Convergence

Active member

- Messages

- 110

- Likes

- 8

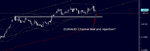

Are there any traders on the site that use SSI as a trading basis? or any newer traders that would like to learn the style? It's not my main trading style but I will usually take a small handful of SSI trades a month mainly on a 4H or daily you can basically just check the charts and the sentiment once a day 30 mins maybe: (see image below) Basically it involves fading the retail sector but its more than just that: price structure, fundamental backdrop, COT, Price action etc all play a part. Its an interesting style with a good rationale (basicaly trading with the smart money). I'm not doing this to teach anything but just to create conversations and stimulate discussions on the markets if anyones interested just post if not the thread will soon be relegated to the bottom of the page

Attachments

Last edited: