be a bit curve-fit.

This is looking bad for the overall results for the basket.

Attachments

Last edited:

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

SP credit crunch surge boosts result, otherwise mediocre

In real trading, would probably prefer a poke in the eye with a sharp stick rather than having to trade this optimisation.

One more to go.

In real trading, would probably prefer a poke in the eye with a sharp stick rather than having to trade this optimisation.

One more to go.

Attachments

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

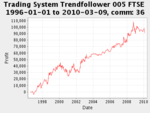

FTSE, the last of the optimisations, finally

And the stunning result of the walkforward for FTSE, 18 months and 76 trades, the grand total profit is ..... fifty six quid!!!! :jester:

I think it's curve fit.

Disappointing, I thought the optimised equity curve looked really stable. I was expecting a good profit from it.

Now to patch the whole lot together in a basket and collate the results, to see if this whole long dull optimisation process actually made any significant improvement.

Just looking at them all by eye, I honestly don't think it made any difference. We shall see.

And the stunning result of the walkforward for FTSE, 18 months and 76 trades, the grand total profit is ..... fifty six quid!!!! :jester:

I think it's curve fit.

Disappointing, I thought the optimised equity curve looked really stable. I was expecting a good profit from it.

Now to patch the whole lot together in a basket and collate the results, to see if this whole long dull optimisation process actually made any significant improvement.

Just looking at them all by eye, I honestly don't think it made any difference. We shall see.

Attachments

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

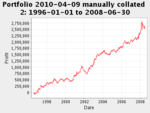

re-optimisation of individual contracts in basket

This is the original, simple optimisation of the whole basket of 25 futures,

the optimisation is the column on the right.

So I re-optimised the markets that were loss-making in the optimisation period (AD, BF, BP, C, CB, CC, CD, EC, EJ, GB, GC, SF, SP, X)

Theoretically I could have done better if I'd re-optimised every market, but that would have taken another few days due to the snails pace I work at.

So I think it demonstrates a slight improvement. In reality though I guess the whole thing is inconclusive because of the massive surge in profit through 2008. After that, in 2009, the walk-forward was loss-making.

There was only one optimisation that was loss-making in 2nd half 2008 and I think it was coffee.

This is the original, simple optimisation of the whole basket of 25 futures,

the optimisation is the column on the right.

So I re-optimised the markets that were loss-making in the optimisation period (AD, BF, BP, C, CB, CC, CD, EC, EJ, GB, GC, SF, SP, X)

Theoretically I could have done better if I'd re-optimised every market, but that would have taken another few days due to the snails pace I work at.

So I think it demonstrates a slight improvement. In reality though I guess the whole thing is inconclusive because of the massive surge in profit through 2008. After that, in 2009, the walk-forward was loss-making.

There was only one optimisation that was loss-making in 2nd half 2008 and I think it was coffee.

Attachments

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

Still counting - 7 weeks to go

Moving up from daily to intra-day data is taking its time.

To cut out all the faffing around with continuous contracts which would take far too long and isn't possible with disktrading data because of the gaps at roll-over due to no back-adjustment, I'm going with forex only.

I have data from 1998 to present. About 10 gigs worth.

It's taken me hours and hours to download it, decompress it and import it into NinjaTrader.

TradeStation4 finally proved to be to puny for the task. I got crashes trying to import the data and then out-of-disk-space errors which I couldn't work out since it had lots of room. Must have been using a temp directory on the C: system drive.

Moving up from daily to intra-day data is taking its time.

To cut out all the faffing around with continuous contracts which would take far too long and isn't possible with disktrading data because of the gaps at roll-over due to no back-adjustment, I'm going with forex only.

I have data from 1998 to present. About 10 gigs worth.

It's taken me hours and hours to download it, decompress it and import it into NinjaTrader.

TradeStation4 finally proved to be to puny for the task. I got crashes trying to import the data and then out-of-disk-space errors which I couldn't work out since it had lots of room. Must have been using a temp directory on the C: system drive.

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

Euro USD tick data imported

Huzzah! I finally finished importing the tick data for EUR:USD into NinjaTrader, which took practically 8 hours of faffing around decompressing and renaming files.

I also had to edit one of the files because it had one day out of sequence which NinjaTrader wouldn't import. Interesting that I had to use VI because no other editor I could find would open the 5 million line file.

Doing the other forex pairs is possibly going to take me another 9 days.

By that time there should be an update available from disktrading for the data, and then theoretically I should be able to leave NinjaTrader running and it will collect the ticks itself.

Not sure how all this will work but it sounds like the computer's going to be running 24x7 from now on.

Huzzah! I finally finished importing the tick data for EUR:USD into NinjaTrader, which took practically 8 hours of faffing around decompressing and renaming files.

I also had to edit one of the files because it had one day out of sequence which NinjaTrader wouldn't import. Interesting that I had to use VI because no other editor I could find would open the 5 million line file.

Doing the other forex pairs is possibly going to take me another 9 days.

By that time there should be an update available from disktrading for the data, and then theoretically I should be able to leave NinjaTrader running and it will collect the ticks itself.

Not sure how all this will work but it sounds like the computer's going to be running 24x7 from now on.

Similar threads

- Replies

- 2

- Views

- 3K