itsover

Junior member

- Messages

- 11

- Likes

- 1

Hi everyone,

this journal mostly serves as an extra layer of accountability for myself. I intend to post daily or weekly (to avoid spam), including when a trading day yields no setup or is filtered. I’m waffling quite a bit down here, so feel free to skip all that.

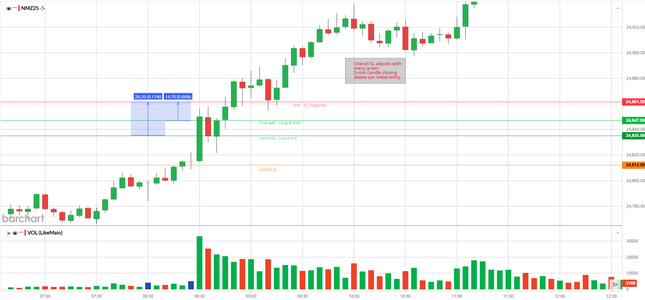

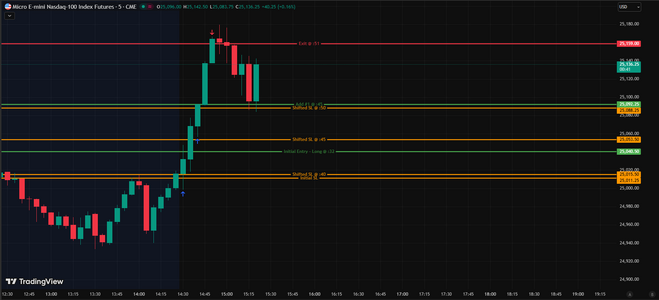

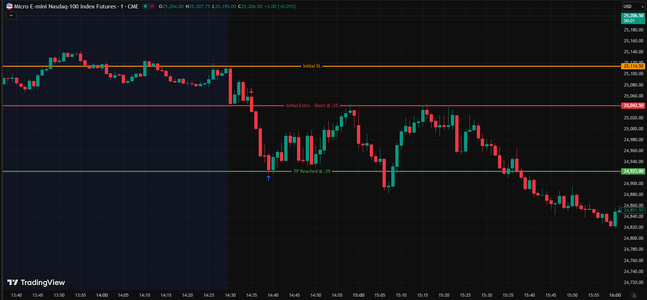

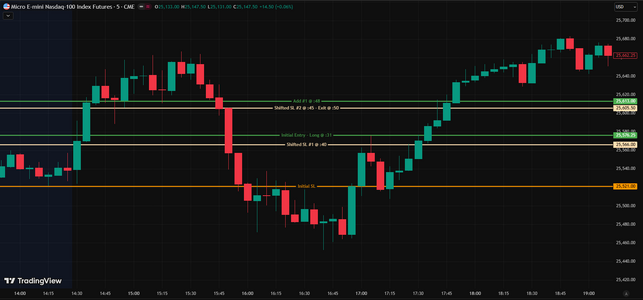

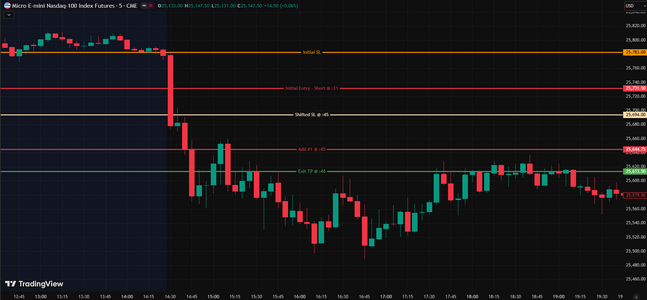

You'll find three example screenshots for 22/09/25, 23/09/25 and 03/10/25 attached to this post. There is a 1 minute and 5 minute chart attached for the trade on 22/09/25.

this journal mostly serves as an extra layer of accountability for myself. I intend to post daily or weekly (to avoid spam), including when a trading day yields no setup or is filtered. I’m waffling quite a bit down here, so feel free to skip all that.

I’ve been trading ‘seriously’ for almost four years now with the goal of fully relying on profits as my income. Frankly, I struggle to acknowledge or see myself as a serious trader without a track record of consistent profitability, so that is why I say it like that.

Much of the first two years I spent trading my own money with small size to the point I’d say it was unrealistic to expect to live off of it. Largely, this has been centered around GBP/USD, DAX, FTSE, Nasdaq and Dow Jones. These days, I only trade the Nasdaq. I don’t think I’ve missed a single trading day since late 2022, which makes my lack of progress in actual profit all the more disheartening.

There were some ups but, of course, mostly downs. I found prop firm challenges spare me the large losses in real capital, so I began trading them late last year. Since then, I’ve managed to reach the sim-funded stage in January, consistently across one month. I actually managed a first maximum payout following two weeks or so after and thought I had this figured out. However, not soon after, losses and resets followed– and in short, I have been stuck at the evaluation phase again since March 2025.

At the time I used a discretionary trading strategy focused on opening drives of the US cash open in the Nasdaq with some reversal trades sprinkled in. It went well enough, until it didn’t. Throughout the years, I found I’m prone to overtrading, FOMO, stubbornness and losing streaks. Often, these losing streaks are followed by switching trading strategies. I firmly believe these points are the main culprits of self-sabotage, which is why I want to start this public journal.

