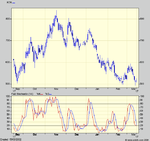

Ive been short on Reuters for a while but recently the downtrend which goes back to the start of the year has been broken quite convinsingly.

Could anyone offer an opinion on how they read the chart?

Sorry but I'm still getting difficulties attaching charts

Thanks

Madog

Could anyone offer an opinion on how they read the chart?

Sorry but I'm still getting difficulties attaching charts

Thanks

Madog