I will give this to you in very simple terms.There is a system but most people don't know.

Take option formula , price is calculated based on historical data , if price is 100 ticks for open to close average , the option price will be 100 from the mid to the top or 100 from the mid to the bottom , that is 200 ticks volatility max , for max premium of of 100 .

In reality premium is 70 , which makes it 35 for up and 35 for down bet (put).If you buy the up bet for 35 , at the advantageous price , you will get 100 , a net profit of 65.

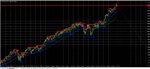

Add to that equation , the stocks are 75% of the time long biased , so buy the up bets called call options , and you have a profitable system.

When you have system , you expect to lose , something you are not mentally prepared for .When you put on the trade , you made analysis or emotional trades , if it fails it will insult your intelligence and self worth , something you are not mentally prepared for.It will also arouse the enemy within , as often said the many psychological demons within.

I suggest you do "daily mental preparations for losing " and prepare a mindset "ready to lose".You will be ready to behave properly , until the market does not dance to your thinking and beliefs.