china white

Established member

- Messages

- 979

- Likes

- 12

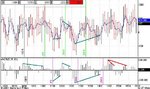

Read this if u r a TICK trader!

quite straighforward day with up to 14-16 pts available. If u cud only crack the midday puzzle :cheesy:

At 12:52 clear ND recorded on TICK and its momentum. I took it as a fake B/O, and reversed to short @ 1030.25. Blimey wrong - out flat. 13:28 - an even more pronounced ND, short again - out at a loss of 0.5 pts. Of coz, those WERE fake B/O but the big money was not YET legging over smaller fish on those attempts. Which led smaller fish to stage the 3rd try. U can c downward sloping res line B/O on both TICK and its momentum. Perfect chance to go long, I did not, missed out on 2-2.5 pts, but even more importantly, cud've missed out on a big move, it it had been one.

Finally comes 1034 - ND only on MACD of TICK, test of 20 ema (60 min ES) and 40 ema (5 min SOX). Tricky. The answer somes from TICK registering HOD @ above 1000 and reversing - expect SELL within 10 min. + a hint from pos time frame (see graph)

quite straighforward day with up to 14-16 pts available. If u cud only crack the midday puzzle :cheesy:

At 12:52 clear ND recorded on TICK and its momentum. I took it as a fake B/O, and reversed to short @ 1030.25. Blimey wrong - out flat. 13:28 - an even more pronounced ND, short again - out at a loss of 0.5 pts. Of coz, those WERE fake B/O but the big money was not YET legging over smaller fish on those attempts. Which led smaller fish to stage the 3rd try. U can c downward sloping res line B/O on both TICK and its momentum. Perfect chance to go long, I did not, missed out on 2-2.5 pts, but even more importantly, cud've missed out on a big move, it it had been one.

Finally comes 1034 - ND only on MACD of TICK, test of 20 ema (60 min ES) and 40 ema (5 min SOX). Tricky. The answer somes from TICK registering HOD @ above 1000 and reversing - expect SELL within 10 min. + a hint from pos time frame (see graph)