City Index

Junior member

- Messages

- 23

- Likes

- 0

US equities look to be at an important inflection point with focus on today’s US PCE Price Index, and Federal Reserve Chairman’s speech at the Jackson Hole Symposium.

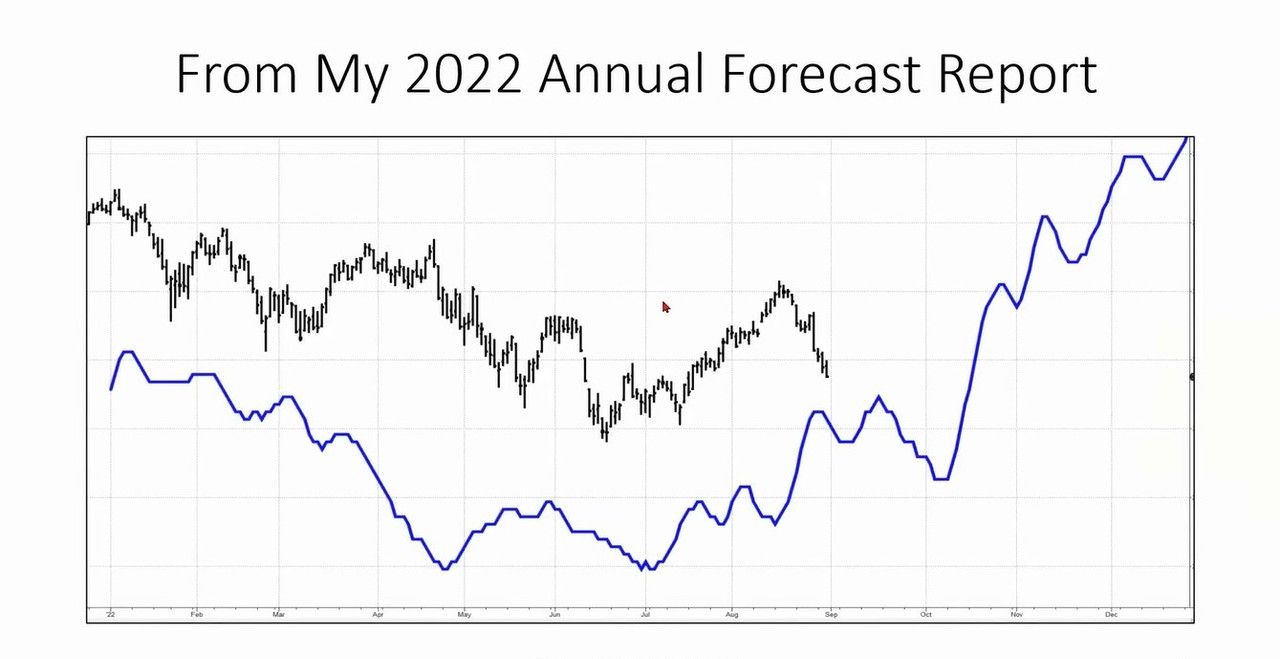

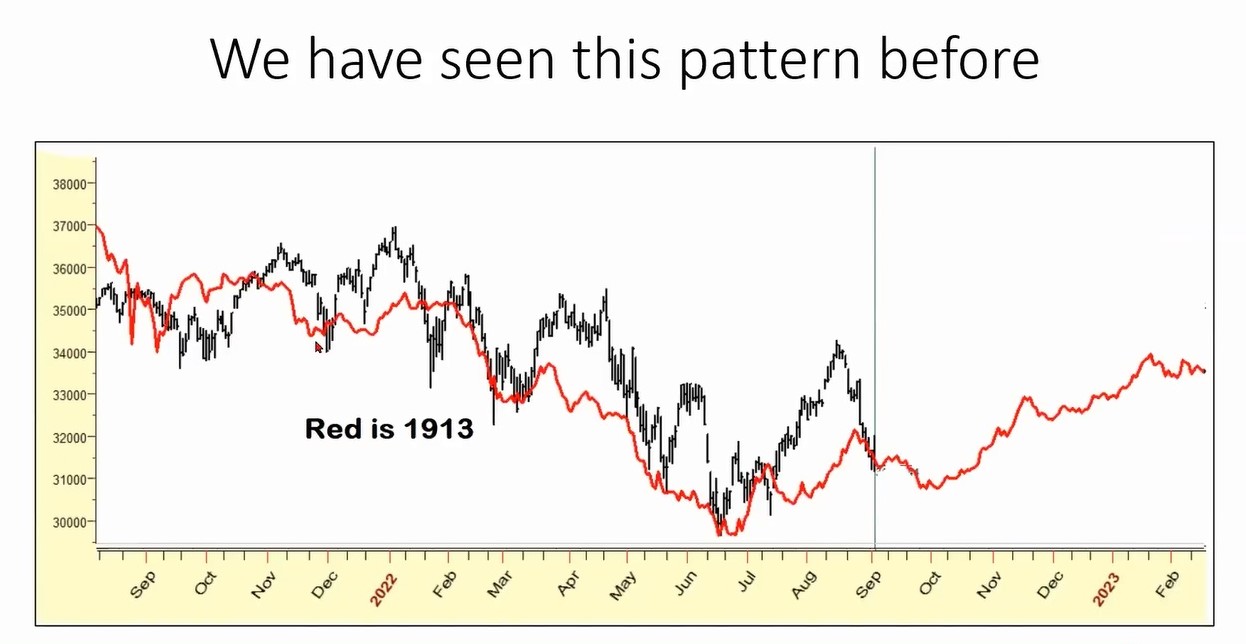

The S&P500 stalled at a confluence of resistance around the 200-day MA last week, including a downtrend resistance coming from the all-time-highs. The index has shown signs of basing near 4100 this week, but direction from here will be key in determining whether this rebound is sustainable, or if was a bear market rally ahead of the next leg lower.

Traders currently appear to be split on expectations for a 50bps or 75bps interest rate hike at next month’s FOMC Meeting, and today’s events have the potential tip the scales in either direction.

A hot Core PCE print, along with a hawkish monetary policy outlook from Chair Powell could expose the market to another sharp decline. While further indications of peak inflation, and any sign of a pivot from the Fed may help $SPX’s establish a new leg higher, and retest its major resistance levels.

All trading carries risk, but it will be interesting to see how today’s price action unfolds, and whether it has any role in setting-up the index’s next move.

The S&P500 stalled at a confluence of resistance around the 200-day MA last week, including a downtrend resistance coming from the all-time-highs. The index has shown signs of basing near 4100 this week, but direction from here will be key in determining whether this rebound is sustainable, or if was a bear market rally ahead of the next leg lower.

Traders currently appear to be split on expectations for a 50bps or 75bps interest rate hike at next month’s FOMC Meeting, and today’s events have the potential tip the scales in either direction.

A hot Core PCE print, along with a hawkish monetary policy outlook from Chair Powell could expose the market to another sharp decline. While further indications of peak inflation, and any sign of a pivot from the Fed may help $SPX’s establish a new leg higher, and retest its major resistance levels.

All trading carries risk, but it will be interesting to see how today’s price action unfolds, and whether it has any role in setting-up the index’s next move.