Many people participate in the stock markets, some as investors; others as traders. Investing is done with a long term view in mind, years or even decades. Trading, meanwhile, is done to pocket gains on a regular basis.

There are many sub categories of traders. One of the common ways to distinguish them is the “time period” for which traders hold a stock, which can vary from a few seconds to months or even years. Some of the popular trading strategies are day trading, swing trading, scalping and position trading. Choosing a style that suits your own trading temperament is essential for the success in the long term. This article lays out the differences between the scalping strategy and a swing trading strategy.

Scalping

The strategy of scalping targets minor changes in the intra-day stock price movement to build up profits by frequent entry and exit throughout the trading session. It is sometimes seen as a subtype of the day trading technique; scalping involves multiple trades but with a very short holding period, a few seconds to minutes. Since the positions are held for a very short period, the gains on a particular trade (or profits per trade) are small and thus scalpers indulge in numerous trades (even in hundreds during the day) to build up the profit. The limited time exposure to the market reduces the risk for the scalper.

Scalpers are quick and do not stick to any pattern, they may be short in one trade and then go long in the next; small opportunities are what they target. Scalpers commonly tend to work around the bid-ask spread i.e. buying on the bid and selling at ask (or rather around the bid and ask), thus making the spread their profit. Such opportunities normally exist more than large moves, as fairly still markets also witness minor movements that can be exploited. Scalpers usually follow the short period charts like the 1 minute, 5 minute charts or even transactions based tick charts, to study the price movement and take a call on a certain trade.

Scalpers look for adequate liquidity as it is compatible with the high frequency of trading. There should be access to accurate data (quote system, live feed) as well as fast execution of trades (thus there is preference for direct access brokers). Since there is frequent buying and selling, high commissions tend to reduce the profit, as they increase the cost of performing the trades.

Scalping is best suited to those who can devote time to the markets, stay focused and act swiftly. It’s usually said that impatient people make good scalpers as they tend to exit from a trade as soon as it becomes profitable. Scalping is for those who can handle stress, take quick decisions and act accordingly.

Swing Trading

The strategy of swing trading involves identifying the trend and then playing within it. For example, Swing traders would usually pick a strongly trending stock after a correction or consolidation i.e. just before it’s ready to rise again and exit after they pocket some profit. Such buying and selling is repeated to reap gains and in cases where stocks fall through support, they would move to the other side and go short. Typically, swing traders are “trend followers”, if there is an uptrend, they go long and if the overall trend is towards the downside, they would go short.

Swing trades remain open from a few days to weeks (near-term) to even months (intermediate term), but typically last a few days. In terms of the time frame, patience required and potential returns, swing trading falls between day trading and trend trading. Swing traders use technical analysis and charts that display the price action which helps to locate the points of entry and exit for profitable trades. These traders study resistance and support and use Fibonacci extensions by combining them with other patterns and technical indicators. Some amount of volatility is healthy for swing trading as it gives rise to opportunities.

Swing traders keep an eye on bigger gains by indulging in fewer stocks, this helps to keep brokerage costs lower. The strategy works well for those who cannot stay glued full time to the markets as it does not require keeping a minute by minute track of things. Part time traders who are able to peek at what’s happening during their work intervals often opt for this strategy. To be successful at swing trading, pre-market and post-market review is considered crucial. Swing trading requires people to be patient with overnight holdings and hence it’s not for those who get anxious in such situations. Swing trading is considered suitable for all types of investor including novices.

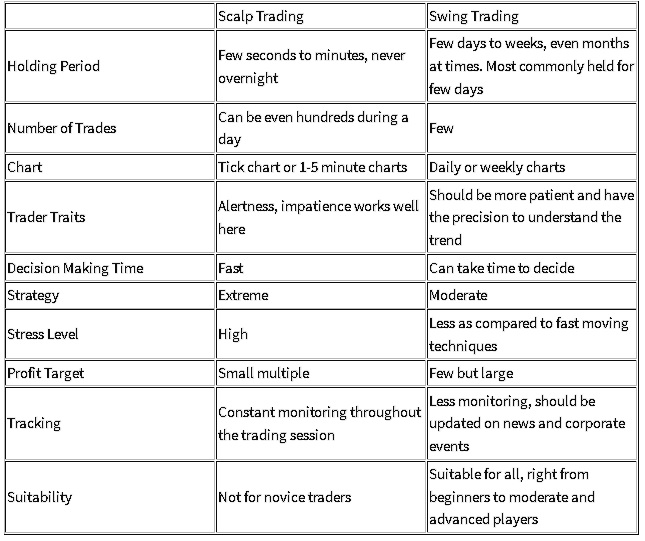

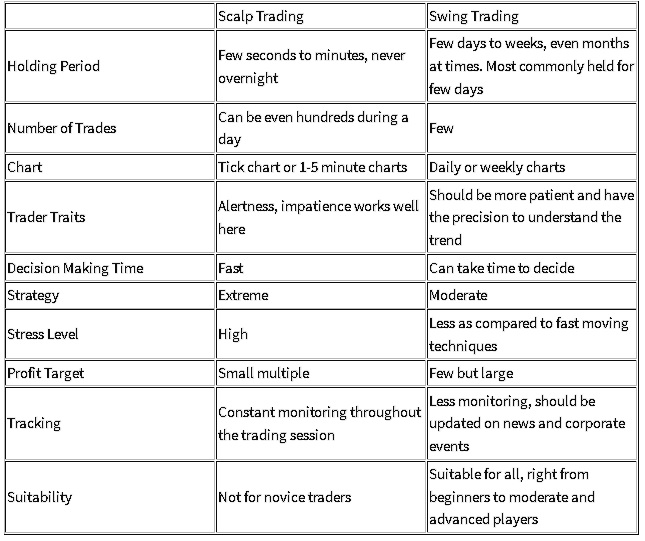

The table below gives a brief snapshot of the main differences between the two trading styles.

In Summary

Every trading style comes with its own set of risks and rewards. There is no perfect strategy which suits all traders, thus it is best to choose a trading strategy based on your skill, temperament, time that can be dedicated, account size, experience of trading and risk tolerance. In general as traders devote more time and become increasingly alert towards their holdings, the lesser the time they choose to hold the stocks!

Prableen Bajpai can be contacted at FinFix

There are many sub categories of traders. One of the common ways to distinguish them is the “time period” for which traders hold a stock, which can vary from a few seconds to months or even years. Some of the popular trading strategies are day trading, swing trading, scalping and position trading. Choosing a style that suits your own trading temperament is essential for the success in the long term. This article lays out the differences between the scalping strategy and a swing trading strategy.

Scalping

The strategy of scalping targets minor changes in the intra-day stock price movement to build up profits by frequent entry and exit throughout the trading session. It is sometimes seen as a subtype of the day trading technique; scalping involves multiple trades but with a very short holding period, a few seconds to minutes. Since the positions are held for a very short period, the gains on a particular trade (or profits per trade) are small and thus scalpers indulge in numerous trades (even in hundreds during the day) to build up the profit. The limited time exposure to the market reduces the risk for the scalper.

Scalpers are quick and do not stick to any pattern, they may be short in one trade and then go long in the next; small opportunities are what they target. Scalpers commonly tend to work around the bid-ask spread i.e. buying on the bid and selling at ask (or rather around the bid and ask), thus making the spread their profit. Such opportunities normally exist more than large moves, as fairly still markets also witness minor movements that can be exploited. Scalpers usually follow the short period charts like the 1 minute, 5 minute charts or even transactions based tick charts, to study the price movement and take a call on a certain trade.

Scalpers look for adequate liquidity as it is compatible with the high frequency of trading. There should be access to accurate data (quote system, live feed) as well as fast execution of trades (thus there is preference for direct access brokers). Since there is frequent buying and selling, high commissions tend to reduce the profit, as they increase the cost of performing the trades.

Scalping is best suited to those who can devote time to the markets, stay focused and act swiftly. It’s usually said that impatient people make good scalpers as they tend to exit from a trade as soon as it becomes profitable. Scalping is for those who can handle stress, take quick decisions and act accordingly.

Swing Trading

The strategy of swing trading involves identifying the trend and then playing within it. For example, Swing traders would usually pick a strongly trending stock after a correction or consolidation i.e. just before it’s ready to rise again and exit after they pocket some profit. Such buying and selling is repeated to reap gains and in cases where stocks fall through support, they would move to the other side and go short. Typically, swing traders are “trend followers”, if there is an uptrend, they go long and if the overall trend is towards the downside, they would go short.

Swing trades remain open from a few days to weeks (near-term) to even months (intermediate term), but typically last a few days. In terms of the time frame, patience required and potential returns, swing trading falls between day trading and trend trading. Swing traders use technical analysis and charts that display the price action which helps to locate the points of entry and exit for profitable trades. These traders study resistance and support and use Fibonacci extensions by combining them with other patterns and technical indicators. Some amount of volatility is healthy for swing trading as it gives rise to opportunities.

Swing traders keep an eye on bigger gains by indulging in fewer stocks, this helps to keep brokerage costs lower. The strategy works well for those who cannot stay glued full time to the markets as it does not require keeping a minute by minute track of things. Part time traders who are able to peek at what’s happening during their work intervals often opt for this strategy. To be successful at swing trading, pre-market and post-market review is considered crucial. Swing trading requires people to be patient with overnight holdings and hence it’s not for those who get anxious in such situations. Swing trading is considered suitable for all types of investor including novices.

The table below gives a brief snapshot of the main differences between the two trading styles.

In Summary

Every trading style comes with its own set of risks and rewards. There is no perfect strategy which suits all traders, thus it is best to choose a trading strategy based on your skill, temperament, time that can be dedicated, account size, experience of trading and risk tolerance. In general as traders devote more time and become increasingly alert towards their holdings, the lesser the time they choose to hold the stocks!

Prableen Bajpai can be contacted at FinFix

Last edited by a moderator: