CabedoClenow

Junior member

- Messages

- 20

- Likes

- 14

Hello everyone,

I'm opening this thread to provide updates on the progress of Darwin CLN.

https://www.darwinex.com/darwin/CLN

The investment strategy is a modified version of the system described in the book "Stocks on the Move" by Andreas F. Clenow. In summary, it's a stock selection system for US stocks based on the momentum factor.I started operating the system approximately a year ago on Darwinex to make it easier for my family and friends to follow.

On my X profile (Twitter), I regularly update the portfolio's stock situation and its results.

https://twitter.com/Cabedovestment

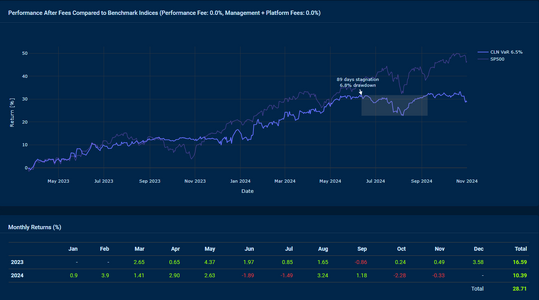

During these initial months of investment, we've had the opportunity to test the main features that make the system a good long-term investment. We initiated the investment in March with the RISK ON signal and went through a RISK OFF period from August to November 2023. The results obtained so far are quite acceptable, and while the system hasn't outperformed the SP500 index, it has achieved a close return while significantly reducing investment volatility.

To ensure that the original system published in the book works, I have implemented a version of it in Quantconnect to study its behavior in the years following the book's publication. The results can be found in the following post, and the code can be cloned by anyone for modifications and attempts to improve it.

https://www.quantconnect.com/forum/...e-quot-momentum-strategy-by-cabedovestment/p1

On my Twitter profile, you can find statistics for the improved system I implemented on Darwinex, which I extended to evaluate its performance during the 2008 crisis.

If you are intrigued by the potential of the Darwin CLN strategy and its resilient performance through varying market conditions, I invite you to join our community of investors. The journey has been marked by adaptability and consistent results, and we believe there is room for growth and success in the long run. Feel free to explore the Darwinex link for more detailed insights, and don't hesitate to reach out if you have any questions or if you're considering becoming a part of this investment venture. Your interest and participation contribute to the collective success of the Darwin CLN, and we welcome new investors to join us on this exciting investment path.

Let's navigate the markets together and build a future of financial prosperity!

I'm opening this thread to provide updates on the progress of Darwin CLN.

https://www.darwinex.com/darwin/CLN

The investment strategy is a modified version of the system described in the book "Stocks on the Move" by Andreas F. Clenow. In summary, it's a stock selection system for US stocks based on the momentum factor.I started operating the system approximately a year ago on Darwinex to make it easier for my family and friends to follow.

On my X profile (Twitter), I regularly update the portfolio's stock situation and its results.

https://twitter.com/Cabedovestment

During these initial months of investment, we've had the opportunity to test the main features that make the system a good long-term investment. We initiated the investment in March with the RISK ON signal and went through a RISK OFF period from August to November 2023. The results obtained so far are quite acceptable, and while the system hasn't outperformed the SP500 index, it has achieved a close return while significantly reducing investment volatility.

To ensure that the original system published in the book works, I have implemented a version of it in Quantconnect to study its behavior in the years following the book's publication. The results can be found in the following post, and the code can be cloned by anyone for modifications and attempts to improve it.

https://www.quantconnect.com/forum/...e-quot-momentum-strategy-by-cabedovestment/p1

On my Twitter profile, you can find statistics for the improved system I implemented on Darwinex, which I extended to evaluate its performance during the 2008 crisis.

If you are intrigued by the potential of the Darwin CLN strategy and its resilient performance through varying market conditions, I invite you to join our community of investors. The journey has been marked by adaptability and consistent results, and we believe there is room for growth and success in the long run. Feel free to explore the Darwinex link for more detailed insights, and don't hesitate to reach out if you have any questions or if you're considering becoming a part of this investment venture. Your interest and participation contribute to the collective success of the Darwin CLN, and we welcome new investors to join us on this exciting investment path.

Let's navigate the markets together and build a future of financial prosperity!