You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Traderallen

Active member

- Messages

- 248

- Likes

- 41

I use MB Trading and have been using them since 2005 I am quite happy with them. You have two options of pay per limit which is what I use or lower spreads. Since a good majority of my orders I send off as limits I prefer the pay per limit. They are strictly an easy and broker. Their main trading platform is really good and I get great fills using it. They only chart in five digit but you do have the option of whatever Chart you want to create. Since I purchased Ninjatrader I use it for my charting services and order entry. If you're just learning this method there a great combination to use because you can open an account with a couple hundred dollars download the free Ninjatrader version from the link and trade this method exactly using a demo to your ready to go live. You can still place your live orders with a desktop Pro while using Ninjatrader for free. Beats having to pay 50 bucks or more for a charting platform every month.

Thank You Traderallen

Let me get this straight ( because I am a little slow..lol).

You purchased Ninjatrader because it allows you to do your bracket orders from the chart. Does this mean you cannot do this with the MB Trading Ninjatrader that they offer clients?

I would also like to do this from the chart.

For demo purposes do they let you trade from the chart?

When trading from your own purchased Ninjatrader you are allowed to use the "limits" plan with MB. Correct?

Thank you so much in advance.😀

Let me get this straight ( because I am a little slow..lol).

You purchased Ninjatrader because it allows you to do your bracket orders from the chart. Does this mean you cannot do this with the MB Trading Ninjatrader that they offer clients?

I would also like to do this from the chart.

For demo purposes do they let you trade from the chart?

When trading from your own purchased Ninjatrader you are allowed to use the "limits" plan with MB. Correct?

Thank you so much in advance.😀

Traderallen

Active member

- Messages

- 248

- Likes

- 41

Hi sean1963, welcome to the forum I have a couple things to go over before I get to your questions. I just posted another video for you guys check it out at my webpage at http://www.wallstreet2easystreet.com/ or you can see it directly at YouTube http://youtu.be/RvaDwjQRH-g

I purchased ninja trader because I wanted to be able to use the chart trader this is the only thing you can't do with the free version. Prior to this I place my trades using navigator. A short explanation is when you launch the free version of ninja trader and MB navigator window will also open. When you place your live orders you would use navigator instead of chart trader. Since your bracket orders are preset using desktop Pro when you take a TTO as your entry method it sets your brackets. So all order manipulation is done through navigator. It's not as easy as using chart trader but it's not hearty either. And since you're just learning this method it's a good way to go because you're not throwing money into a system that may not work for you. When you place a limit order it goes to MB server so yes it does pay to use the pay per limit plan, if you're going to be placing lots of limit orders. This is something you'll have to experiment with. I like doing it this way but I will occasionally miss a trade due to an order not getting filled at my limit. I have several accounts with MB, and find them to be a good broker overall. Again the important thing is to be able to practice this method for several months or more before you begin to live trade, using the free ninja trader/ MB combination allows you to do this at no expense. Then when you're ready you can start trading with one or two micros on a live account. Which is also what I recommend. Since in the beginning you will likely have a lot of losers.

I purchased ninja trader because I wanted to be able to use the chart trader this is the only thing you can't do with the free version. Prior to this I place my trades using navigator. A short explanation is when you launch the free version of ninja trader and MB navigator window will also open. When you place your live orders you would use navigator instead of chart trader. Since your bracket orders are preset using desktop Pro when you take a TTO as your entry method it sets your brackets. So all order manipulation is done through navigator. It's not as easy as using chart trader but it's not hearty either. And since you're just learning this method it's a good way to go because you're not throwing money into a system that may not work for you. When you place a limit order it goes to MB server so yes it does pay to use the pay per limit plan, if you're going to be placing lots of limit orders. This is something you'll have to experiment with. I like doing it this way but I will occasionally miss a trade due to an order not getting filled at my limit. I have several accounts with MB, and find them to be a good broker overall. Again the important thing is to be able to practice this method for several months or more before you begin to live trade, using the free ninja trader/ MB combination allows you to do this at no expense. Then when you're ready you can start trading with one or two micros on a live account. Which is also what I recommend. Since in the beginning you will likely have a lot of losers.

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Hey Traderallen (and everyone else)

I just wanted to thank you for all your efforts to help others through your posts, videos etc. I have found your perspective interesting and it has only helped broaden my own understanding of the myriad of ways that trading can be approached.

However, I do feel the need to point out, especially to traders new to this thread, that many of the trades you take, and the way you manage them (based on the videos you've shared), are not 'valid' according to Bob Volman's method. I'm not saying they are poor entries or anything like that, but as someone who has read the book (many, many times), and just as importantly, studied the charts Bob has been sending out over the last couple of years (again, over and over) it is clear that there is a significant difference in trade validity.

But let me be clear here - this is not a criticism, because according to what you say, you are extremely profitable - the ultimate goal right? I think it's fantastic that you have developed a method that works for you, and I enjoy hearing about it.

I just felt it needed to be pointed out so that others who have read the book and are trying to make a go of this don't get frustrated and bewildered if they are trying to imitate you and not having the same level of success.

At the end of the day everyone has to find/develop a method that works for THEM. So while this thread was started to discuss "Bob Volman Price Action Scalping," it's great to hear from traders like you who have morphed and made their own what information they have gleamed from Bob's book/charts.

For me personally, I have started to gun for smaller targets (partly thanks to you), with the aim of hitting them more frequently than a possible 10 pip run tends to show itself these days. I'm finding 3 - 5 pip targets more realistic and higher odds. I still go for 10 when the set-up has the potential, but it is becoming less and less often. The key for me though is to KEEP LOSSES SMALL.

I totally agree with you Allen that it is paramount to focus on account protection.

Anyway, thanks again for everything you do. It's appreciated.

I just wanted to thank you for all your efforts to help others through your posts, videos etc. I have found your perspective interesting and it has only helped broaden my own understanding of the myriad of ways that trading can be approached.

However, I do feel the need to point out, especially to traders new to this thread, that many of the trades you take, and the way you manage them (based on the videos you've shared), are not 'valid' according to Bob Volman's method. I'm not saying they are poor entries or anything like that, but as someone who has read the book (many, many times), and just as importantly, studied the charts Bob has been sending out over the last couple of years (again, over and over) it is clear that there is a significant difference in trade validity.

But let me be clear here - this is not a criticism, because according to what you say, you are extremely profitable - the ultimate goal right? I think it's fantastic that you have developed a method that works for you, and I enjoy hearing about it.

I just felt it needed to be pointed out so that others who have read the book and are trying to make a go of this don't get frustrated and bewildered if they are trying to imitate you and not having the same level of success.

At the end of the day everyone has to find/develop a method that works for THEM. So while this thread was started to discuss "Bob Volman Price Action Scalping," it's great to hear from traders like you who have morphed and made their own what information they have gleamed from Bob's book/charts.

For me personally, I have started to gun for smaller targets (partly thanks to you), with the aim of hitting them more frequently than a possible 10 pip run tends to show itself these days. I'm finding 3 - 5 pip targets more realistic and higher odds. I still go for 10 when the set-up has the potential, but it is becoming less and less often. The key for me though is to KEEP LOSSES SMALL.

I totally agree with you Allen that it is paramount to focus on account protection.

Anyway, thanks again for everything you do. It's appreciated.

Yorkshire Terrier

Established member

- Messages

- 620

- Likes

- 73

Week 16 charts from Volman:

https://www.dropbox.com/sh/1amxmi9af0fk6ej/VA5_ZrjQF1

thank you for the charts.

YT. 😎

runninscared

Newbie

- Messages

- 4

- Likes

- 0

so after starting to learn how to trade forex about 2 months ago roughly, ive gone through some stuff mainly the chart school at babypips and currency trading for dummies i recently discovered bob's book FPAS and i think scalping would really fit me stylistically but ive run into somewhat of a problem.... the time frames i can trade in are roughly 5-9 PM CST. since i was trading on a demo account on oanda for a few weeks now i noticed the eur/usd pair stays range bound and only moves 4-5~ pips and takes quite awhile to complete a single 70 tick candle.

so i was wondering... would bobs method of scalping work w/ market conditions being like they are for my trading times (NY close/asia open period) or has anyone else tried it on a different currency pair? say the USD/JPY or the AUD/USD since there is a decent amount of movement in those pairs during my timeframes.

also would really like to thank BLS for the insightful TA posts and uploading bobs trades. Learning alot from those

and especially traderallen. i was struggling to find a broker/trading platform that had a 70 tick chart til i discovered your post about MBT/ninjatrader. MUCH thanks. also enjoy your videos /website. they've been very helpful to a newbie trader like myself

so i was wondering... would bobs method of scalping work w/ market conditions being like they are for my trading times (NY close/asia open period) or has anyone else tried it on a different currency pair? say the USD/JPY or the AUD/USD since there is a decent amount of movement in those pairs during my timeframes.

also would really like to thank BLS for the insightful TA posts and uploading bobs trades. Learning alot from those

and especially traderallen. i was struggling to find a broker/trading platform that had a 70 tick chart til i discovered your post about MBT/ninjatrader. MUCH thanks. also enjoy your videos /website. they've been very helpful to a newbie trader like myself

Last edited:

Hi to all and thanks for the great questions and answers on this thread. Also thanks to Bob for supplying charts and BLS for posting them.

As I stated in my first post I am new to Bobs method. Never traded tick charts. Am just amazed at how well the 70tick chart performs on the EURUSD.

Platforms I am presently using are Tradestation= spread too high. And have been testing some software on my Synergyfx Mt4 platform, both are live. Have looked at PRT and may have to re-visit it . Did not like it to start with. Notice a few of you using Ninja so will have a look at that also. Any advice on a data feed is welcome and respect that some of you are using MB Trading.

So with the Synergy platform I found a tick chart for MT4 Rainwoods tick chart. I have been using this (testing) last couple of weeks, having found this interesting as i can watch a higher timeframe as well as the tick chart my results have been very good considering learning a new method etc. The problem with RWtick is if you draw lines, zones, box's , entry arrows, as the chart moves so do they. So they move to the left against price.

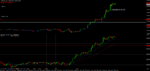

Chart 1 is a consolidation shooting star which i have noticed develop the same signal a few times last week which i traded with a 3 pip stop. I know this is not classic Bob, but feel the r/r justified the trade. I have done many of these on time charts, tick far better. You can also see other trades I took prior having to go for dinner as the long trades set-up. By no means am I implying or even understanding everything about Bobs method.Only read the book once. However the results are proving themselves so far. Also on RWTick chart it does not show entry , stop, target.

Also added a comparison 1min using RWtick , with entry on Mt4 shown. And a Mt4 15 min and 70 tick.

By no means am I promoting Mt4 or Rwtick. I am still undecided on which platform I will use for Bobs method and welcome any comments.

Thanks once again for a great thread.

As I stated in my first post I am new to Bobs method. Never traded tick charts. Am just amazed at how well the 70tick chart performs on the EURUSD.

Platforms I am presently using are Tradestation= spread too high. And have been testing some software on my Synergyfx Mt4 platform, both are live. Have looked at PRT and may have to re-visit it . Did not like it to start with. Notice a few of you using Ninja so will have a look at that also. Any advice on a data feed is welcome and respect that some of you are using MB Trading.

So with the Synergy platform I found a tick chart for MT4 Rainwoods tick chart. I have been using this (testing) last couple of weeks, having found this interesting as i can watch a higher timeframe as well as the tick chart my results have been very good considering learning a new method etc. The problem with RWtick is if you draw lines, zones, box's , entry arrows, as the chart moves so do they. So they move to the left against price.

Chart 1 is a consolidation shooting star which i have noticed develop the same signal a few times last week which i traded with a 3 pip stop. I know this is not classic Bob, but feel the r/r justified the trade. I have done many of these on time charts, tick far better. You can also see other trades I took prior having to go for dinner as the long trades set-up. By no means am I implying or even understanding everything about Bobs method.Only read the book once. However the results are proving themselves so far. Also on RWTick chart it does not show entry , stop, target.

Also added a comparison 1min using RWtick , with entry on Mt4 shown. And a Mt4 15 min and 70 tick.

By no means am I promoting Mt4 or Rwtick. I am still undecided on which platform I will use for Bobs method and welcome any comments.

Thanks once again for a great thread.

Attachments

Last edited:

This message is for Traderallen as well as any others that are experiencing success. First off, thank you for your website...very helpful!

My question is for those making money at this. What is your average outcome per trade, not counting the news trades?

As a simple example of what I mean is..... 10 trades, 7 winners @ 10 Pips each=70. 3 losers@10=30. Total net is 40 PIPS for 10 trades= 4 Pips per trade.

I am a firm believer that a method with positive expectations can be broken down into this simple formula especially when you have many trades under your belt. The more trades the more solid the number.

I am curious to know if you guys keep track of your statistics this way or another way?

My question is for those making money at this. What is your average outcome per trade, not counting the news trades?

As a simple example of what I mean is..... 10 trades, 7 winners @ 10 Pips each=70. 3 losers@10=30. Total net is 40 PIPS for 10 trades= 4 Pips per trade.

I am a firm believer that a method with positive expectations can be broken down into this simple formula especially when you have many trades under your belt. The more trades the more solid the number.

