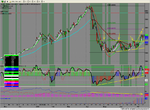

Silver reversal on the cards?

Arguments FOR a reversal are:

1. Fib 38% retracement from April decline,

2. Silver seasonally very weak between end July- mid aug (see chart)

3. Hit GANN resistance lines (?),

4. Silverstocks (HL, PAAS, CDE) act rather sluggish

Arguments against:

1. In uptrend since May,

2. Bull flag pattern on the daily chart atgetting 6.90-7.00'ish (fib 505 retracement)

3. weak USD,

4. a bit far fetch if argued that silver is industrial metal, than one would not want to see strong copper stocks which are rallying and continue to look bullish.

As always, keen to hear your views.

Arguments FOR a reversal are:

1. Fib 38% retracement from April decline,

2. Silver seasonally very weak between end July- mid aug (see chart)

3. Hit GANN resistance lines (?),

4. Silverstocks (HL, PAAS, CDE) act rather sluggish

Arguments against:

1. In uptrend since May,

2. Bull flag pattern on the daily chart atgetting 6.90-7.00'ish (fib 505 retracement)

3. weak USD,

4. a bit far fetch if argued that silver is industrial metal, than one would not want to see strong copper stocks which are rallying and continue to look bullish.

As always, keen to hear your views.