TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

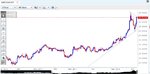

Nikkei market has doubled since the low of 8000 last year and recently dropped from 16000 to 12000. It has retraced to close to 14000.

BUT, if this doesn't hold I will get short the dow and sit in for the next 4 -6 weeks at least.

US GDP came under the 2.5% mark, QE tappering is likely in the Autumn but the drop in bonds in Japan is the most worrying; if their debt costs rise it will wipe out the current account and send shock waves around the markets.

For forex this could mean US$ and Yen see repatriation - GBP / EUR have performed well recently but I will be watching for key levels this week as the Nikkei could change things.

I will wait for confirmation as the week unfolds.

BUT, if this doesn't hold I will get short the dow and sit in for the next 4 -6 weeks at least.

US GDP came under the 2.5% mark, QE tappering is likely in the Autumn but the drop in bonds in Japan is the most worrying; if their debt costs rise it will wipe out the current account and send shock waves around the markets.

For forex this could mean US$ and Yen see repatriation - GBP / EUR have performed well recently but I will be watching for key levels this week as the Nikkei could change things.

I will wait for confirmation as the week unfolds.