Phylo

Veteren member

- Messages

- 4,569

- Likes

- 401

Good Joke (for mathematically inclined) – the nonsense should be fairly obvious. However, I wonder how obvious....

There is nothing special about today, this year, any other year or every 1,000 years.

- If the age of anyone on the 31 December (note: the last day of the year) is added to the year of their birth the sum will – always = the current year, exact.

- If the age of anyone is calculated before their birthday of the current year then the sum of their age + year of birth will – always = the current year - 1 year (the current year less 1 year).

Anthony Hopkins (an actor, by way of example - see wikipedea, if interested) was born 31 Dec 1937.

This year, at current date - 6 Dec 2022 - Anthony is 84 years old.

84 + 1937 = 2021.

This year, on 31 Dec 2022 - Anthony will be 85.

85 + 1937 = 2022. (the current year, exact)

Example 2:

Next year, on 1 Jan 2023 Anthony will - still - be 85.

85 + 1937 = 2022.

Next year, on the 31 Dec 2023 Anthony will be 86.

86 + 1937 = 2023. (the current year, exact)

LAUGH OF THE DAY – anyone interested in more calculations with basic calculus ?

Some may find of interest and swing traders may be inspired to rediscover mathematical entertainment and sharpening of calculation skills while waiting for swing alert/s.

To code more complex indicators and automations an understanding of at least basic Mathematics is, at times, required.

Calculating the FTSE 100

Came across this actual problem in a book I chanced to glance through. The book provides answers to questions. I provide solution calculations (accommodate any typos) - some basic calculus.

[Question - 5.2 Contextual Q:3]

- On a particular day, the Financial Times 100 Share Index (FTSE 100) opens in London at 4,000.

- During the rest of the day, its value t hours at 9 a.m. is given as F = 4,000 - 16t^2 + 8t^3 - 3/4t^4.

- A broker is instructed to sell* the client’s position only if the value of the FTSE is falling.

- * according to pre-agreed increments and criteria – not relevant to Question and Answers and solutions.

Questions:

- What is the value of the FTSE at noon.

- Calculate the highest value of the index during the day and at what time to the nearest minute did this occur.

- If trading finishes at 4.30 p.m., by how much has the index risen or fallen during the day.

- During which times of the day could the broker have sold off the clients position ?

- 4011.3 points. note: indexes are designated in points (professionally) not pips.

- 4183.9 points at 3.19 p.m.

- Rise of 102.0 points at 4.30 p.m.

- Between 9 a.m. and 10.41 a.m. and between 3.19 p.m. and 4.30 p.m.

Solution A:

12.00 (noon) - 9.00 = 3. Therefore: t = 3. Note: 9.00 a.m. ~ t = 0; 10 a.m ~ t = 1; 11.00 a.m ~ t =2; 12.00 p.m. ~ t = 3.

At 9.00 a.m ~ t = 0

F = 4,000 - 16t^2 + 8t^3 - 3/4t^4

F= 4,000 - 16(0^2) + 8(0^3) - 3/4(0^4)

F= 4,000 - 16(0) + 8(0) - 3/4(0)

F= 4,000 - 0 + 0 - 0

The index = 4,000 points at 9.00 a.m. or when time t = 0.

At 12.00 ~ t = 3

F = 4,000 - 16t^2 + 8t^3 - 3/4t^4

F= 4,000 - 16(3^2) + 8(3^3) - 0.75(3^4)

F = 4,000 - 16(9) + 8(27) - 0.75(81)

F = 4,000 - 144 + 216 - 60.75

F= 4,011.25

F= 4,011.3

Answer A: The index vaue is 4,011.3 points at noon (12.00 p.m.)

Solution B:

See YouTube for basic differentiation

- Differentiate F(t) to determine local and absolute maximum/minimum values.

Normally the horizontal axis is designated the x-axis with x-values and the vertical axis is designated y-axis with y-values.

In this instance t(time) is equivalent to the x-axis and index point values equivalent to the y-axis. ---> this may help:

F = 4,000 - 16t^2 + 8t^3 - 3/4t^4

F'(t) - differentiated = -32t + 24t^2 -3t^3

Note: F'(t) is differentiated to the first order; F"(t) is defferentiated to the second order.

F"(t) = -32 + 48t - 9t^2

F'"(t) = 48 -18t

Note:

F = 4,000 - 16t^2 + 8t^3 - 3/4t^4 can also be arranged as - pay attention to (-) signs and (+) signs -

F = -3/4t^4 + 8t^3 - 16t^2 + 4,000.

F'(t) = -32t + 24t^2 -3t^3 can also be arrange as

F'(t) = -3t^3 + 24t^2 - 32t.

The latter is the normal way - presenting expressions/equations in decending exponential order of power - but it is not necessary.

It also become tedious to be pedantic about exact/strict/rigorous mathematical notation when knocking off a few quick solutions.

However, whether decending or assending, incremental exponential order of powers should be maintained.

Factorise - t:

-32t + 24t^2 -3t^3 = t(-32 + 24t - 3t^2)

a: t=0,

b: -32+24t-3t^2 = 0 or rearranged b: -3t^2+24t-32 (see above Note)

Apply -

quadratic formula to -32 + 24t - 3t^2 or

cubic formula to -32t + 24t^2 -3t^3

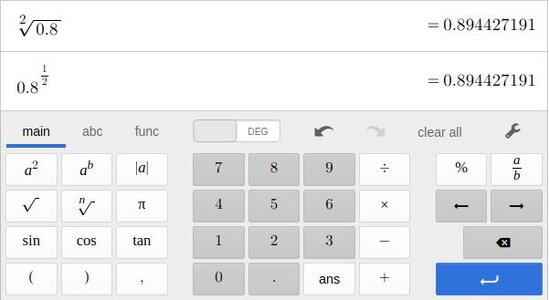

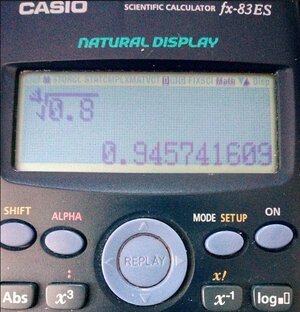

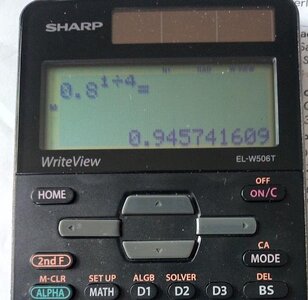

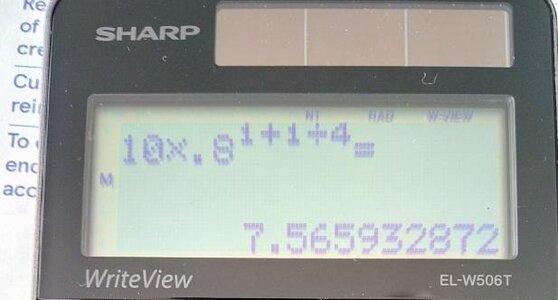

Sharp EL-W505T, may be suitable, cheap and considered superior features to comparable Casio – and bonus one key press ease of access re Pi - (not referal links) https://www.amazon.co.uk/Sharp-EL-W5.../dp/B07PHT9LN4 / https://www.sciencestudio.co.uk/product/sharp-el-w506t/

Applying quadratic formular to -32 + 24t - 3t^2

(note: calculator inputs will be in order, -3,+24,-32)

Then:

t2 = 1.690 (derived from factorisation -> quadratic formular calculation) [calculator or pen/paper if hardcore]

t3 = 6.309 (derived from factorisation -> quadratic formular calculation)

and t1 = 0 (derived from factorisation - refer a: )

