rpmfxtrader

Member

- Messages

- 77

- Likes

- 0

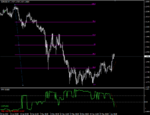

+250 pips on $GBPJPY on going

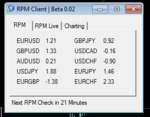

Using only the RPM indicator - trade called here in the FF Forum: http://bit.ly/ac3Ttks.

Using only the RPM indicator - trade called here in the FF Forum: http://bit.ly/ac3Ttks.