I am curious to know if you guys keep track of your statistics this way or another way?

This message is for Traderallen as well as any others that are experiencing success. First off, thank you for your website...very helpful!

My question is for those making money at this. What is your average outcome per trade, not counting the news trades?

As a simple example of what I mean is..... 10 trades, 7 winners @ 10 Pips each=70. 3 losers@10=30. Total net is 40 PIPS for 10 trades= 4 Pips per trade.

I am a firm believer that a method with positive expectations can be broken down into this simple formula especially when you have many trades under your belt. The more trades the more solid the number.

I am curious to know if you guys keep track of your statistics this way or another way?

Hi Sean,

I am not the person to ask as I am new to this method, however I am connecting a live account to myfxbook this week which will be dedicated to only trading Bobs method. Another thing to mention I have been trading for almost 30yrs and FX since 92. FX has been a thorn in my side and am pleased to find Bob Volmans method.

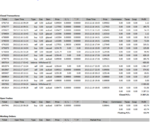

Here are a few results from some trades.

I have also posted some trade live results from the Xmas period. I am just getting back into trading from a 3 month summer Holiday. Most of these are using Bobs method in sync with a method I developed on time. I believe Bobs method to be better on its own. However, I also believe if you see a signal on a higher timefame such as 4hr or daily and use Bobs method for entry you can also grab some bigger trades which was done here.

[4/23/2014 11:39:41 AM] : just woke up, traded 9hrs last night through US session. 6 wins 43pips 3 losses 9 pips.

Have also done several others where i am gettiing around 87% correct with a risk/reward 1:3

Once I decide on which platform/broker to use I will crank my lot size , 1: 8 lot position, then 10, all the way to 50:100 lot positions. My whole plan is to cherry pick the very best trades and only target 10 pips profit daily and hopefully I can do that with 3 hrs trading.

Attachments

Last edited:

BLS

Established member

- Messages

- 642

- Likes

- 229

Week 17 charts from Volman:

https://www.dropbox.com/sh/1amxmi9af0fk6ej/VA5_ZrjQF1

https://www.dropbox.com/sh/1amxmi9af0fk6ej/VA5_ZrjQF1

Couple of trades tonight on the London opening.[/QUOTE

It is obvious now that this was a textbook long. But prior to breakout , there was a short signal too , . You did not jump in , why?

Couple of trades tonight on the London opening.[/QUOTE

It is obvious now that this was a textbook long. But prior to breakout , there was a short signal too , . You did not jump in , why?

The short happened on the Asian opening. Always weary of asia openings.

The other thing also, the tick chart has to load the data as it happens. Once I close Mt4 and open i have to wait for the tick charts to load.

Will start using Ninja this week. Be only demo till i get used to the platform. However the Mt4 tick chart has some nice features also.

Last edited:

Traderallen

Active member

- Messages

- 248

- Likes

- 41

Hi matty_dunn You are exactly right not all of my trades are textbook Bob Volman setups. Although I trade the FPAS method almost exclusively, I have done two things, one which is probably the most important and I have even mentioned to Bob in an email conversation, I have molded his method with my own personality to make this trading method my own. This is something everyone must do to become a competent trader. The second and maybe equally important is I constantly make minor adjustments to keep the method working with in the current market conditions. This is also very important because you can only take what the markets willing to give.

runninscared I use this method on the dollar yen, and also on the aussie yen (although the spreads can be wide) during the late Asian session I think it's a lot harder and you don't get near as many good setups. But it would work just the same on any trading vehicle that has sufficient volume with a low spread. When you're scalping you need your trading costs to be as low as possible.

patong I use MT4 often for many of my trades typically they are not scalping trades because I have found that using the third-party routing software that is the background of every MT4 program takes far too long for scalping orders to get filled. If you're using a demo account you won't see this, but when you're using a live account it can sometimes take several seconds for a order to be filled. This of course is not acceptable for scalping. But for most other trading its fine.

sean1963 Month over month my average is around six to seven pips. Not quite as high as were I wanted to be since in order for me to quit my day job I need to average 10 pips per day of 1 1/2 lots. But I have no doubt as I continue to improve I will be there soon. I use a simple Excel spreadsheet where I record every trade and more importantly every trade I take as soon as it is closed I take a snapshot of it so I constantly go back and review each trade as it played out. This is important if you're using a tick chart since it's time one is built they are slightly different. I can go back and look at every single trade I placed since I started using this method exclusively August 1 of last year. This is not a get rich quick method but for me it works and I have not had a losing month since I started focusing on this method. As far as your follow-up question I think you'll find most of the people on here using this method are not at the profitable stage yet. If I had to guess why I would say number one too many times there placing trades during unfavorable conditions. And number two focus and concentration, that something you can't learn you have to build it over time.

