Good Morning

I see that this thread has been left in place. So be it.

I have completed my obligation to train a class and am free to post again

I have also posted on another thread as a courtesy to a trader who indicated an interest

in my work. Copy of that post below

----------------

Good Afternoon

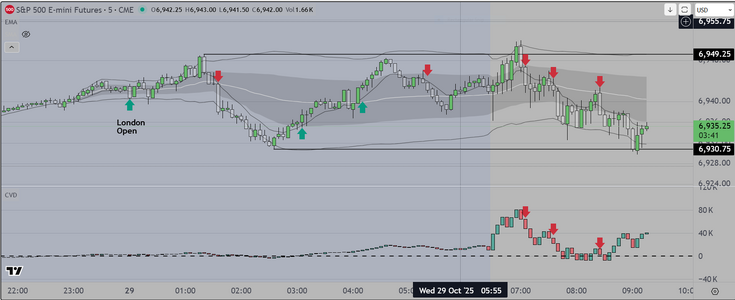

It is Wednesday 29 Oct the time is approximately 1am in the City (one assumes London time)

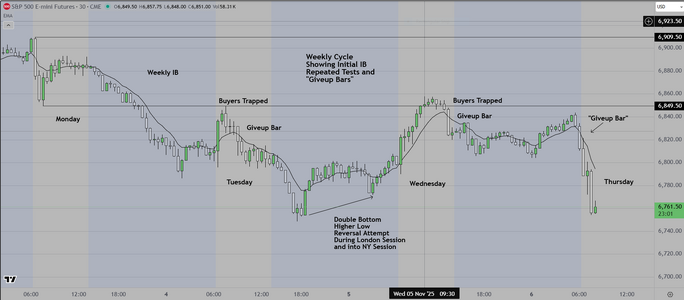

I have begun to provide a comment for traders interested in trading the London Session of the

S&P futures. Current Volatility is approximately 18 after spiking to 24. This event (for most professionals)

signals opportunity and that is what you will see in the attached chart.

I will provide a more detailed comment shortly so that traders interested in this market can evaluate the

opportunities. In my view we are probably going to see more sessions like this one and therefore it might

make sense to think about how to monetize it, providing you have the requisite skills

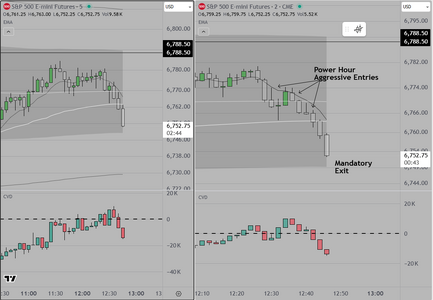

The chart uses 5 min candles and CVD and is about as simple as I can make it for retail traders. As a side not

most professionals would be reading order flow, however I have not see a retail trader do it successfully or

consistently (I am talking about reading "stack & pull"). I am willing to give it a go if someone wants to learn,

I just think this is much easier to learn and the rules are simple.

Finally, in a couple of days I will start livestreaming on Twitch. I will show the preparation process that leads to this

result. It requires about 30 minutes prior to the open, and is very simple. We simply review economic data, and create

three (3) scenarios, "Risk On, Risk Off, and Neutral". We also suggest that traders think about restricting their entries

to specific time frames, in order to give themselves the best chance of success.

I see that this thread has been left in place. So be it.

I have completed my obligation to train a class and am free to post again

I have also posted on another thread as a courtesy to a trader who indicated an interest

in my work. Copy of that post below

----------------

Good Afternoon

It is Wednesday 29 Oct the time is approximately 1am in the City (one assumes London time)

I have begun to provide a comment for traders interested in trading the London Session of the

S&P futures. Current Volatility is approximately 18 after spiking to 24. This event (for most professionals)

signals opportunity and that is what you will see in the attached chart.

I will provide a more detailed comment shortly so that traders interested in this market can evaluate the

opportunities. In my view we are probably going to see more sessions like this one and therefore it might

make sense to think about how to monetize it, providing you have the requisite skills

The chart uses 5 min candles and CVD and is about as simple as I can make it for retail traders. As a side not

most professionals would be reading order flow, however I have not see a retail trader do it successfully or

consistently (I am talking about reading "stack & pull"). I am willing to give it a go if someone wants to learn,

I just think this is much easier to learn and the rules are simple.

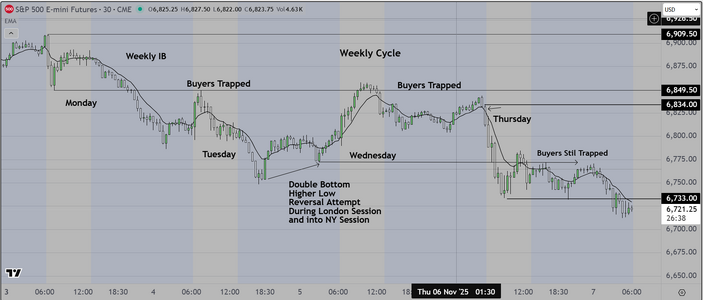

Finally, in a couple of days I will start livestreaming on Twitch. I will show the preparation process that leads to this

result. It requires about 30 minutes prior to the open, and is very simple. We simply review economic data, and create

three (3) scenarios, "Risk On, Risk Off, and Neutral". We also suggest that traders think about restricting their entries

to specific time frames, in order to give themselves the best chance of success.