Hoggums

Senior member

- Messages

- 2,176

- Likes

- 878

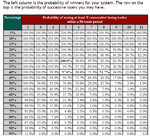

Ok ok - it all depends on your win/lose ratio etc - but I thought I'd share a simple spreadsheet I created to check out any system you have going.

Put your figures in the green fields and it will show you how likely you are to suffer drawdowns over time.

I'm not a statistical genius and the spreadsheet only accounts for getting several losers in a row - not for a general decline in the account. So the percentages you see on the spreadsheet are the absolute minimum - the real chances are likely to be higher.

Even so they can be an eye opener. I've put in a pretty typical trading system, one that wins 35% of the time and winners are 2.5x bigger than losers, averaging 2 trades a day. Risking 5% of your account on each trade you are 99.6% likely to suffer a 50% drawdown within five years because of 14 losers in a row.

Have fun.

Put your figures in the green fields and it will show you how likely you are to suffer drawdowns over time.

I'm not a statistical genius and the spreadsheet only accounts for getting several losers in a row - not for a general decline in the account. So the percentages you see on the spreadsheet are the absolute minimum - the real chances are likely to be higher.

Even so they can be an eye opener. I've put in a pretty typical trading system, one that wins 35% of the time and winners are 2.5x bigger than losers, averaging 2 trades a day. Risking 5% of your account on each trade you are 99.6% likely to suffer a 50% drawdown within five years because of 14 losers in a row.

Have fun.