Applying qubic formular to -32t + 24t^2 - 3t^3 (note: calculator inputs will be in order, -3,+24,-32,0)

Then:

t1 = 0 (derived from cubic formula calculation) [calculator or pen/paper if hardcore]. Note: The 'solve any cubic-synthetic division method' as touted by clickbate YouTuber's is not univeral and only solve for the YouTuber's cherry-picked equations. For a fuller understanding of cubic formular see - Enhancements - at end of post

t2 = 1.690 (derived from cubic formula calculation)

t3 = 6.309 (derived from cubic formula calculation)

Process t1

F1 = 4,000 - 16t1^2 + 8t1^3 - 3/4t1^4

F1 = 4,000 - 16(0^2) + 8(0^3) - 4/4(0^4)

F1 = 4,000 - 0 + 0 - 0

F1 = 4,000 (point value at t = 0 or 9.00 a.m.)

Process t2

F2 = 4,000 - 16t2^2 + 8t2^3 - 3/4t2^4

F2 = 4,000 - 16(1.69^2) + 8(1.69^3) -3/4(1.69^4)

F2 = 4,000 - 16(2.8561) + 8(4.826809) - 0.75 (8.15730721)

F2 = 4,000 - 45.6976 + 38.614472 -6.117980408

F2 = 3,986.798892

F2 = 3,986.8 points

Calculating time: 1.69

Minutes: .69(60) = 41.4 = 41

Hours: 9.00 + 1 = 10

Time2 = 10.41

Process t3

F3 = 4,000 - 16t3^2 + 8t3^3 - 3/4t3^4

F3= 4,000 - 16(6.309^2) + 8(6.309^3) -3/4(6.309^4)

F3= 4,000 = 16(39.8034) + 8(251.120) - 0.75(1,584.317)

F3 = 4,000 - 636.855 + 2,008.96 - 1,188.237

F3 = 4,183.868

F3 = 4,183.9

Calculation time: t = 6.309.

Hours: 9:00 + 6 = 15

Minutes: .309(60) = 18.54 = 19

Time3 = 15:19 = 3.19 p.m.

Answer B: The highest value of the index is 4,183.9 points at 3.19 p.m.

Solution C:

Time: t = 16.30 - 9.00 = 7.30 ; 30 minutes / 60 minutes = 0.5 ; t = 7.5

F = 4,000 - 16t^2 + 8t^3 - 3/4t^4

F = 4,000 - 16(7.5^2) + 8(7.5^3) - 0.75(7.5^4)

F= 4,000 - 16(56.25) + 8(421.875) - 0.75(3,164.0625)

F= 4,000 - 900 + 3375 - 2373.146875

F = 4,101.853125

F = 4,102

4,102 - 4,000 = 102

Answer C: The index has risen by 102 points at 4.30 p.m.

Solution D:

At 9.00 a.m. point value = 4,000.0

At 10:41 a.m. point value = 3,986.8 (this was the min value- determined by 1st level calculus differentiation)

At 3.19 p.m. point value = 4,183.9 (this was the max value-determined by 1st level calculus defferentiation)

At 4.30 p.m point value = 4,102.0

The index was falling between 9.00 a.m and 10.41 a.m. and 3.19 p.m. and 4.30 p.m.

Answer D: The broker could have incrementally sold off the client's position between 9.00 a.m - 10.41 a.m and 3.19 p.m. and 4.30 p.m.

Additional Material:

- Scientific Calulator, Online Graphing Calculator - www.desmos.com/calculator , pen + paper required.

- Refresher Kit (1 of 2/3) http://www.pdfdrive.com/complete-pur...184782396.html (sign in not required).

Note: Solve 'any' Cubic Equations - Synthetic Division Method: as touted by clickbate-youtubers is not a universal solution method as made to believe and will eventually fail outside the scope of clickbate-youtuber example criteria.

Mathologer is solid-bonafide-professional.

Last edited: