Hello Traders

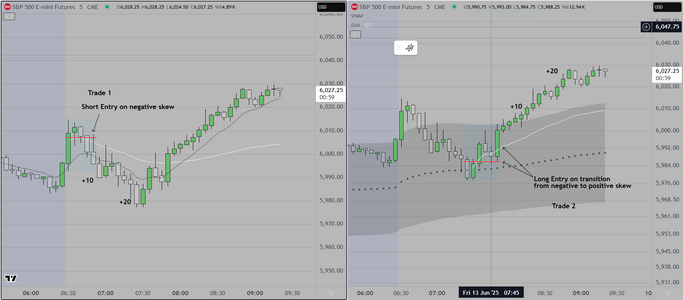

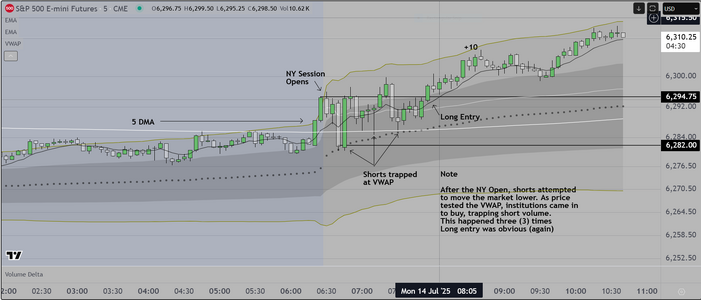

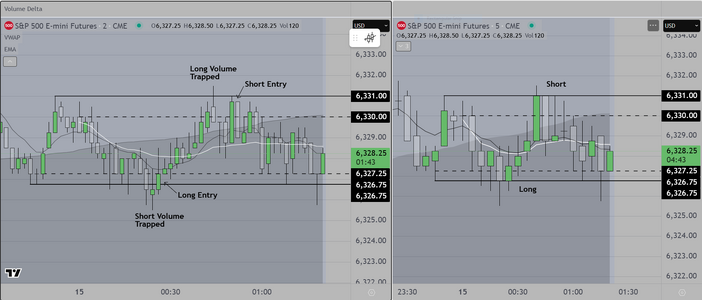

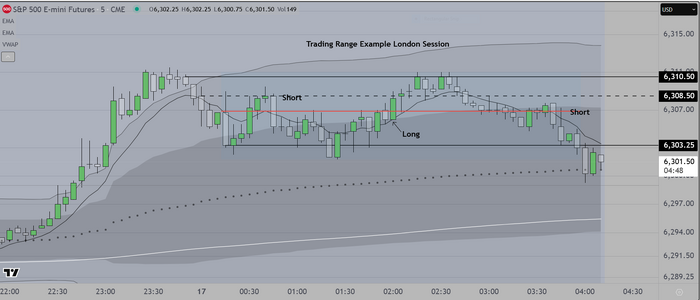

This will be example 3, showing how institutions "trap" traders in order to move

markets in the desired direction

Traders should know that computer programs monitor price action and when certain

"behaviors" occur, they trigger automated buying or selling. The markets are reacting to

world news as well as regional economic news. Specifically,

1) The top tier financial institutions believe that President Trump's tariff threats are largely

meaningless (he is bluffing) and wants to obtain leverage by threatening the world with

monetary penalties. Because these tariffs would have a negative effect on his own population

he continues to back down.

2) The US economy continues to be resilient, with reasonably strong spending and big companies

continuing to operate without having to lay off personnel (yet)

3) Economic news has been reflective of a strong economy, however as we know, that can change

As of now the top tier banks are forecasting only "measured effects" from possible tariffs

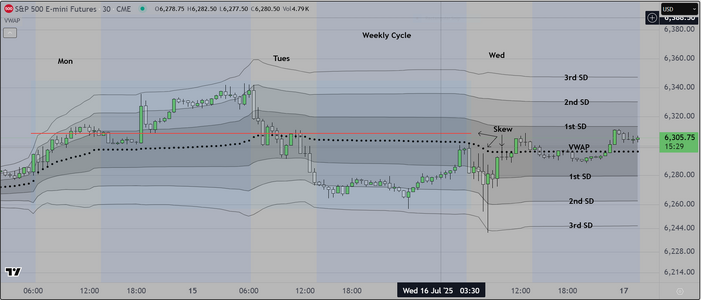

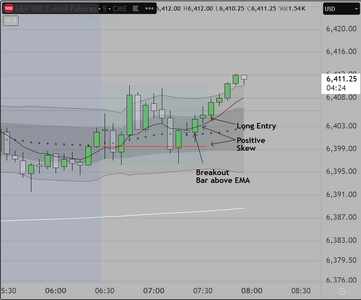

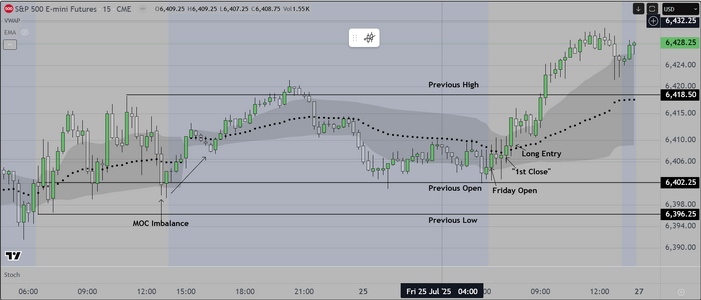

Our charts confirm (so far) that the markets are forward looking and positive and they do this

by staying above certain "Key References", one of which is the 5DMA (I show my students how

to display this on any time frame). As they see the market test this reference point, they have only

to watch and see what the response is, then they look for a place to get long. I am tempted to say

that it is "simple", but of course it takes more than that to trade it. As mentioned previously, we

look for this scenario to take shape prior to the open of each session. We show traders how to frame

this activity and (finally) we show them the importance of "timing". Automated buys and sells enter

the market as the institutions signal each other by activating buying or selling "spikes". Its not how much

they buy or sell but how quickly the orders are entered, that triggers continuation (trend). If a human

trader is watching their screen and they see this, it is relatively easy to recognize and jump on board.

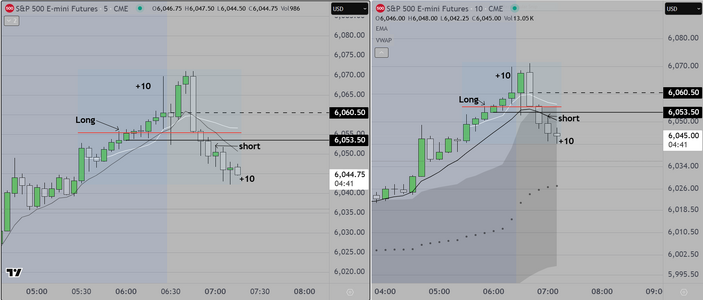

Finally and perhaps most importantly, once you see how this works, not only do you know when

to enter, but you also know that you should HOLD your position, because it is likely to trend for at least +10

Why? because institutions need to get at least +10 pts to make it "worth the risk". If you look back at my

posts, you will note that I am almost always holding for at least +10

I understand that scalping is easier psychologically, but the bottom line is that for retail traders, you simply

will not be able to create a sustainable business that way. The important take away is to trade less frequently

to hold trades longer, to be willing to close out trades at breakeven or at a small loss until you hit a +10 winner.

Good Luck