Copy into Excel and justify properly to see SnD.

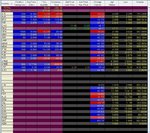

Estimated world uranium balance

Tonnes U (1) 2006e 2007f 2008f 2009f 2010f

---Mine Production 39584 44427 49124 56060 62771

---Other Supply 22661 20482 19635 20444 19250

Total Supply 62245 64909 68759 76504 82021

% Change YoY -2.7 4.3 5.9 11.3 7.2

Reactor Requirements 72765 69300 70532 73304 74729

% Change YoY -3.1 -4.8 1.8 3.9 1.9

Balance -10520 -4391 -1773 3200 7292

Note (1): Tonne U (tU) = 1.179 * 1 Tonne U308

Source: Macquarie Research, Ux Consulting, April 2007

"The new Ranger mine output figures for 2007 and 2008

compare to our (pre-7 March) production forecasts of

4,620tU in 2007, and 5,005tU in 2008, resulting in a cut

in our production forecasts of 594tU for 2007 and 1985-

2388tU for 2008. This is a substantial downward revision

to supply over the next two years, and has the effect of

pushing the market further into deficit in 2007 (-4,391tU),

and changing the market from a small surplus in 2008 to

a sizeable deficit (-1,773tU).

This development highlights the susceptibility of uranium

supply to disruption, as well as the concentrated nature

of uranium mine supply (ie, market depends on a small

number of large mines).

While we believe that supply will eventually come online,

this development, together with the news on 18 March

that production at Cameco’s Cigar lake project would be

delayed until at least 2010, is likely to leave the market

tight for longer than we had previously forecast, and also

raises the question of whether we should be allowing a

bigger allowance in our supply forecasts for

delays/disruption

Output growth out to 2010 is now much more dependent

on planned strong mine supply growth in Kazakhstan

and Africa. All eyes will be on production developments

in these countries over the next two years, and any

problems/delays will result in further substantial

increases in prices. Spot uranium prices are currently

trading at $95/lbU308, up from $40/lbU308 a year ago.

Overall, we believe that the implications of ERA’s

announcement on Monday have yet to work their way

through the spot market, and remain extremely bullish

for uranium prices in 2007 and 2008."