Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

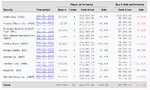

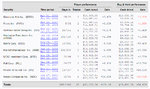

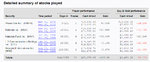

Ok, best accuracy yet

This below shows that I have reached an outstanding accuracy, at least by my own standards. Not very good yet at letting profits run, but at least I learned that I am capable of playing without taking any risks, and stopping my losses immediately and then trying again in case I had a loss, I managed to be profitable on 19 stocks out of 20. I stop here because I know how it goes once I incur a loss. It becomes the first one of a series, at least until my whole system will be univocally defined and automated, which it isn't right now.

Anyway, with 19 profitable stocks out of 20, I can once again say that it is possible to trade profitably just based on charts. It's not a random walk, and charts can indeed be read, interpreted and predicted accordingly.

I have realized that what I mostly need to do now is, rather than focusing on my accuracy, which is good enough already, is to focus on learning to cut my losses. Even in a trading simulator, I get very upset by losses, and cannot accept the idea that I've made a mistake and that the market isn't going my way. Actually, the more accurate I become, and the harder it is to accept that I made a mistake when that happens, because it happens less and less frequently.

Once I'll learn to cut my losses without any doubts and hesitation, I'll worry about letting profits run a little more. The most important thing that I need to convince myself of, and to prove to myself is that I can be profitable, constantly profitable, undoubtedly profitable, always profitable (as long as I can make a certain amount of trades).

Another thing I need to learn is going short, which i still rarely do, because i can't focus on so many things at once.

All these things will have to come later. But right now the most important thing is still to realize and get used to the idea that I can be consistently profitable. This confidence alone will bring many other psychological improvements in my trading.

This below shows that I have reached an outstanding accuracy, at least by my own standards. Not very good yet at letting profits run, but at least I learned that I am capable of playing without taking any risks, and stopping my losses immediately and then trying again in case I had a loss, I managed to be profitable on 19 stocks out of 20. I stop here because I know how it goes once I incur a loss. It becomes the first one of a series, at least until my whole system will be univocally defined and automated, which it isn't right now.

Anyway, with 19 profitable stocks out of 20, I can once again say that it is possible to trade profitably just based on charts. It's not a random walk, and charts can indeed be read, interpreted and predicted accordingly.

I have realized that what I mostly need to do now is, rather than focusing on my accuracy, which is good enough already, is to focus on learning to cut my losses. Even in a trading simulator, I get very upset by losses, and cannot accept the idea that I've made a mistake and that the market isn't going my way. Actually, the more accurate I become, and the harder it is to accept that I made a mistake when that happens, because it happens less and less frequently.

Once I'll learn to cut my losses without any doubts and hesitation, I'll worry about letting profits run a little more. The most important thing that I need to convince myself of, and to prove to myself is that I can be profitable, constantly profitable, undoubtedly profitable, always profitable (as long as I can make a certain amount of trades).

Another thing I need to learn is going short, which i still rarely do, because i can't focus on so many things at once.

All these things will have to come later. But right now the most important thing is still to realize and get used to the idea that I can be consistently profitable. This confidence alone will bring many other psychological improvements in my trading.

Last edited: