stoploss please

Established member

- Messages

- 780

- Likes

- 10

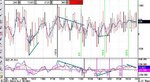

Trading the ES 20/10 to 24/10

S&R & pivot calculations for 20/10/03

Hi

S&R are obtained from the previous two days price action. This is where I think they should be. It would be good to hear if anyone has different calculations. These levels have been taken from a 15 minute time frame.

S&R

1052.25

1047.25

1043.50/1042.75

1038.50

1034.75

Pivot points, all obtained from a pivot point calculator.

http://www.stelaronline.com/resource/pivot.htm

R3 1065.50

R2 1058.75

R1 1048.25

Pivot 1041.50

S1 1031

S2 1024.25

S3 1013.75

Fib levels from low of 30/09 to high of 15/10

25% 1037.34

38.2% 1028.62

50% 1028.84

61.8% 1013.05

Other areas of interest,

Higher gap level at 1024.25. This equates to S2 obtained from the calculator.

Lower gap level at 1021

Kind regards and happy trading

Andy

S&R & pivot calculations for 20/10/03

Hi

S&R are obtained from the previous two days price action. This is where I think they should be. It would be good to hear if anyone has different calculations. These levels have been taken from a 15 minute time frame.

S&R

1052.25

1047.25

1043.50/1042.75

1038.50

1034.75

Pivot points, all obtained from a pivot point calculator.

http://www.stelaronline.com/resource/pivot.htm

R3 1065.50

R2 1058.75

R1 1048.25

Pivot 1041.50

S1 1031

S2 1024.25

S3 1013.75

Fib levels from low of 30/09 to high of 15/10

25% 1037.34

38.2% 1028.62

50% 1028.84

61.8% 1013.05

Other areas of interest,

Higher gap level at 1024.25. This equates to S2 obtained from the calculator.

Lower gap level at 1021

Kind regards and happy trading

Andy