Welcome to our new friend

@QAVinversion !

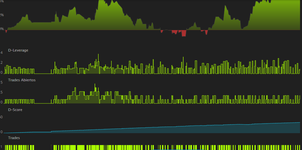

Here we have a promising young darwin:

->

https://www.darwinex.com/darwin/QAV

Can you expand a bit about your strategy?

Is it manual or automated?

What about style and timeframes?

Thank you,

First of all I hope that my text will be understood.

I'm surprised because I didn't ask for a thread, I appreciate it.

I will answer the 3 questions to be brief.

1. i trade on 4h time frames, 1D, 1W, different pairs with emphasis on JPY. for trend and counter trend, I don't use martingale, no averaging, nothing like that.

My maximum DD is 1.33% in subyacent and 2% approx in darwin ( per day, I use SL) , with unlimited potential profits, I do not use take profit, I close at the end of the newyork day, this as this operation ( taking into account that I open in the tokyo session and the operation can close by touching the stop lost )

I plan to deposit money to the account from the 50 dscore.

2. i trade manually, i don't know much about programming in mt4, but my strategy is programmable, no doubt about it, and of course i would like to do it at some point.

3. my operations have a duration ranging from x hours to a maximum of 20 hours, at some point (February) I was mixing another strategy, but it was too much risk for me, so I consider myself a trader, somewhat conservative, I aspire to make a living from this. Daily I do a follow up of what I did, to check where I was wrong and how many points I lost according to my reference which is the backtesting (12 years approximately).

I would like to receive questions, reviews, and some follow up. I am not trying to promote my Darwin, because, if my trading plan is good, QAV should show results by itself.

Translated with

www.DeepL.com/Translator (free version)