natureboy

Established member

- Messages

- 770

- Likes

- 2

Good Morning Everyone.

Yesterday was Murphy's Law in action. yikes.

GBPAUD - fail.

GBPUSD - fail

EURUSD - fail.

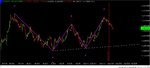

USDCAD long worked. I'm experimenting with some new intraday context filters. Pattern can help in the reward to risk department. And with filters and entry exit rules, a variety of probabilities are possible for practical trading.

I've got strength, trend, timing, so i'm automating long entries on EURUSD. We'll see if Disaster, Inc is still open for business. I lost 4% yesterday, so i'm only willing to hand over 2% max on this long, spread out over 10 separate entries. Stingy. Be Stingy, seriously.

Yesterday was Murphy's Law in action. yikes.

GBPAUD - fail.

GBPUSD - fail

EURUSD - fail.

USDCAD long worked. I'm experimenting with some new intraday context filters. Pattern can help in the reward to risk department. And with filters and entry exit rules, a variety of probabilities are possible for practical trading.

I've got strength, trend, timing, so i'm automating long entries on EURUSD. We'll see if Disaster, Inc is still open for business. I lost 4% yesterday, so i'm only willing to hand over 2% max on this long, spread out over 10 separate entries. Stingy. Be Stingy, seriously.