Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

I either get out today at a good price or... I am changing my mind about closing it.

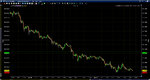

A bounce is overdue:

Do you know how it's going to feel to close my trade and see JPY rise for 5 days?

If I don't close it, how much more can it fall?

I am really delusional, I know. It's really a bad spot I am in.

I selected a bad trade, because I didn't want to lose 200 dollars. Really think about it. I would have never gotten into this trade, had it not been for that 200 dollars I was losing from it. I tend to be vengeful and hold grudges, both with life and trading.

Same as in 2008 actually. GBP was losing 200 dollars. I added contracts, and brought my account from 24k to 5k.

I have to close it?

I don't know. I am really frustrated by this choice of whether to close it and risk feeling like an idiot because it bounces on Monday, or keeping it open and risk feeling like an idiot because it doesn't bounce and I blow out my account.

If it could just rise 50 ticks and allow me to close it without a 6000 dollars loss, it would be easier.

So far it's like this for me: if I can get out of this crap with a loss of 3000, I'll be ok with closing it.

If if I have to lose 6000, I am very tempted by the idea of not closing it.

Only 4 more hours to go.

It's amazing how little the JPY bounces in general. It just goes straight down or straight up. It reverses on the next day. Forget about expecting the wild swings of all other markets. JPY just goes one way or the other. Too bad not studying this behavior before.

...

On the other hand, let's also think about this:

1) if I close the trade today I risk being an idiot with 18k who missed a trade that could bring him to 25k

2) if I close the trade monday or later, I risk being an idiot with 0k

So the biggest risk is definitely in not closing it. Furthermore, I do deserve some sort of punishment, so feeling like an idiot for closing it before it rises would be an acceptable feeling.

Would I go long on JPY tonight? If I were flat and had lost nothing, would I consider going long on it, even with just one contract?

Nope. Too risky. Therefore I should be wise and risk feeling like an idiot for missing profit rather than for blowing out my account. There is no doubt that the feeling might be the same, but losing money is worse than missing profit.

idea2develop

Missing profit is almost no big deal at all, because opportunities are there every day. Losing money is different, because money is not there every day. You should not risk losing money out of being afraid of missing profit.

All right then. I need to close the trade today. Even if there is a big chance that Monday it will go my way and I'll regret it. But today I don't know what I will know Monday, so it makes no sense to feel like an idiot for being unable to predict the future.

This situation is too similar to GBP 2008. I martingaled on it, left my positions open and left for my vacation, for an entire month. When I came back, I had lost everything.

I cannot repeat that mistake. Lost money is worse than missed profit. Lost money is worse than missed profit. Lost money is worse than missed profit. Lost money is worse than missed profit...

I must show to myself that I've learned something from my past blowing out of accounts. Not everything I was taught, but at least a small percentage of the beatings I've taken. At least those lessons that resemble the present, I must at least learn from those.

If, despite all these realizations, I still decide to keep my JPY contracts open, then I am a Jesse Livermore, for life.

The question is really down to this: do I want to make money or do I want to be thrilled and break records but only temporarily until I blow out my account? Do I want to make money or do I want to go after % performances and then blow out my account?

If I close my positions today, I still have a good capital and a chance to increase it. If I don't close it, I will be playing russian roulette. Which is what I did yesterday. But if you play russian roulette, in the long run you blow out your account.

It is not anymore an issue of technical analysis here, as it wasn't yesterday. It is about whether i want to gamble or trade. Whether I want to play russian roulette or increase my money. The moment I decide I am not playing russian roulette, I will despise myself for playing it so many times. For not ending this madness one day earlier.

But I will not have blown out my account one more time.

This is a costly mistake. That set me back two weeks or more.

But it won't set me back 4 months if I close the trades today. If I don't close them today, the risk is losing 4 months of work.

But I might also not lose any time at all, because it could bounce back up.

The question is also this: what happens if I am set back 2 weeks? If I am dead by being set back two weeks, then I might as well risk it. But since I am in it for the long haul... then I might as well **** the two weeks and not risk the 4 months, because unless i learn this method of minimizing risk, it will happen again in the future, so I might as well show myself that I have learned now by losing 2 weeks, rather than showing late that I have not learned anything by blowing out an account much bigger than this one.

This could set me back 2 weeks now, and spare me later suffering. If I do learn.

I could get lucky by staying long overnight, and then this will happen again. As it's been happening given the luck I've had with it before, the martingale method I mean.

Only 3 and a half hours to go. I think I've made up my mind and I will close it. But if I am here with this trade open, it means there's other tendencies in me as well, that, after all these years of trading/gambling, are still active in my mind.

I don't know if we could call these tendencies "self-destructive" or what else, and if I tried, I might come up with some nice explanation that sounds very good and that is wrong, maybe linking everything to my parents. Let's just say that I have tendencies that make me blow out my account despite knowing how to not blow it out. Maybe there's two people in me, that alternate one another, and one of the two is not wise.

A bounce is overdue:

Do you know how it's going to feel to close my trade and see JPY rise for 5 days?

If I don't close it, how much more can it fall?

I am really delusional, I know. It's really a bad spot I am in.

I selected a bad trade, because I didn't want to lose 200 dollars. Really think about it. I would have never gotten into this trade, had it not been for that 200 dollars I was losing from it. I tend to be vengeful and hold grudges, both with life and trading.

Same as in 2008 actually. GBP was losing 200 dollars. I added contracts, and brought my account from 24k to 5k.

I have to close it?

I don't know. I am really frustrated by this choice of whether to close it and risk feeling like an idiot because it bounces on Monday, or keeping it open and risk feeling like an idiot because it doesn't bounce and I blow out my account.

If it could just rise 50 ticks and allow me to close it without a 6000 dollars loss, it would be easier.

So far it's like this for me: if I can get out of this crap with a loss of 3000, I'll be ok with closing it.

If if I have to lose 6000, I am very tempted by the idea of not closing it.

Only 4 more hours to go.

It's amazing how little the JPY bounces in general. It just goes straight down or straight up. It reverses on the next day. Forget about expecting the wild swings of all other markets. JPY just goes one way or the other. Too bad not studying this behavior before.

...

On the other hand, let's also think about this:

1) if I close the trade today I risk being an idiot with 18k who missed a trade that could bring him to 25k

2) if I close the trade monday or later, I risk being an idiot with 0k

So the biggest risk is definitely in not closing it. Furthermore, I do deserve some sort of punishment, so feeling like an idiot for closing it before it rises would be an acceptable feeling.

Would I go long on JPY tonight? If I were flat and had lost nothing, would I consider going long on it, even with just one contract?

Nope. Too risky. Therefore I should be wise and risk feeling like an idiot for missing profit rather than for blowing out my account. There is no doubt that the feeling might be the same, but losing money is worse than missing profit.

idea2develop

Missing profit is almost no big deal at all, because opportunities are there every day. Losing money is different, because money is not there every day. You should not risk losing money out of being afraid of missing profit.

All right then. I need to close the trade today. Even if there is a big chance that Monday it will go my way and I'll regret it. But today I don't know what I will know Monday, so it makes no sense to feel like an idiot for being unable to predict the future.

This situation is too similar to GBP 2008. I martingaled on it, left my positions open and left for my vacation, for an entire month. When I came back, I had lost everything.

I cannot repeat that mistake. Lost money is worse than missed profit. Lost money is worse than missed profit. Lost money is worse than missed profit. Lost money is worse than missed profit...

I must show to myself that I've learned something from my past blowing out of accounts. Not everything I was taught, but at least a small percentage of the beatings I've taken. At least those lessons that resemble the present, I must at least learn from those.

If, despite all these realizations, I still decide to keep my JPY contracts open, then I am a Jesse Livermore, for life.

The question is really down to this: do I want to make money or do I want to be thrilled and break records but only temporarily until I blow out my account? Do I want to make money or do I want to go after % performances and then blow out my account?

If I close my positions today, I still have a good capital and a chance to increase it. If I don't close it, I will be playing russian roulette. Which is what I did yesterday. But if you play russian roulette, in the long run you blow out your account.

It is not anymore an issue of technical analysis here, as it wasn't yesterday. It is about whether i want to gamble or trade. Whether I want to play russian roulette or increase my money. The moment I decide I am not playing russian roulette, I will despise myself for playing it so many times. For not ending this madness one day earlier.

But I will not have blown out my account one more time.

This is a costly mistake. That set me back two weeks or more.

But it won't set me back 4 months if I close the trades today. If I don't close them today, the risk is losing 4 months of work.

But I might also not lose any time at all, because it could bounce back up.

The question is also this: what happens if I am set back 2 weeks? If I am dead by being set back two weeks, then I might as well risk it. But since I am in it for the long haul... then I might as well **** the two weeks and not risk the 4 months, because unless i learn this method of minimizing risk, it will happen again in the future, so I might as well show myself that I have learned now by losing 2 weeks, rather than showing late that I have not learned anything by blowing out an account much bigger than this one.

This could set me back 2 weeks now, and spare me later suffering. If I do learn.

I could get lucky by staying long overnight, and then this will happen again. As it's been happening given the luck I've had with it before, the martingale method I mean.

Only 3 and a half hours to go. I think I've made up my mind and I will close it. But if I am here with this trade open, it means there's other tendencies in me as well, that, after all these years of trading/gambling, are still active in my mind.

I don't know if we could call these tendencies "self-destructive" or what else, and if I tried, I might come up with some nice explanation that sounds very good and that is wrong, maybe linking everything to my parents. Let's just say that I have tendencies that make me blow out my account despite knowing how to not blow it out. Maybe there's two people in me, that alternate one another, and one of the two is not wise.

Last edited: