Back home.

Usual routine. I checked first if there's emails from IB talking about margin violation or liquidation and there's none. Great.

Other than this, now comes the moment of truth.

When I last checked, this morning at 9 am CET, JPY had gone just 15 ticks from my first contract exit. Did it fall after that, in the ensuing 6 hours?

I wonder.

I think at least 2 contracts got executed, but I dream of all 4 contracts being executed.

And after this, if I get away with this, I must really quit my martingale crap.

I'll check in a while, after getting changed so I can be ready in my pajamas in case of a heart attack.

...

Didn't check yet. Anyway, in my opinion it went up because remember what I said about the JPY? It either goes up all day long or down all day long, and so given that it decided to go up, it will go up all day long, and big time hopefully.

So I am definitely hoping to see all my 4 contracts closed. Of course, whatever happens, given that I spread them out over 40 ticks, I'll have something to regret. But let's remember that it was what I chose to do, and that when I did choose, I did not know the future.

...

Wow, I've been home for half an hour and I am still postponing checking how my trades turned out. I am looking for some magical propitiatory ritual to do before checking, pretty crazy... but I can't come up with anything really powerful to skew JPY in my favor.

I'll click another poke to my facebook girlfriend. By the way, we're back together I think. She's been poking me a few times per day as of lately.

Nope.

She hasn't poked me back, so I can't poke her again.

What do I do?

I feel like going out and buying some sushi. It's japanese food, so it might help my trade, literally. If everyone started buying sushi, JPY would somehow be affected.

Yeah, I should definitely go out and buy sushi before checking the markets.

Besides, as i said, it goes all day in one direction, so the longer I wait, the longer it has to go up, and you know what happens if I check. I will be so happy to get out with a small loss, that I'll cut profits short even on the last contract, or whatever is still open. Hopefully just the last one, which didn't have an exit.

...

I guess it's like when someone dies and I get very mad at my aunt for telling me that "x died". Stupid bitch. Or my father does it, too. Mother ****ing asshole. I tell them to break the news to me little by little and not all at once.

In the same way, I'd like to do for JPY. Someone to meet me and tell me: it is going pretty well, but not as well as you expected...

Or someone to tell me: sit down, unfortunately...

I think I am going to get drunk, which is the equivalent of having the news a little at a time. Right, because when you're drunk, everything is softer.

I'll go buy sushi and japanese beer, so I can actually help the JPY to rise.

Then, once I am drunk, I will check how my trades are doing.

...

OK, back.

It's been an hour.

I ate my japanese food, and drank one sapporo beer already. About to start the second one, at the end of which, I will check my JPY trades. Already a bit dizzy.

The child next door is talking, he can't be nuked, so I need some heavy duty music.

Actually I am in a good mood, because I presume my trades went well and got executed.

If it's not the case... I better be drunk when I find out.

...

Ok, the child is still noisy. I need red hot chili peppers. Norah Jones won't do.

The Zephyr Song - Red Hot Chili Peppers + lyrics - YouTube

You know, one sapporo beer can is one huge mother ****er...

You can walk into a movie theater in Amsterdam and buy a beer. And I don't mean just like no paper cup. I'm talkin' about a glass of beer.

And I don't mean no paper cup. I'm talkin' about a 650 ml can.

...

Ok, I am drunk enough to check the JPY.

I'll drink the rest of the can in case it didn't go as well as expected.

Let's go for it.

I'll start from esignal, because it breaks the news slowly and it prevents a heart attack. I don't want to see a -x thousands on TWS without expecting it. Yeah, that's how sensitive I am. That's why I engaged in martingale to begin with, because a 200 dollars bothered me that much.

Ok, but first of all, let's define my hopes. What am I expecting?

There was no margin call last time I checked so I am expecting to have a loss less than 4000. That's for sure.

1) loss > 4000 will make me very unhappy

2) ongoing loss = 2000 will not change my mood

3) 1 contract exited at 60 will make me slightly happy

4) a second contract exited at 70 will make me pretty happy

5) a third contract exited at 80 will make me abundantly happy

6) a fourth contract exited at 90 will make me extremely happy

7) a fifth contract with ongoing profit in the thousands will make me exceedingly happy

Red Hot Chili Peppers - Universally Speaking Lyrics - YouTube

A bit drunker.

Ready to go to esignal.

...

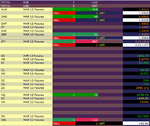

Wow, not looking good at all... approaching ti very slowly. I first looked at AUD, CHF, and GBP now. And wow, it's at record lows. That doesn't bode well.

Dollar is strong relative to GBP, so how weak can it be relative to JPY?

I wonder.

Little by little.

Let's check the other currencies, and last JPY. I am not ready. I am fearful. I am cold.

Holy ****!

AUD, CAD, CHF (so so), EUR, GBP are all weak to the dollar!

How on earth am I going to be making money on JPY?

I need to drink another class of sapporo.

Ok, **** it. I finished my last can of sapporo. It is one mother ****ing heavy can. It weighs about a kilo.

Let's go for it.

Let's check JPY.

No, wait. Let's check my email for a margin violation warning, to be prepared for the worse.

...

None.

So, where the **** is price?

Let's do it. Let's check JPY. On esignal.

wELL, I've written down my hopes anyway.

So let's check it. One more song before checking it.

Red Hot Chili Peppers - Can't Stop Lyrics - YouTube

My hands are cold. My beer is finished. I need to check JPY.

...

****!

It didn't get anywhere?!

In all these hours?!

The high is the same as this morning? 1.1045?!

How can it stay within that range for 24 hours?

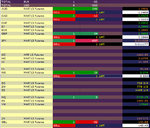

I'm going to check the details now and then, in a minute, assess my happiness.

...

wow...

No trades must have been triggered.

Yup.

Yep.

Right, because... JPY didn't exceed that high, from this morning... well, esignal is delayed by 10 minutes... but what's the chance?

So. How happy am I?

Let me check my ongoing loss on TWS.

I guess my prayers didn't work.

Well, at any rate it looks like it's bouncing big time. I mean, the chart looks real good.

Let's check the ongoing loss and assess my happiness.

Mood lower than expected. A bit pissed off to unchanged.

I am going to keep this going overnight.

...

The CAD is flying now, upwards. Didn't I tell you it would?

I wonder how all these currency reversals will affect/interact with JPY.

I hope it will follow suit.

JPY seems to be stuck.

But remember what I said. If it goes up, it goes up big time. If it goes down, viceversa.

And today it was an up-day.

I cannot betray my appraisal of the situation, at a time when I was unbiased.

Its rise is meager. But i am not going to leave it to chase other currencies.

On the other hand, if I quit now, I would have equity at 20k, and my dream would still be alive.

Instead, I am monitoring the hourly chart, and praying:

But don't forget that monitoring is bad for me.

20k.

3k lost relative to before starting this JPY trade.

3k/23k= 13% loss... acceptable.

Should I close at a loss of 3k?

Maybe I will, if I stare at it long enough.

I might regret it dearly if I don't.

I was expecting a 200 ticks rise today.

Ending the day with a capital of 20k would be a success at this point.

Ok, **** it.

I am going to set an exit at 40 fo everyoen.

0.011040 for everyone.

if it happens, so be it.

i'll lose 2700 from this evil trade - acceptable, totally acceptable

thats it

lets do it

17 ticks to go

fcourse i might cancel it in case it starts flying

16 ticks away from the end of the nightmare

Dream A Little Dream (Laura Fygi) - YouTube

14 ticks from the end of my nightmare

...

17 ticks...

Harry Nilsson - Over the Rainbow (explicit) - YouTube

...

Fine, JPY, you want a promise?

Fine, I swear I won't change my LMT order.

5 contracts at 40.

Just get there and I'll get the **** out.

I sweaar I won't change it.

0.011040 for all 5 contracts.

Not higher, not lower.

Oh, god, 20 ticks to go.

...

24 ticks to go

I should have thought abou texiting before.

now my 2700 of loss don't look so easy anoy more

25 ticks to go

27 tiocs tp gp

I shpouid have thpougth bout it before

28

29

screw you all

i am goin to turn it ooff

and set the exits much higher

...

no, wait there might be a way out right now...

... a bounce...?

the overleveraged trader hangs on the market's lips (can you say this? it sounds right in italian)

Anyway...

the move, what seemed a reversal is evolving:

As I said, I promise I won't move my exit LMT order.

This is it. If you let me off the hook, I will get the **** out.

The Godfather - Tessio is taken away

JPY, can you let me off the hook, for old times' sake?

20 ticks to go

18 ticks to go

...

The Godfather - 07 - Love Theme From The Godfather - YouTube

20 ticks to go

in the meanwhile CAD keeps rising. I told you so.

I should just get out of this crap and go long on CAD with all the capital I have.

19 ticks to go.

...

my facebook girlfriend poked me again!

Now the markets certainly will go my way.

I could make 10k, but I'll be happy with exiting with a 2700 dolalrs loss.

...

very odd. She poked me, on facebook, and yet the markets aren't going my way, yet.

now 21 ticks to go, before my orders get executed.

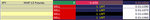

In the meanwhile, while I am blowing out the account, my journals are kicking ass:

Yep, 380k view all combined. I wish that was my capital. One dollar per view.

Damn. I suck.

24 ticks to go.

I guess I'll start another post, in order to finish the day. Too much information on this one and I wouldn't want some technical error to delete the entire post, with all the images attached.