for those of you interested i have found a way to create dashboards of economic indicators. Go to http://ieconomics.com and create an account (its totally free)

Click on indicators and then clear all the ones visible and start adding your indicators. When you are happy you can click on the share button at the bottom of the page and this will give you a uri. You can then simply save that in a favourites folder

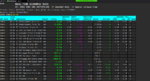

here is an example of Europe inflation (top 5 economies [excluding uk] and a Euro Area overview

http://ieconomics.com/i/4JaitVHzz1611/2

Website doesn't work. Btw good fundamental overview will be looking for the Friday payrolls also its hard to imagine additional spur to US Dollar as climbing over historical peaks is not likely to be supported by wary investors. 🙂