Hi,

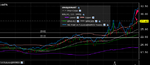

I'm hoping to better understand the relationship between how some of these ETF's are coupled to their underlying. In particular, I've been watching NAT GAS. UNG, the ETF for the front month NAT GAS future is supposed to (as is my understanding) try to match the percentage movement in it's underlying. Over the last 6 months or so, it appears to have done that. I note that the last few days though, NAT GAS when compared to UNG, they are pulling apart. See below chart

Are they likely to consolidate and how is this achieved (if it does not naturally).

Is there any way to take advantage of this such as a pairs type trade, perhaps sell nat gas, buy UNG, assuming the gap will contract?

Thanks.

I'm hoping to better understand the relationship between how some of these ETF's are coupled to their underlying. In particular, I've been watching NAT GAS. UNG, the ETF for the front month NAT GAS future is supposed to (as is my understanding) try to match the percentage movement in it's underlying. Over the last 6 months or so, it appears to have done that. I note that the last few days though, NAT GAS when compared to UNG, they are pulling apart. See below chart

Are they likely to consolidate and how is this achieved (if it does not naturally).

Is there any way to take advantage of this such as a pairs type trade, perhaps sell nat gas, buy UNG, assuming the gap will contract?

Thanks.