Hello London & Euro Traders

Currently it is just after 5pm in The City

We woke feeling a bit off, and so did not trade

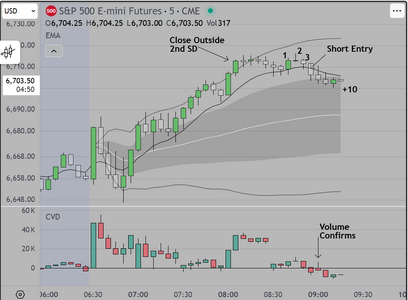

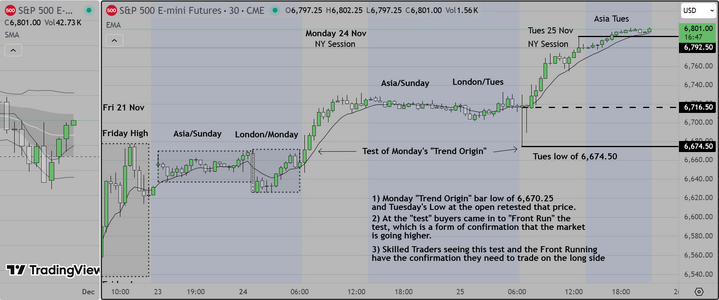

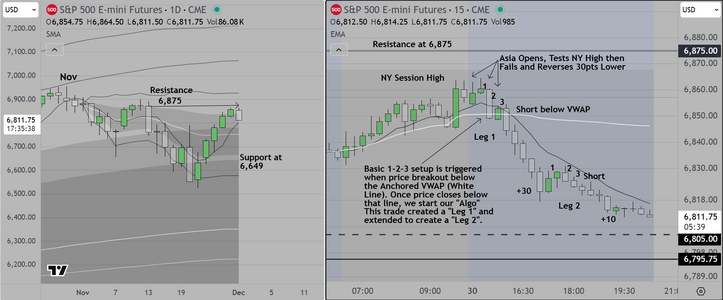

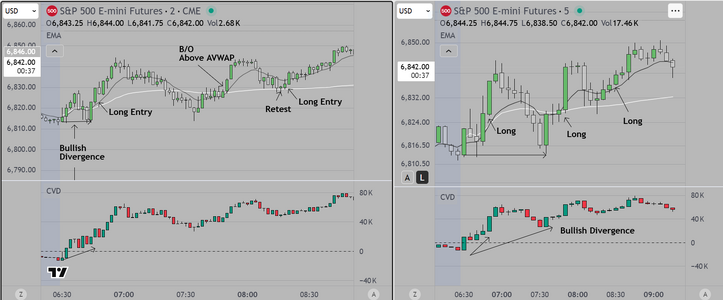

Reviewing the charts we saw several setups, the most recent

is shown on the attached chart and if I had been trading I

would have taken it for the following reasons

1) The setup occurs after the end of US/Euro Overlap

2) The setup is a reversal which is common at this point in time

3) It is a Mean Reversal Setup, and so we might have taken profit

already (at 8 or perhaps 9 points)

Also the setup was confirmed by CVD (which is in "Test Mode" currently

meaning that it resets hourly.

Here is the chart. The next possible setup would normally occur in about

three (3) hours. We have a doctor's appt and so will not be posting again

today

Good Luck

Currently it is just after 5pm in The City

We woke feeling a bit off, and so did not trade

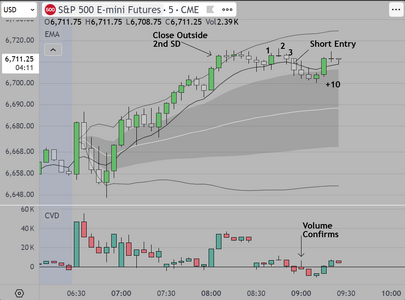

Reviewing the charts we saw several setups, the most recent

is shown on the attached chart and if I had been trading I

would have taken it for the following reasons

1) The setup occurs after the end of US/Euro Overlap

2) The setup is a reversal which is common at this point in time

3) It is a Mean Reversal Setup, and so we might have taken profit

already (at 8 or perhaps 9 points)

Also the setup was confirmed by CVD (which is in "Test Mode" currently

meaning that it resets hourly.

Here is the chart. The next possible setup would normally occur in about

three (3) hours. We have a doctor's appt and so will not be posting again

today

Good Luck