Hello Traders

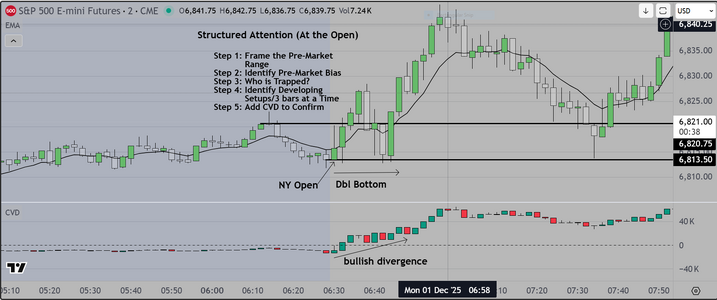

This chart is quite important because it provides the basic rules we follow

in order to profitably trade the open (also known as the "IB" or "Initial Balance")

The skill needed is not native to everyone. In fact most people simply do not know

how to organize themselves, what to focus on, and how to structure their thought

processes so that they can 1) identify tradeable opportunities and just as importantly

2) avoid "traps" and "trading range" opens.

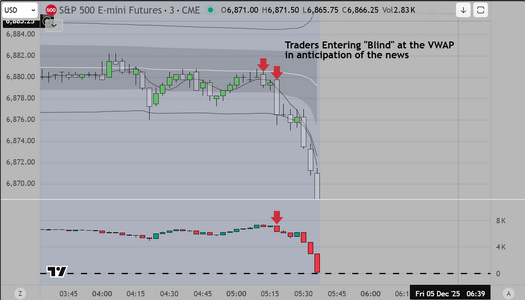

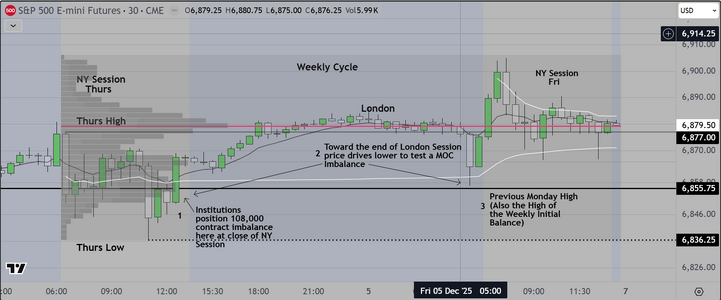

The attached chart shows the previous NY session of the S&P 500 Futures, and we show

a chart with 2 minute candles, because this time frame provides the "granularity" needed

to identify developing, tradeable patterns. The chart is marked up to show "Step1".

In our class, we go over this because this skill (the ability to direct your attention to the most

important data before and after the formal open of any market) is hard to obtain, and unless

the retail trader learns it, IF THEY TRADE THE OPEN, ODDS ARE THEY ARE GOING TO LOSE.

WHY? BECAUSE IT IS DESIGNED THAT WAY. TO CONFUSE, TO TRAP, AND TO STRAND TRADERS

ON THE WRONG SIDE.

Good Luck

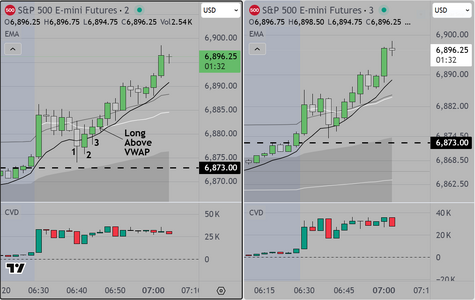

This chart is quite important because it provides the basic rules we follow

in order to profitably trade the open (also known as the "IB" or "Initial Balance")

The skill needed is not native to everyone. In fact most people simply do not know

how to organize themselves, what to focus on, and how to structure their thought

processes so that they can 1) identify tradeable opportunities and just as importantly

2) avoid "traps" and "trading range" opens.

The attached chart shows the previous NY session of the S&P 500 Futures, and we show

a chart with 2 minute candles, because this time frame provides the "granularity" needed

to identify developing, tradeable patterns. The chart is marked up to show "Step1".

In our class, we go over this because this skill (the ability to direct your attention to the most

important data before and after the formal open of any market) is hard to obtain, and unless

the retail trader learns it, IF THEY TRADE THE OPEN, ODDS ARE THEY ARE GOING TO LOSE.

WHY? BECAUSE IT IS DESIGNED THAT WAY. TO CONFUSE, TO TRAP, AND TO STRAND TRADERS

ON THE WRONG SIDE.

Good Luck