And here is an example of the consensus for the Nov Jobs Report which is released late

due to the US Government Shutdown

U.S. November Jobs Report (Due December 16)

The consensus among economists for the delayed November jobs report indicates a continued slowdown in hiring activity.

Analysts anticipate that the overall headline job figures will be somewhat "noisy" or distorted due to federal government job cuts stemming from earlier buyout offers, which could drag down the total number of jobs added.

and

U.S. November CPI Data (Due December 18)

For the inflation report, expectations point to both headline and core inflation remaining above the Federal Reserve's 2% target.

The monthly headline CPI increase is expected to be primarily driven by a surge in gasoline and energy prices. However, some analysts note that seasonal adjustments might make the reported figure seem higher than the real-time experience for consumers.

The combined data from these reports will be heavily scrutinized by the markets and the Federal Reserve to determine whether December's recent interest rate cut was a cautious adjustment or the beginning of a more sustained easing cycle

Our evaluation is as follows

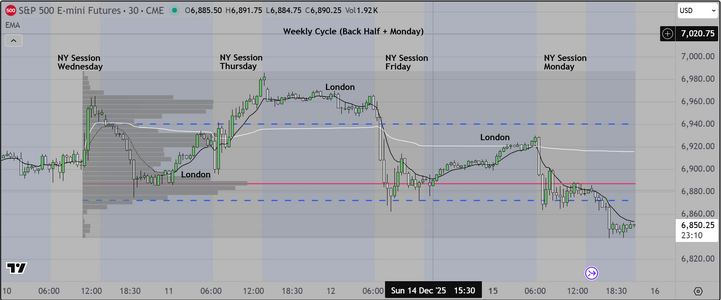

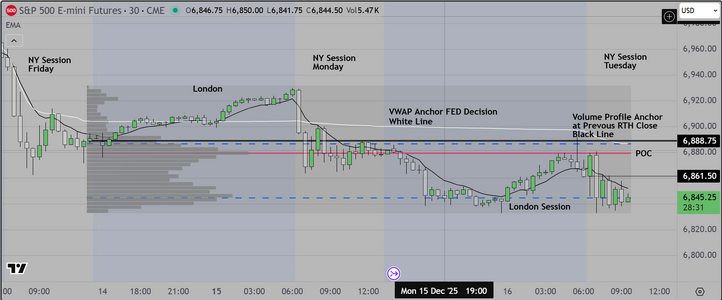

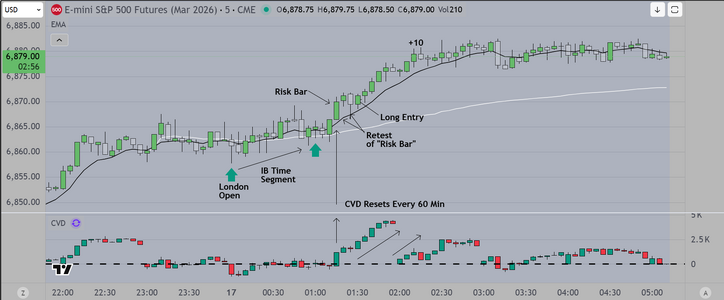

The S&P 500 futures market response this week will likely depend on which data set "surprises" the market more: the labor report or the inflation report. The S&P 500 has been trading near record highs, partly on the expectation that the Federal Reserve can continue to cut rates, an assumption that relies on both a cooling job market and cooling inflation.

Potential Scenarios for S&P 500 Futures

- Bullish Scenario (S&P 500 rallies): If both reports align closely with the expected "soft landing" narrative (i.e., a weak jobs report is matched by a tamer-than-expected CPI increase), the S&P 500 futures could climb. The market views a weakening labor market as a green light for further Fed rate cuts, which is generally positive for equities, provided inflation is also under control.

- Bearish Scenario (S&P 500 sells off): The most significant risk for a sharp downturn in futures would be the combination of weaker-than-expected jobs data (pushing recession worries) and a higher-than-expected CPI print (suggesting sticky inflation). This would create a dilemma for the Fed and likely cause volatility and selling pressure as investors worry about "stagflation" or that the Fed has less flexibility to support the economy.

Mixed Reaction (Volatile, little net change): This is highly probable given the current forecasts.

Key Data Point to Watch

While the headline jobs number gets initial attention,

wage growth (Average Hourly Earnings) and

core CPI figures may be more important for Fed expectations and thus more likely to drive sustained S&P 500 futures movements. An acceleration in wages would likely unnerve the market, capping equity gains

This post is a "one time" event to show interested parties how we prepare. Future presentations will happen in the class.

Good luck