wasp said:

last week and bigger picture...

I can't fiind a list of the weeks economic events easily copyable as I use forexfactory and copying and pasting that is a nightmare to read so if anyone has such a thing in plain text....

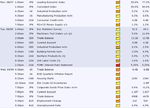

Economic calendar for week 06-Aug-2006 - 14-Aug-2006

Date / Time (GMT) / Source / Description / Forecast / Previous

8/7/2006 01:30 AUS ANZ Job Advertisements n/a -3.2%

8/7/2006 05:00 JPN Leading Economic Index n/a 77.3%

8/7/2006 05:00 JPN Coincident Index n/a 80.0%

8/7/2006 08:00 EU Bloomberg Germany Retail PMI n/a 54.7

8/7/2006 08:00 EU Bloomberg Eurozone Retail PMI n/a 55.1

8/7/2006 08:30 UK Industrial Production (YoY) n/a -0.7%

8/7/2006 08:30 UK Manufacturing Production (YoY) n/a 0.9%

8/7/2006 19:00 US Consumer Credit $4.0B $4.4B

8/7/2006 23:01 UK BRC July Retail Sales Monitor n/a n/a

8/7/2006 23:01 UK NIESR GDP Estimate n/a 0.6%

8/7/2006 23:50 JPN Money Supply M2+CD (YoY) n/a 1.2%

8/7/2006 23:50 JPN Broad Liquidity (YoY) n/a 2.3%

8/7/2006 23:50 JPN Bank Lending (YoY) n/a 1.7%

8/8/2006 01:30 AUS National Australia Bank's July Business Survey n/a n/a

8/8/2006 05:00 JPN Eco Watchers Survey: Current n/a 49.1

8/8/2006 05:00 JPN Eco Watchers Survey: Outlook n/a 51.8

8/8/2006 06:00 EU German Trade Balance n/a 12.9B

8/8/2006 06:00 EU German Current Account (EURO) n/a 4.3B

8/8/2006 06:00 EU German Imports SA (MoM) n/a -2.6%

8/8/2006 06:00 EU German Exports SA (MoM) n/a -1.5%

8/8/2006 10:00 EU German Industrial Prod. YoY (nsa wda) n/a 5.9%

8/8/2006 12:30 US Nonfarm Productivity 2Q P 1.2% 3.7%

8/8/2006 12:30 CAN Building Permits MoM 2.0% 6.9%

8/8/2006 12:30 US Unit Labor Costs 2Q P 3.5% 1.6%

8/8/2006 14:00 US IBD/TIPP Economic Optimism Aug n/a n/a

8/8/2006 18:15 US FOMC Rate Decision Expected 5.25% 5.25%

8/8/2006 21:00 US ABC Consumer Confidence n/a n/a

8/9/2006 01:30 AUS Home Loans n/a 4.7%

8/9/2006 01:30 AUS Investment Lending n/a 4.9%

8/9/2006 05:00 JPN Machine Orders YoY% 5.9% 15.8%

8/9/2006 08:30 UK Visible Trade Balance GBP/Mn n/a -GBP6753

8/9/2006 08:30 UK Trade Balance Non EU25 GBP/Mn n/a -GBP3715

8/9/2006 09:30 UK Bank of England Quarterly Inflation Report n/a n/a

8/9/2006 11:00 US MBA Mortgage Applications 55.0% n/a

8/9/2006 12:15 CAN Housing Starts 225.0K 236.4K

8/9/2006 14:00 US Wholesale Inventories 0.6% 0.8%

8/9/2006 22:45 NZ Unemployment Rate 2Q n/a 3.9%

8/9/2006 23:50 JPN Domestic CGPI (YoY) n/a 3.3%

8/9/2006 23:50 JPN Export Price Index (YoY) n/a 4.8%

8/9/2006 23:50 JPN Import Price Index (YoY) n/a 18.5%

8/9/2006 23:50 JPN Current Account Total Yen1209.3B Yen1613.9B

8/9/2006 23:50 JPN Adjusted Current Account Total n/a Yen1580.5B

8/9/2006 23:50 JPN Trade Balance-BoP Basis n/a Yen467.4B

8/10/2006 01:30 AUS Employment Change n/a 52.0K

8/10/2006 01:30 AUS Unemployment Rate n/a 4.9%

8/10/2006 01:30 AUS Participation Rate n/a 64.8%

8/10/2006 05:00 JPN BoJ Monetary Policy Meeting n/a n/a

8/10/2006 05:00 JPN Consumer Confidence 49.0 47.3

8/10/2006 05:00 JPN Consumer Confidence Households n/a 47.2

8/10/2006 06:00 JPN Machine Tool Orders (YoY) n/a 11.0%

8/10/2006 08:00 EU ECB Publishes Aug. Monthly Report n/a n/a

8/10/2006 12:01 NZ ANZ-Business NZ PMI n/a 52.1

8/10/2006 12:30 US Trade Balance -$64.4B -$63.8B

8/10/2006 12:30 CAN New Housing Price Index MoM 0.9% 1.3%

8/10/2006 12:30 CAN Int'l Merchandise Trade n/a C$4.1

8/10/2006 12:30 US Initial Jobless Claims n/a n/a

8/10/2006 12:30 US Continuing Claims n/a n/a

8/10/2006 18:00 US Monthly Budget Statement -$48.0B -$53.4B

8/10/2006 23:50 JPN Gross Domestic Product (QoQ) 2Q P n/a 0.8%

8/10/2006 23:50 JPN GDP Annualized 2Q P n/a 3.1%

8/10/2006 23:50 JPN GDP Deflator YoY 2Q P n/a -1.2%

8/11/2006 01:30 AUS Trade Balance n/a -2266M

8/11/2006 01:30 AUS Exports n/a 1645M

8/11/2006 01:30 AUS Imports n/a 18720M

8/11/2006 04:30 JPN Industrial Production (YoY) n/a 4.8%

8/11/2006 04:30 JPN Capacity Utilization n/a 103.9

8/11/2006 06:00 JPN BoJ Monthly Report n/a n/a

8/11/2006 12:30 US Import Price Index (YoY) n/a 7.2%

8/11/2006 12:30 US Advance Retail Sales 0.6% -0.1%

8/11/2006 12:30 US Retail Sales Less Autos 0.5% 0.3%

8/11/2006 12:30 US Business Inventories 0.5% 0.8%