Dear Community

I just wanted to share something with you which I have had a hard time understanding or grasping. I believe this might be something that maybe a statistician or mathematician might be able to shed some light on.

I have a trading strategy which I have been testing for the last 2 weeks. This is a continuation of research I was doing last year. When I took the first 4 trades of each day for this strategy over the last 15 days the result were as follows.

02/02/2018 3 1 (won 3 lost 1)

03/02/2018 0 3 (won 0 lost 3)

04/02/2018 2 2 (won 2 lost 2)

05/02/2018 3 1 and so on

06/02/2018 2 2

07/02/2018 4 0

08/02/2018 2 2

09/02/2018 3 1

10/02/2018 4 0

11/02/2018 2 2

12/02/2018 3 1

13/02/2018 3 0

14/02/2018 2 2

15/02/2018 0 2

16/02/2018 1 3

Now this is a system where for each winner I make £180 and each loser I lose £100. Looking at the results above its clear its a profitable system as this is replicating similar results from last year when I tested this over a sample of 200 trades.

NOW HERE IS THE ISSUE.

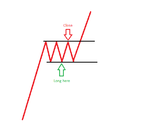

Because the results are positive and seem to be a showing a win rate of around 58% and with a reward to risk ratio of 1.8:1 I felt that maybe instead of gtrading just 4 times I should be taking every possible opportunity per day where a trading opportunity comes available.

However what I have found is that most of the time If I continue to trade throughout the day taking the same opportunities as per my system that its almost as if I experienced increased randomness where I start hitting big losing streaks of 5-6 losing trades.

For instance today I won my first 3 trades and lost my 4th trade. I decided to continue trading and then won only 1 trade out of the next 6.

The question I would like to ask is why is it that if I keep it to just the first 4 trades that the results tend to be favorable for me whereas when I start increasing the number of trades per day outside the first 4 that the results then start showing such a level of randomness that it starts making me question whether my win rate is really 58% and whether its more like 40%.

What I am saying is that If i limit to 4 trades per day my win rate seems to always average around the 58% mark whereas if I trade endlessly where possible each day where the same type of trading set up comes along it seems that my win rate drops significantly to around 40% .

I cannot explain what is happening as if trading many more times per day is the real insight regarding the metrics of my system then why isnt this more reflected in the first 4 results of each day. As you can see above me losing 3-4 trades in a row in my first 4 trades is not the dominant occurrence.

Or is this the man upstairs trying to tell me you are only supposed to trade 4 times per day so you can have time to do other things.

Is this something anyone else has experienced and is there a scientific understanding behind this.

It seems like there is more randomness/variance the more trades I take when I thought (hypothetically speaking) that the more coin flips you do the less the variance/randomness and that increased variance was when you took few trades or coin flips.

Anyone can help here.

Thanks

UK Trader

I just wanted to share something with you which I have had a hard time understanding or grasping. I believe this might be something that maybe a statistician or mathematician might be able to shed some light on.

I have a trading strategy which I have been testing for the last 2 weeks. This is a continuation of research I was doing last year. When I took the first 4 trades of each day for this strategy over the last 15 days the result were as follows.

02/02/2018 3 1 (won 3 lost 1)

03/02/2018 0 3 (won 0 lost 3)

04/02/2018 2 2 (won 2 lost 2)

05/02/2018 3 1 and so on

06/02/2018 2 2

07/02/2018 4 0

08/02/2018 2 2

09/02/2018 3 1

10/02/2018 4 0

11/02/2018 2 2

12/02/2018 3 1

13/02/2018 3 0

14/02/2018 2 2

15/02/2018 0 2

16/02/2018 1 3

Now this is a system where for each winner I make £180 and each loser I lose £100. Looking at the results above its clear its a profitable system as this is replicating similar results from last year when I tested this over a sample of 200 trades.

NOW HERE IS THE ISSUE.

Because the results are positive and seem to be a showing a win rate of around 58% and with a reward to risk ratio of 1.8:1 I felt that maybe instead of gtrading just 4 times I should be taking every possible opportunity per day where a trading opportunity comes available.

However what I have found is that most of the time If I continue to trade throughout the day taking the same opportunities as per my system that its almost as if I experienced increased randomness where I start hitting big losing streaks of 5-6 losing trades.

For instance today I won my first 3 trades and lost my 4th trade. I decided to continue trading and then won only 1 trade out of the next 6.

The question I would like to ask is why is it that if I keep it to just the first 4 trades that the results tend to be favorable for me whereas when I start increasing the number of trades per day outside the first 4 that the results then start showing such a level of randomness that it starts making me question whether my win rate is really 58% and whether its more like 40%.

What I am saying is that If i limit to 4 trades per day my win rate seems to always average around the 58% mark whereas if I trade endlessly where possible each day where the same type of trading set up comes along it seems that my win rate drops significantly to around 40% .

I cannot explain what is happening as if trading many more times per day is the real insight regarding the metrics of my system then why isnt this more reflected in the first 4 results of each day. As you can see above me losing 3-4 trades in a row in my first 4 trades is not the dominant occurrence.

Or is this the man upstairs trying to tell me you are only supposed to trade 4 times per day so you can have time to do other things.

Is this something anyone else has experienced and is there a scientific understanding behind this.

It seems like there is more randomness/variance the more trades I take when I thought (hypothetically speaking) that the more coin flips you do the less the variance/randomness and that increased variance was when you took few trades or coin flips.

Anyone can help here.

Thanks

UK Trader