I hope I didn't skip anyone's questions, if I did let me know. traderallen

runninscared I use this method on the dollar yen, and also on the aussie yen (although the spreads can be wide) during the late Asian session I think it's a lot harder and you don't get near as many good setups. But it would work just the same on any trading vehicle that has sufficient volume with a low spread. When you're scalping you need your trading costs to be as low as possible.

patong I use MT4 often for many of my trades typically they are not scalping trades because I have found that using the third-party routing software that is the background of every MT4 program takes far too long for scalping orders to get filled. If you're using a demo account you won't see this, but when you're using a live account it can sometimes take several seconds for a order to be filled. This of course is not acceptable for scalping. But for most other trading its fine.

sean1963 Month over month my average is around six to seven pips. Not quite as high as were I wanted to be since in order for me to quit my day job I need to average 10 pips per day of 1 1/2 lots. But I have no doubt as I continue to improve I will be there soon. I use a simple Excel spreadsheet where I record every trade and more importantly every trade I take as soon as it is closed I take a snapshot of it so I constantly go back and review each trade as it played out. This is important if you're using a tick chart since it's time one is built they are slightly different. I can go back and look at every single trade I placed since I started using this method exclusively August 1 of last year. This is not a get rich quick method but for me it works and I have not had a losing month since I started focusing on this method. As far as your follow-up question I think you'll find most of the people on here using this method are not at the profitable stage yet. If I had to guess why I would say number one too many times there placing trades during unfavorable conditions. And number two focus and concentration, that something you can't learn you have to build it over time.

I hope I didn't skip anyone's questions, if I did let me know. traderallen

Hi matty_dunn You are exactly right not all of my trades are textbook Bob Volman setups. Although I trade the FPAS method almost exclusively, I have done two things, one which is probably the most important and I have even mentioned to Bob in an email conversation, I have molded his method with my own personality to make this trading method my own. This is something everyone must do to become a competent trader. The second and maybe equally important is I constantly make minor adjustments to keep the method working with in the current market conditions. This is also very important because you can only take what the markets willing to give.

runninscared I use this method on the dollar yen, and also on the aussie yen (although the spreads can be wide) during the late Asian session I think it's a lot harder and you don't get near as many good setups. But it would work just the same on any trading vehicle that has sufficient volume with a low spread. When you're scalping you need your trading costs to be as low as possible.

patong I use MT4 often for many of my trades typically they are not scalping trades because I have found that using the third-party routing software that is the background of every MT4 program takes far too long for scalping orders to get filled. If you're using a demo account you won't see this, but when you're using a live account it can sometimes take several seconds for a order to be filled. This of course is not acceptable for scalping. But for most other trading its fine.

sean1963 Month over month my average is around six to seven pips. Not quite as high as were I wanted to be since in order for me to quit my day job I need to average 10 pips per day of 1 1/2 lots. But I have no doubt as I continue to improve I will be there soon. I use a simple Excel spreadsheet where I record every trade and more importantly every trade I take as soon as it is closed I take a snapshot of it so I constantly go back and review each trade as it played out. This is important if you're using a tick chart since it's time one is built they are slightly different. I can go back and look at every single trade I placed since I started using this method exclusively August 1 of last year. This is not a get rich quick method but for me it works and I have not had a losing month since I started focusing on this method. As far as your follow-up question I think you'll find most of the people on here using this method are not at the profitable stage yet. If I had to guess why I would say number one too many times there placing trades during unfavorable conditions. And number two focus and concentration, that something you can't learn you have to build it over time.

I hope I didn't skip anyone's questions, if I did let me know. traderallen

Hi Traderallen,

Cheers for your feed back. I only trade live accounts. This is how i earn a living.

Mt4 depends on the broker you use. I use Synergyfx and have found them to be very good. My execution be as fast as anyone's trading from any platform. I am testing Bobs methods and RWtick which I am finding has some seriously good advantages over the normal Tick only chart. Mainly that you can look at higher time period charts and really cheery pick a trades higher s/r zones. But this is still being determined as i need atleast 100 trades to get the full picture.

Presently now running Ninja, Tradestation, Mt4 and will have another look at Prorealtime.

Plus 38 live pips last night 2 full lots.

Similar threads

- Replies

- 15

- Views

- 8K