James Austin

Member

- Messages

- 59

- Likes

- 3

I have no idea if an edge can be extracted from this approach but I'll give it a shot,

posting set-ups in real time starting here next week.

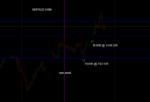

1] draw up horizontal S/R: 60, 240, 1440, weekly when trading off 60M; 240, 1440, weekly when trading off 240M

2] look for set-ups (as shown in image) at S/R on 60M and 1440M

3] trade in trend direction only (for time being) for the TF that set-up shows up on

3] open @ start next bar, SL above/below set-up, TP next S/R, RR 1:1 or greater

4] no trading at news time

*your view welcomed and encouraged 🙂

posting set-ups in real time starting here next week.

1] draw up horizontal S/R: 60, 240, 1440, weekly when trading off 60M; 240, 1440, weekly when trading off 240M

2] look for set-ups (as shown in image) at S/R on 60M and 1440M

3] trade in trend direction only (for time being) for the TF that set-up shows up on

3] open @ start next bar, SL above/below set-up, TP next S/R, RR 1:1 or greater

4] no trading at news time

*your view welcomed and encouraged 🙂

Attachments

Last edited: