I nailed down the transaction costs - slippage and commission - on the two strategies I'm working on. I think realistic level is for every round-turn is 0.00024 or 24 currency units per 100,000.

I base this on:

- 0.4 ticks commission

- 3 ticks slippage on stop orders, which only make up 1/3 of the strategies' executions. The other executions are limit orders. So that's 1 tick slippage on average per round-turn

- 1 tick just in case because of stuff like the spread (I buy at the ask and sell at the bid, but my tick data is based on reported trade prices).

Saying that this is conservative is a bit of a joke, it's not conservative at all, but the higher the transaction costs, the more my results tend towards longer term systems. But using anything unrealistically low for transaction costs leads to high frequency systems which are unrealistic unless I was working in an HFT set-up.

My Holy Grail would be a system that shows results (across a basket) with mostly positive monthly profits and a profit per trade of about $25 over and above transaction costs.

So what I have at the moment is still a way's away from Holy Grail status.

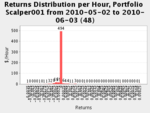

My Scalper2010 system makes simple 1-bar-only style trades on the hourly timeframe. For long trades, it buys at a limit set at the min of the previous 3 lows, and it exits at the end of the bar using a limt & stop order bracket on the 1 min timeframe.

If I didn't filter the trades I'd get about 3 trades a day. So I'm running through all the different types of filter I could use to see if anything works, alone or in combination, e.g. MA[0] > MA[1], high overlap, low negative volatiliity / positive volatility, ADX, low candle length / ATR, bullish Haramis (or no bearish Haramis)

Scalper2010 on the EUR/CHF is my Holy Grail, almost - without any filter. Just entering and exiting. The only problem is that it fails badly every year for a month, and it seems to have failed completely every month this year, bizarrely (or Sod's Law perhaps). Its equity curve looks more like a stock market chart than an equity curve. It's interesting to see why, looking at the different market behaviours during those periods.

The other strategy is called with great originality "TrendFollower". It's a mean reversion system. OK, OK, it is actually a trend follower.

It uses limit order entries like Scalper2010 but with a different trigger using volatility, sometimes a whole ATR for the timeframe, sometimes a factor of 0.5 depending on market behaviour. I've been dividing up the market behaviours into different types defined by its own algorithm.

For instance, a rampant bull or bear is defined by consecutive big candle bodies with small or no overlap. These occur more and for more bars on the 60min timeframe compared to daily, but they still only last for relatively short number of bars, normally 3 or 4 and then the move is over, so I identify these market types based purely on the last two maybe 3 bars.

Again like Scalper, I set filters, often based on the same market type definitions.

As for exits, I use a parabolic trailing stop, which is hit approx 1/3 of the time, and when it gets close, I replace it with a limit / stop order bracket which forces the exit. I guess I throw away some potential for bigger moves picking up again, but I think that's too infrequent to worry about and the bracket exit gives me a 33% chance of a limit order exit with no slippage.

So those are my lego bricks and I get to play all day at putting them together into trading systems - at long last after struggling with NinjaTrader and NinjaScript for so long.

Today I'll devote half my time to each, just looking at price action in the charts and creating algorithms to fit market behaviours, backtesting and re-backtesting. (Yes I know I use the word fit and the alarm bells went off, but it's not curve fitting, it's identifying market behaviours, perhaps 4 or 6 max across all markets).

It's not all rosy in the garden though - I've blown through my deadline and the first thought in my head when I wake up is "I don't have a working system". So it really feels like I'm looking for a break-through now on the system development, which has replaced the confidence that I'd be bound to find something. If it gets to the weekend and Thurs, Fri and Saturday haven't brought anything useful, it's going to be a time for tough decisions again. How many times have I been here before? I'm going to go and ponder that over a coffee, and wrack my brains to make sure I haven't forgotten something fundamental that cost so much to learn.