You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

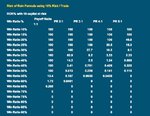

I was also wondering if the following chart's data remains the same if I risk 20% or 50% of capital per trade?

I noticed the data is under the heading - risk of ruin - so I think that explains it

Also - why does it stop at 65% accuracy - must be for the commercial world ;-)

Good Trading

F

I noticed the data is under the heading - risk of ruin - so I think that explains it

Also - why does it stop at 65% accuracy - must be for the commercial world ;-)

Good Trading

F

It didn't stop. Meaning if you are better than 65%, there is 0% chance of ruining your account.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

I was also wondering if the following chart's data remains the same if I risk 20% or 50% of capital per trade?

Of course not , but its all theoretical , in reality even with 10% risk/trade you are going to blow your account unless your win rate is 90% ...

Last edited:

Of course not , but its all theoretical , in reality even with 10% risk/trade you are going to blow your account unless your win rate is 90% ...

Explain why

Do the math. At 10% risk, a couple losses in a row very quickly deplete your account. Your winners will have to work double time to catch up.

Try 0.5-3% risk instead. Less profits, but you'll live longer.

A couple would be 20% technically. Also, a 75% trader isn't going to lose 10 in a row.

VielGeld

Experienced member

- Messages

- 1,422

- Likes

- 179

He absolutely can lose 10 in a row. I don't care if his win % is 99. If and when it does happen, he may find himself over-leveraged for the situation and he will blow up.

What you want to do is completely avoid the blow-up scenario. Limit your risk and the money will come if you have an edge.

What you want to do is completely avoid the blow-up scenario. Limit your risk and the money will come if you have an edge.

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

A couple would be 20% technically. Also, a 75% trader isn't going to lose 10 in a row.

Sorry to disappoint you - but a 75% trader can lose 10 in a row - he can lose even more - but similar he could win 35 in a row

I have been lucky last 5 years - as never lost more than 7 in a row - and my average scalping win ratios based on thousands of live trades - per 100 - ranges from a low of 62% to high around 87%.

So normally I expect 70 - 80% win ratio and then I use a method that if I lose 3 trades in a row in a session - I stop for an hour or more - and then break the sequence by making sure during the next 3 trades I pull one with any profit over 1 pip.

Black swan events can ruin accounts - although they might only happen now and again - sometimes a few times a year - they can cause havoc

Remember nothing is certain in trading

The more experienced and skilled in trading - the more likely you will have a way to break sequences - and not allow them to ruin your psych.

i work on very tight stops - so expect losses - every day but I can never say I will never have over 7 losses in a row because I have not had them in last 12000+ live trades.

Expect the unexpected - and as Vielgeld mentioned for retail stay under 3%

Ok if its just $100 account and you are not bothered losing it - yes take more risk - but at least under 3% stake size you can ride any runs of say 10 or 20 bad trades out of say 25 trades.

Also if you have a great run with over 30 consecutive winners due to a small change to your technique - dont think you have found the holy grail ;-)

Some top scalpers can go over 50 - 90+ winners in a row - but similar in a bad 4 hrs session when they lose focus - concentration etc that can turn to 10 - 20 losses.

You are only as good as your mind allows you to be ;-)

Hope that helps anyone saving a new account

Regards

F

He absolutely can lose 10 in a row. I don't care if his win % is 99. If and when it does happen, he may find himself over-leveraged for the situation and he will blow up.

What you want to do is completely avoid the blow-up scenario. Limit your risk and the money will come if you have an edge.

So 10 in a row at 99% would mean he would have had to win 990 in a row. I understand what you're saying, but realistically the odds are low of a 75% trader losing 10 in a row, especially a 99% trader.

VielGeld

Experienced member

- Messages

- 1,422

- Likes

- 179

^ See it this way. The odds are low that you would have a car accident, right?

But what if it happens? At best, you'll have a couple scratches on your car. At worst, you're dead or paralyzed for life. Can you afford this to happen? Most likely no, so you drive safely so as to minimize accidents.

The same principle applies here. The odds may be low, but can you afford having it happen? Most likely not. 🙂

But what if it happens? At best, you'll have a couple scratches on your car. At worst, you're dead or paralyzed for life. Can you afford this to happen? Most likely no, so you drive safely so as to minimize accidents.

The same principle applies here. The odds may be low, but can you afford having it happen? Most likely not. 🙂

CostaKapo

Active member

- Messages

- 164

- Likes

- 12

Sorry to disappoint you - but a 75% trader can lose 10 in a row - he can lose even more - but similar he could win 35 in a row

I have been lucky last 5 years - as never lost more than 7 in a row - and my average scalping win ratios based on thousands of live trades - per 100 - ranges from a low of 62% to high around 87%.

So normally I expect 70 - 80% win ratio and then I use a method that if I lose 3 trades in a row in a session - I stop for an hour or more - and then break the sequence by making sure during the next 3 trades I pull one with any profit over 1 pip.

Black swan events can ruin accounts - although they might only happen now and again - sometimes a few times a year - they can cause havoc

Remember nothing is certain in trading

The more experienced and skilled in trading - the more likely you will have a way to break sequences - and not allow them to ruin your psych.

i work on very tight stops - so expect losses - every day but I can never say I will never have over 7 losses in a row because I have not had them in last 12000+ live trades.

Expect the unexpected - and as Vielgeld mentioned for retail stay under 3%

Ok if its just $100 account and you are not bothered losing it - yes take more risk - but at least under 3% stake size you can ride any runs of say 10 or 20 bad trades out of say 25 trades.

Also if you have a great run with over 30 consecutive winners due to a small change to your technique - dont think you have found the holy grail ;-)

Some top scalpers can go over 50 - 90+ winners in a row - but similar in a bad 4 hrs session when they lose focus - concentration etc that can turn to 10 - 20 losses.

You are only as good as your mind allows you to be ;-)

Hope that helps anyone saving a new account

Regards

F

So many people get very confused with probabilities. Those with no formal education in the subject can get definitely confused. But even those with a formal education in the subject easily can get off track.

One area of confusion I see often is people thinking that processes, such as stock movement, follow probabilites, instead of probabilities describing processes. Probabilities are just mathematical descriptions based on past history and other considerations. The processes themselves know nothing about the probabilities. They don't know when you had started counting your sequence, for instance. They have no memory.

How about the so-called gambler's paradox. A gambler is watching a roulette wheel and notices that it has landed on black ten times in a row. He knows that the odds are 50/50 (ignoring "0" and "00" for the moment) between landing on a black or a red for each individual spin. He also know that the probability of getting ten blacks in a row is 1/1024 (2 to the tenth power is 1024); that is, virtually zero. So he thinks that FOR SURE the next spin has to be a red since the chances of NOT getting a red in 11 spins is virtually zero.

What the gambler has forgotten (or, more likely simply ignorant of) is that the roulette wheel has no memory. For each individual spin the chances are 50/50 between red and black regardless of the recent past.

So even though it is true that BEFORE THE 11 SPINS there is an exact probability of 1/2048 that in 11 spins of a roulette wheel you would get 11 blacks in a row, once the first ten have occurred and you notice all blacks, you cannot say anything about the next spin other than that there's a 50/50 chance for either black or red--just like all the other spins. Again, the roulette wheel has no memory of what has occurred prior.

The same is true with stock market probabilities. Even if they were exact like the roulette wheel (and stock market probabilites are surely not exact), you can use them only as guides into the future for a particular time range. But once the stock movement has started to occur, you need to at the very least recalculate the probabilities for whatever range of time is still of interest to you. If the stock hasn't moved as much as it was "supposed to" have during the initial part of the time range, you cannot assume it will "make it up" in the latter part. If you think this, you are falling victim to a version of the gambler's paradox.

One more thing: Along the lines of what I just said, I've seen traders completely misuse probabilities and standard deviations when attempting to make correct market decisions. I once read a pseudo-scientific article written by someone whom I believe was sincere. But ... oh so how misguided! His system went something like this. Throughout the trading day he constructs a bell-shaped (normal) curve of a stock based on its intraday movements. If a majority of the bell curve seems to be being built on either the left or the right side of the bell, he says there is a great chance that the rest of the bell "has to be" built on the opposite side. Thus, he would use this "knowledge" to day trade the latter half of the trading day.

The errors in his thinking are numerous. One of the errors, of course, is that the stock movement doesn't "know" its on someone's left- or right-side of a bell. Indeed, if he had instead constructed a bell in real time with a total time range of only the first half of the day (instead of the full day), he would have ended up with a completely different bell that is is "filled in" on both sides. Everything about his method is arbitrary including the time range. There are an infinite number of time ranges and an infinite number of possible histogram bin possibilities when constructing your histogram. Yet he swore by this "scientific" system. Lots of ignorance abounds.

why risking so much for your own money.

sometimes people too harsh to believe in the losing state trade, while too much put attention on how much profit they will get.

let's check the fact.

%loss % amount necessary to restore original equity

25% 33%

50% 100%

75% 400%

the math do the fact, now it's time for you to decide.

sometimes people too harsh to believe in the losing state trade, while too much put attention on how much profit they will get.

let's check the fact.

%loss % amount necessary to restore original equity

25% 33%

50% 100%

75% 400%

the math do the fact, now it's time for you to decide.

iMusingKiMi

Junior member

- Messages

- 41

- Likes

- 3

Amateur FOCUS on REWARDS,

Professional FOCUS on RISK.

Professional FOCUS on RISK.

Similar threads

- Replies

- 210

- Views

- 103K

- Replies

- 18

- Views

- 6K