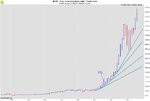

It's all just cyclical...people get all melancholic about it towards the top as though the future is going to be somehow radically different ,but it won't be...the market will sort it out if people are patient enough to allow that to happen..the problem has been that people are not patient so they bid up the price in fear of having to pay more tomorrow...that can happen when inflation is rife and wages are rising etc etc...but if incomes are stagnant and costs in financing have been tightening you'd be brave to think 'real' prices were going to be meaningfully higher tomorrow...just be patient, build your capital meantime ...years ago it was exceptional for people to own theirown homes at the ages that young people today expect to do so......so we have an expectation problem to adjust to as well.

Young people who can't afford to mortgage at this price level with a 'margin of safety' built in should take the 'hard' choice and stand aside until they can otherwise they just increase their chances of ending up in the 'basket case' with all the rest who couldn't make the 'hard' choice. Instant gratification has a cost.

One of the problems we face is 'ignorance' (without conotations)...a couple of years ago I was in conversation witha a couple of guys while on holiday..they were both mid management types ,one with a US blue chip...they were talking and I was listening....they were asserting that property prices would keep on going up by 10% pa ,no doubts !

I enquired if this was possible even if incomes were only rising by 3 to 4% with inflation at half that ?...oh yes ,they said ,it's been going on for years now so why shouldn't it keep going on!

You see these two wouldn't even be your first choices for being 'ignorant' so what does that tell you about the larger universe. If at that time I had any doubts that I should be out of that market then that conversation alone would have been enough to clinch it.

LOL..the problem with waiting for a greater fool to sell to is it might end up being you.

Young people who can't afford to mortgage at this price level with a 'margin of safety' built in should take the 'hard' choice and stand aside until they can otherwise they just increase their chances of ending up in the 'basket case' with all the rest who couldn't make the 'hard' choice. Instant gratification has a cost.

One of the problems we face is 'ignorance' (without conotations)...a couple of years ago I was in conversation witha a couple of guys while on holiday..they were both mid management types ,one with a US blue chip...they were talking and I was listening....they were asserting that property prices would keep on going up by 10% pa ,no doubts !

I enquired if this was possible even if incomes were only rising by 3 to 4% with inflation at half that ?...oh yes ,they said ,it's been going on for years now so why shouldn't it keep going on!

You see these two wouldn't even be your first choices for being 'ignorant' so what does that tell you about the larger universe. If at that time I had any doubts that I should be out of that market then that conversation alone would have been enough to clinch it.

LOL..the problem with waiting for a greater fool to sell to is it might end up being you.