jungles

Guest

- Messages

- 614

- Likes

- 67

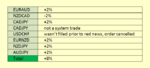

This thread will record my testing of a simple strategy, taking trades after a bounce off a 21SMA, 60M.

Whilst the bounce is the signal to take notice, the strategy also relies heavily upon reading PA and SR.

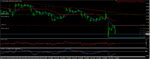

In the trade shown below, taken Friday, we have a bounce off the 21SMA (blue arrow), a good up trend (higher highs, higher lows), and no resistance at/ near entry.

The +2% TP was reached.

I have no idea if this strategy will deliver an edge.........more live trades testing this simple strategy starting next week.

.

Whilst the bounce is the signal to take notice, the strategy also relies heavily upon reading PA and SR.

In the trade shown below, taken Friday, we have a bounce off the 21SMA (blue arrow), a good up trend (higher highs, higher lows), and no resistance at/ near entry.

The +2% TP was reached.

I have no idea if this strategy will deliver an edge.........more live trades testing this simple strategy starting next week.

.