Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

Cycle and Trends . What are they ….

The purpose of cycle analysis is to find the turning points in the market for a given time frame. If you knew these turning points then you could buy low and sell high and achieve the impossible and make loads of $$$ every day .. How is that possible ? Well , that is not an easy subject to master but if you did then you have got yourself a treasure map .

Ok ,, lets talk about trends, I discussed this few years back on this BB and called it BIRTH OF TREND.. Trends are born from cycles. Just the way a baby is born from a mother and not the other way . cycles give birth to trend and not the other way round ,,

Trends how ever don’t not live for ever ( just like the baby ) they get to a certain age and mature .., once they mature ( in TA we call them exhaustion ) they calm down and form the HIGH and LOW of the cycle.

So what grey1? What is that good to me ?

Well if you want to catch the trend you have to know a bit more about the cycle that the instrument is going through … In another word if the cycles is near its HIGH then it is not clever to take the LONG position and be on the wrong side of the cycle. Is it ?

Well how do I know

a) How do I know what side of the cycle I am ?

well you should have known about this subject before opening a broker account. You should use oscillators to identify where you stand with dominate cycles and hence the dominant time frame ...

b) what is the dominant time frame ?

Answer;- you can use an eyeball and approximate means of finding the dominate time frame by looking at @ what time frame the price last formed top or bottom and assume the future behaviour be the same or use more advanced techniques to identify periodity and hence find the nodes.. ( I refer you guys to read on dominate cycles period by Ehler and his book Rocket Science for traders )

Once you find the nodes then you know on what side of the nodes you will be and hence you can have a clear view of market or stock direction .

c) What TA indicator Do I need to measure cycle periodity ?

Answer:-- you don’t measure periodity with indicators.. you measure them with oscillators such as RSI,,,, CCI or what ever which gives you OB /OS levels. Of course there are more intelligent oscillators than RSI and CCI around

Now lets say you have got yourself an awesome oscillator..

This will be your strategy

IF Price hit HIGH of the day and turning in HIGHER TIME FRAME ( CYCLE) then Trend is born in lower time frame ..

IF price hit high of the day but still rising then move to next time frame up and look for reversal .

I hope this is clear.

I have tried to make this as simple as I could to avoid people walking away from the subject.

Grey1

The purpose of cycle analysis is to find the turning points in the market for a given time frame. If you knew these turning points then you could buy low and sell high and achieve the impossible and make loads of $$$ every day .. How is that possible ? Well , that is not an easy subject to master but if you did then you have got yourself a treasure map .

Ok ,, lets talk about trends, I discussed this few years back on this BB and called it BIRTH OF TREND.. Trends are born from cycles. Just the way a baby is born from a mother and not the other way . cycles give birth to trend and not the other way round ,,

Trends how ever don’t not live for ever ( just like the baby ) they get to a certain age and mature .., once they mature ( in TA we call them exhaustion ) they calm down and form the HIGH and LOW of the cycle.

So what grey1? What is that good to me ?

Well if you want to catch the trend you have to know a bit more about the cycle that the instrument is going through … In another word if the cycles is near its HIGH then it is not clever to take the LONG position and be on the wrong side of the cycle. Is it ?

Well how do I know

a) How do I know what side of the cycle I am ?

well you should have known about this subject before opening a broker account. You should use oscillators to identify where you stand with dominate cycles and hence the dominant time frame ...

b) what is the dominant time frame ?

Answer;- you can use an eyeball and approximate means of finding the dominate time frame by looking at @ what time frame the price last formed top or bottom and assume the future behaviour be the same or use more advanced techniques to identify periodity and hence find the nodes.. ( I refer you guys to read on dominate cycles period by Ehler and his book Rocket Science for traders )

Once you find the nodes then you know on what side of the nodes you will be and hence you can have a clear view of market or stock direction .

c) What TA indicator Do I need to measure cycle periodity ?

Answer:-- you don’t measure periodity with indicators.. you measure them with oscillators such as RSI,,,, CCI or what ever which gives you OB /OS levels. Of course there are more intelligent oscillators than RSI and CCI around

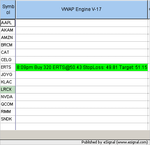

Now lets say you have got yourself an awesome oscillator..

This will be your strategy

IF Price hit HIGH of the day and turning in HIGHER TIME FRAME ( CYCLE) then Trend is born in lower time frame ..

IF price hit high of the day but still rising then move to next time frame up and look for reversal .

I hope this is clear.

I have tried to make this as simple as I could to avoid people walking away from the subject.

Grey1