Compared the strategy to a hedge fund

Here is the

how to:

If you want to evaluate your strategy properly, use a strong LLM to calculate all the relevant metrics. Trust me - if it can calculate time dilation from the Schwarzschild metric near a black hole, it can compute your Sharpe ratio.

Risk-adjusted metrics and benchmark choice depend on the type of your strategy. For example, if it is market-neutral FX (like mine), it makes no sense to benchmark it like a long-only stock portfolio. The LLM needs to understand whether you are running trend-following, mean reversion, market-neutral etc. Show it and explain everythig.

Next, show it your daily returns - that gives much more statistical power. Monthly works too, but less accurate.

Make it calculate the fllowing:

• CAGR

• Sharpe ratio

• Sortino ratio

• Calmar ratio

• Beta

• Absolute alpha

• CAPM alpha

• Alpha t-stat

Important: the larger the data sample, the stronger the statistical confidence. Early metrics can look amazing simply because of a small sample size.

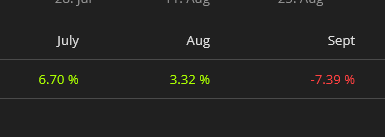

Below are my current figures. In my case, any comparison to a typical hedge fund is statistically limited, because my live sample is only 10 months old. For a meaningful comparison, you would ideally want 5+ years old.

View attachment 345627

View attachment 345628

View attachment 345629

View attachment 345630