This journal isn’t even about P/L– I could trade a completely nonsensical strategy for all I care. To me it is about proving to myself that I can stick to a set of rules no matter what happens. I don’t feel I can progress as a trader or achieve success until I have mastered this come hell or high water.

Much of the first two years I spent trading my own money with small size to the point I’d say it was unrealistic to expect to live off of it. Largely, this has been centered around GBP/USD, DAX, FTSE, Nasdaq and Dow Jones. These days, I only trade the Nasdaq. I don’t think I’ve missed a single trading day since late 2022, which makes my lack of progress in actual profit all the more disheartening.

There were some ups but, of course, mostly downs. I found prop firm challenges spare me the large losses in real capital, so I began trading them late last year. Since then, I’ve managed to reach the sim-funded stage in January, consistently across one month. I actually managed a first maximum payout following two weeks or so after and thought I had this figured out. However, not soon after, losses and resets followed– and in short, I have been stuck at the evaluation phase again since March 2025.

At the time I used a discretionary trading strategy focused on opening drives of the US cash open in the Nasdaq with some reversal trades sprinkled in. It went well enough, until it didn’t. Throughout the years, I found I’m prone to overtrading, FOMO, stubbornness and losing streaks. Often, these losing streaks are followed by switching trading strategies. I firmly believe these points are the main culprits of self-sabotage, which is why I want to start this public journal.

This journal isn’t even about P/L– I could trade a completely nonsensical strategy for all I care. To me it is about proving to myself that I can stick to a set of rules no matter what happens. I don’t feel I can progress as a trader or achieve success until I have mastered this come hell or high water.

I trade pure price action and have recently developed a strategy for the MNQ1! I believe I can stick with and that should be profitable if my backtesting is to be believed. It’s an alteration of strategies I’ve traded across the past year. In short, I want to be early in the rare big runners and add aggressively. Most of these are either done in the first 15 minutes of the day, usually as a Stop-Out, or run about two hours.

The strategy is simple and I will go into detail here so you can see that I abided by it throughout the journal.

Market: MNQ1! | Charts: 1-min, 5-min | 14:31 to 15:00

I think the strategy could be automated very easily. One could argue there is no point for me even trading it manually. As I was messing with this, it occurred to me that true edge might be found in a few different discretionary elements that could come into play, namely:

The strategy is simple and I will go into detail here so you can see that I abided by it throughout the journal.

Market: MNQ1! | Charts: 1-min, 5-min | 14:31 to 15:00

- Preparation: Note prior day’s VIX close to gauge general market volatility.

- Bias: Determined by direction of first 1-min candle at US Cash Open.

- Filter: Skip if any 1-min candle closes on the opposing side of C1 first.

- Entry: Enter upon breakout in the direction of the established bias (2-3 pt buffer).

- Initial Stop Placement: Opposite side of Candle 1 (C1).

- SL Management: Trail after every 5-min candle (of our trend colour) that closes outside the C1 range.

- Add: Add one full-size position after a 5-min candle (other than the one we entered our initial position in) closes outside the 1-min range.

- Take Profit:

Exit via trailing stop or TP targets below, whichever triggers first.

VIX < 16 → 80 pts

VIX 16–20.99 → 120 pts

VIX > 21 → 150 pts

I think the strategy could be automated very easily. One could argue there is no point for me even trading it manually. As I was messing with this, it occurred to me that true edge might be found in a few different discretionary elements that could come into play, namely:

- Knowing when to wait for a full 1 minute close above/below the C1 signal candle and entering upon retest instead of the immediate breakout, avoiding early whipsaws. The risk here is missing the strongest runners.

- Adjusting Stop Loss more swiftly above/below a 1 minute candle that retested the C1 range after breakout. This would again avoid a full Stop Loss, but can mean missing a big runner by being stopped out early.

- Exiting by trailing every directional candle in our favour, sometimes capturing surprisingly large jackpot runners, or exiting all positions at a set target price based on current market volatility every time.

With the details of each trade, I will add a few fixed rule adherence criteria I will score accordingly as well as a comment for the day. The criteria are the following:

| Rule | Criteria |

| 1. Bias Defined | Correctly determined bias from C1 |

| 2. Filter Applied | Did I skip if a 1-min candle closed opposite the range? |

| 3. VIX Checked | Did I confirm and note the correct VIX category for TP? |

| 4. Session Discipline | Was entry within 30 minutes of Open? |

| 5. Valid Entry | Entered only on break in direction of bias. |

| 6. Stop Placement | SL correctly placed at C1 opposite side. |

| 7. Add Rule | Added only after valid 5-min close outside C1 (once only). |

| 8. Management | Trailed stop correctly on 5-min closes of trend colour. |

| 9. Time/Trade Cap | Only one trade today, no overtrading. |

| 10. Loss Limit | Daily loss cap of –$400 respected. |

| 11. Focus & Patience | Avoided FOMO, waited for rules. |

| 12. Emotional Control | Executed calmly without chasing. |

You'll find three example screenshots for 22/09/25, 23/09/25 and 03/10/25 attached to this post. There is a 1 minute and 5 minute chart attached for the trade on 22/09/25.

Attachments

Last edited: