Most investors desire diversification. It only makes sense not to put all your eggs in one basket.

One of the boons of the age of exchange-traded funds (ETFs) is that it’s now easy to diversify among many asset classes within a regular stock brokerage account. Besides funds based on combinations of stock, there are ETFs that follow the prices of bonds, real estate, precious metals, foreign currencies and more.

One category that should be of interest to all investors is the energy market. We all know that the price of oil and gas fluctuates. These may eventually be replaced by renewable energy sources, but for the foreseeable future they will be a vital part of the global economy. Like all commodities, an investment in oil provides a hedge against inflation. And since the price of oil is only loosely connected to the prices of most other things we invest in, it could provide additional diversification.

How to Invest in Oil

You probably know that there are ETFs that track the price of another key commodity, which is gold. Buying shares of the ETF known as GLD is similar to buying bars of gold in that the fund actually owns one ounce of gold for every ten shares it issues. When you own shares of GLD, you indirectly own that physical gold.

It would be nice if there were such a straightforward way to own oil. Unfortunately, oil is not valuable enough in relation to its volume to make it economical to store indefinitely. There is no way to “buy and hold” oil physically since its storage costs would eat up its value in a few years. That’s why no such ETF exists.

So how do you invest in oil? The closest thing to an oil ETF is the fund known as USO, the US Oil fund. That fund owns futures contracts on West Texas Intermediate crude oil (WTI). Over short periods of time, the price of USO very precisely tracks the price of WTI itself. The key there is “over short periods of time,” meaning hours to days. USO is a very good day-trading or overnight hedging vehicle, which is what it was designed for.

Over longer periods, the costs of storing and transporting oil eat into the value of USO, just as they would if you owned the oil physically. If the price of oil remained stationary for a year, the price of USO would decline at a rate roughly equal to those carrying costs.

From January 2007 to January 2017, the price of crude oil went from $58.17 per barrel to $52.25, with excursions along the way between $140 and $28. Over that ten-year period, the net change was a drop of about 10%, as shown on this chart:

Ten-year Historic Price of West Texas Intermediate Crude Oil

The benefits of adding oil to you investment portfolio.

Meanwhile, the value of USO went from $51.60 to $11.36, a drop of over 75%. So, no cigar for USO as a long-term investment.

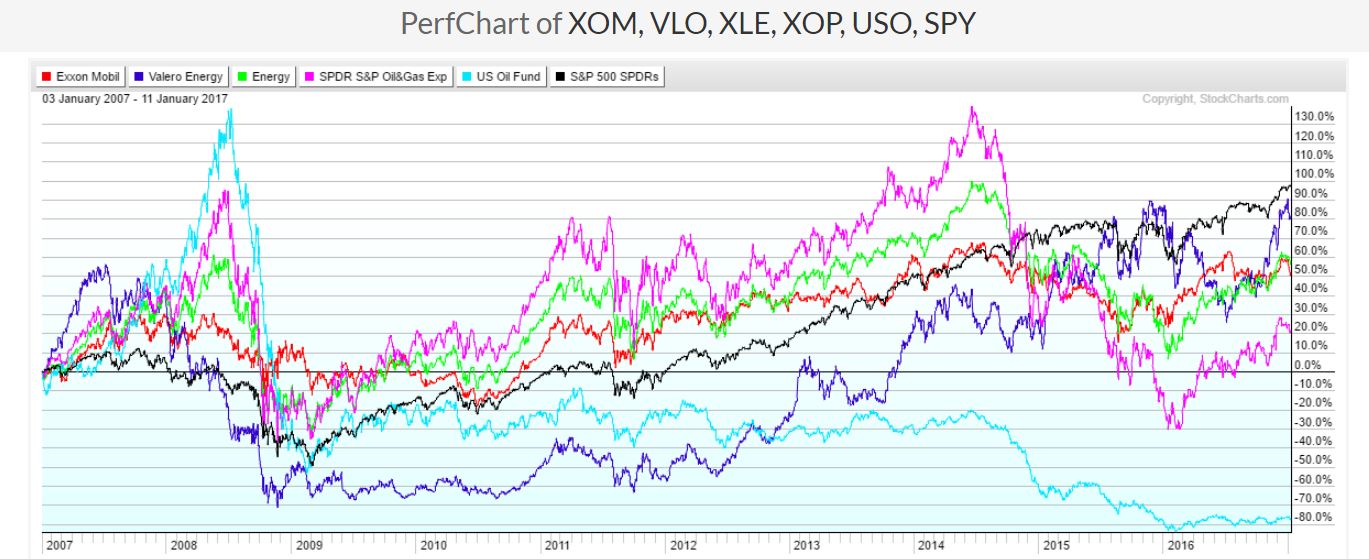

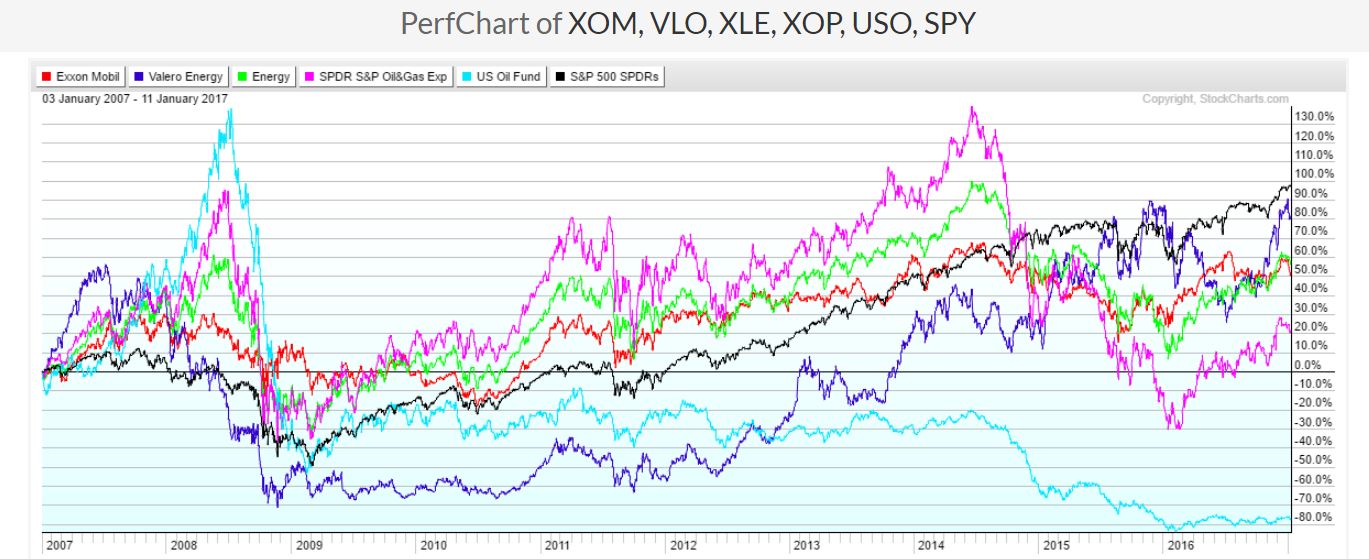

Fortunately, there are other choices. Note the chart below, which compares not just prices but total return including price change and dividends over that ten-year period.

Energy Investments 10-Year Comparison

How to add oil to you investment portfolio.

In the chart above, the approximate cumulative 10-year returns are shown for:

As you can see, the returns of all of these alternatives have had their ups and downs over the years. Each one of them has spent some time at the top of the heap and some time at the bottom. Yet all (except USO) have had a positive net return over a ten-year period when crude oil itself declined by 10%. Also note, the black line which represents the stock market and how often it has been the case that it was not performing as well as these specialized energy investments.

All of the above ETFs have available options, so covered call strategies can be used on them which could boost returns further.

So when considering investing in oil, depending on your appetite for risk you could choose to ride the big waves with XOP or have a little less drama with one or more of the other choices. In any case, think about adding one or more investments in energy to your portfolio.

Russ Allen can be contacted on this link: Russ Allen

One of the boons of the age of exchange-traded funds (ETFs) is that it’s now easy to diversify among many asset classes within a regular stock brokerage account. Besides funds based on combinations of stock, there are ETFs that follow the prices of bonds, real estate, precious metals, foreign currencies and more.

One category that should be of interest to all investors is the energy market. We all know that the price of oil and gas fluctuates. These may eventually be replaced by renewable energy sources, but for the foreseeable future they will be a vital part of the global economy. Like all commodities, an investment in oil provides a hedge against inflation. And since the price of oil is only loosely connected to the prices of most other things we invest in, it could provide additional diversification.

How to Invest in Oil

You probably know that there are ETFs that track the price of another key commodity, which is gold. Buying shares of the ETF known as GLD is similar to buying bars of gold in that the fund actually owns one ounce of gold for every ten shares it issues. When you own shares of GLD, you indirectly own that physical gold.

It would be nice if there were such a straightforward way to own oil. Unfortunately, oil is not valuable enough in relation to its volume to make it economical to store indefinitely. There is no way to “buy and hold” oil physically since its storage costs would eat up its value in a few years. That’s why no such ETF exists.

So how do you invest in oil? The closest thing to an oil ETF is the fund known as USO, the US Oil fund. That fund owns futures contracts on West Texas Intermediate crude oil (WTI). Over short periods of time, the price of USO very precisely tracks the price of WTI itself. The key there is “over short periods of time,” meaning hours to days. USO is a very good day-trading or overnight hedging vehicle, which is what it was designed for.

Over longer periods, the costs of storing and transporting oil eat into the value of USO, just as they would if you owned the oil physically. If the price of oil remained stationary for a year, the price of USO would decline at a rate roughly equal to those carrying costs.

From January 2007 to January 2017, the price of crude oil went from $58.17 per barrel to $52.25, with excursions along the way between $140 and $28. Over that ten-year period, the net change was a drop of about 10%, as shown on this chart:

Ten-year Historic Price of West Texas Intermediate Crude Oil

The benefits of adding oil to you investment portfolio.

Meanwhile, the value of USO went from $51.60 to $11.36, a drop of over 75%. So, no cigar for USO as a long-term investment.

Fortunately, there are other choices. Note the chart below, which compares not just prices but total return including price change and dividends over that ten-year period.

Energy Investments 10-Year Comparison

How to add oil to you investment portfolio.

In the chart above, the approximate cumulative 10-year returns are shown for:

- XOM +53% (red) Exxon Mobil, a global vertically integrated energy company

- VLO +87% (dark blue) – Valero, a refining company. It doesn’t drill; it buys, refines and sells

- XLE + 60% (green) – the Select Energy SPDR fund, a diversified mix of oil company stocks

- XOP +22% (Magenta) – the SPDR S&P Oil & Gas Exploration Fund. It includes stocks of companies that drill and produce, not refiners

- USO -75% (light blue) – the US Oil Fund constructed of WTI futures, for comparison.

- SPY +95% (black) – The S&P 500 index, for a comparison to the US stock market

As you can see, the returns of all of these alternatives have had their ups and downs over the years. Each one of them has spent some time at the top of the heap and some time at the bottom. Yet all (except USO) have had a positive net return over a ten-year period when crude oil itself declined by 10%. Also note, the black line which represents the stock market and how often it has been the case that it was not performing as well as these specialized energy investments.

All of the above ETFs have available options, so covered call strategies can be used on them which could boost returns further.

So when considering investing in oil, depending on your appetite for risk you could choose to ride the big waves with XOP or have a little less drama with one or more of the other choices. In any case, think about adding one or more investments in energy to your portfolio.

Russ Allen can be contacted on this link: Russ Allen

Last edited by a moderator: