Part 1

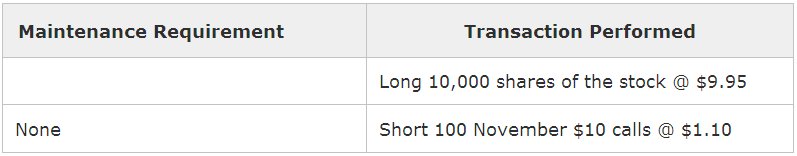

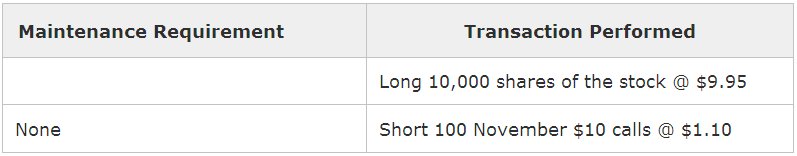

At the end of one my classes at Irvine, an option trader stopped by for some small trading chit-chat. By the look in his eyes, I could tell that he had a large position that was eating away at his sleep as well as his finances. Without disclosing the trader's identity, I would like to describe the situation in which the trader had found himself. He owned 10,000 shares of an unnamed pharmaceutical underlying which, at the time of his entry was trading at $9.95 ($9.95 times 10,000 equals $99,500 in a single trade). Knowing as much as he did about options, he had chosen to sell credit calls on the shares that he owned. As a reminder, each contract controls 100 shares, so if a trader has 10,000 shares (divided by 100) he could sell 100 contracts of covered calls, which is exactly what he did. The strike that he selected was $10 and the stock was trading below $10 at the time of his transaction; $9.95 to be exact. The premium he received equalled $1.10 per contract, or $1.10 times 100 contracts times another 100 since each contract controls 100 shares. The possible maximum profit on the covered calls equalled $11,000 if the stock at expiry closed below $10. In such a scenario he would keep the shares of stock and see the sold calls expire worthless. (Many traders, including him, assume that the maximum profit is theirs to keep from the day they enter the trade. It is only after closing the trade or expiry that a trader knows how much profit he actually gets to keep, for at any given time the trader might have to give some of it back.) The recap of his position is explained visually below in Figure 1

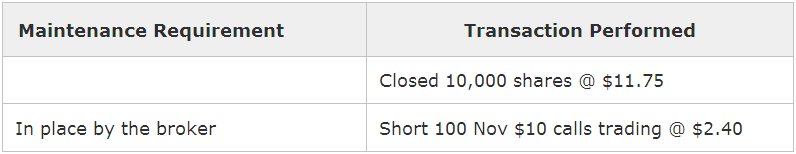

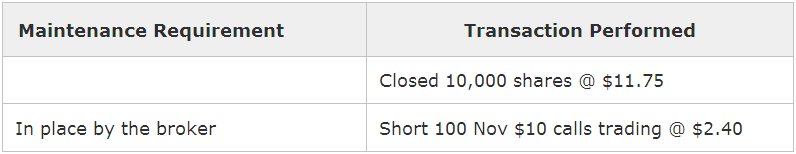

The day he came to see me was Monday afternoon of November expiry week when there were only four trading sessions left. The price of the stock had rallied on good news and he exited his long stock position at approximately $11.75 while he remained short the calls. His calls were left uncovered (naked or exposed). I instantly knew that his broker had probably placed a huge maintenance requirement on his account due to this naked position of 100 short call contracts. We pulled up the option chain together and I observed that the underlying was trading above $12 and the call which he had sold was displaying the Asking price of $2.40. The most logical solution would be to buy back his obligation by repurchasing his sold calls. The illustration below explains the specifics of this scenario as shown in Figure 2

If one really looks at the facts soberly: he purchased the stock at $9.95 and sold it at $11.75, then it is clear that he was profitable on the stock portion of his trade. He bought the stock at $9.95 and sold it for $11.75, earning a profit of $1.80 per share.

Next, the sold call which gave an initial credit of $1.10 per contract needs to be bought back plus an additional $1.30. The sold calls at $1.10 would be repurchased at $2.40 producing a loss of $1.30 per contract.

If the loss on the calls is subtracted from the profit on the stock, $1.80 - $1.30, this still equals a profit of $0.50 per share, which multiplied by 10,000 shares would equal the grand total profit of $5,000. By looking at the trade from this perspective, one could see that he was indeed profitable.

Yet in his opinion that is not how things happened. He viewed it quite differently, for he believed that the premium from the sold calls of $1.10 belonged to him no matter what and giving it back in its entirety was unacceptable to him. By contrast, in reality the $1.10 per contract was never his, for it is only after expiry that the sold premium really fully belongs to the trader. The condition for the entire premium to be kept is that the sold calls expire worthless.

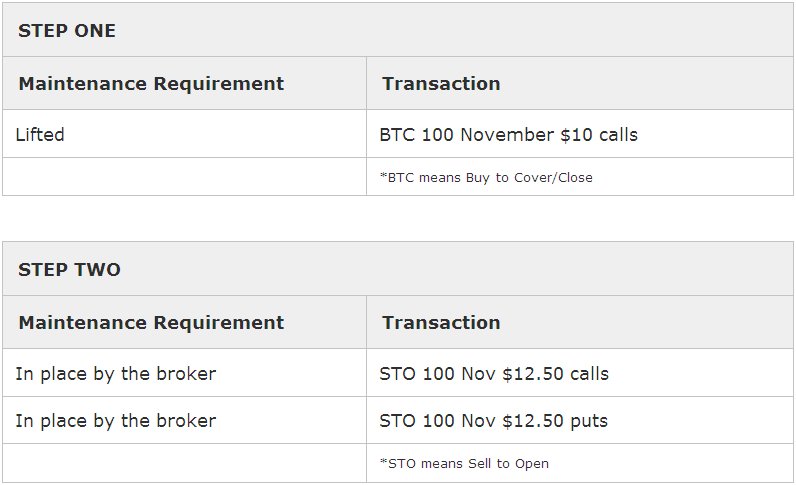

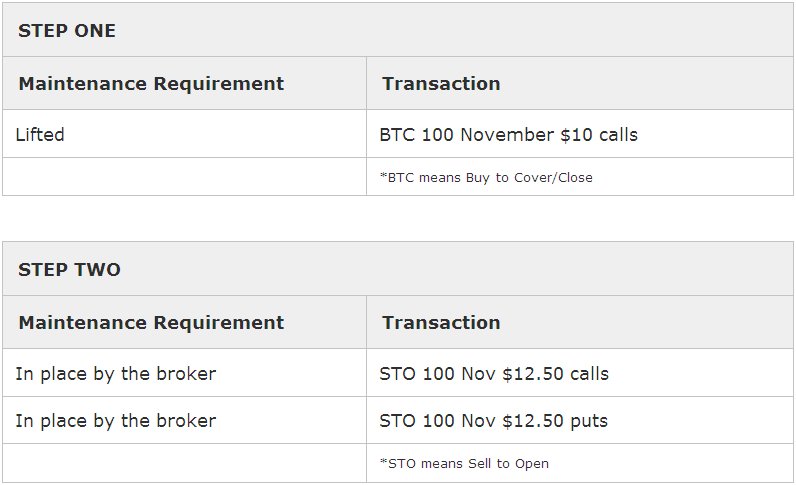

In his case, he did not want to pony up the additional capital of $1.30 per contract to buy back the short calls, so he searched for a solution to at least break even without taking into account the profit he already made on the sale of the stock. He shared with me that his broker, specifically someone at the trade desk, had suggested that he cover his shorts and then sell a straddle at $12.50. We observed by looking at the option chain that the $12.50 calls for November would give him a credit of $0.45 per contract while the $12.50 put would credit him $0.80. When the two premiums were added, the total credit of the two naked positions would credit him $1.25.

I right away understood that this would just prolong the pain of a bad trade and I have previously written an article on that exact topic.

Anyhow, the logic behind this was faulty. When a short straddle is done, it is certain that the trade cannot be wrong on both ends, because one of the two sides would expire worthless while the other one would not. The seller would not be able to keep both premiums. Figure 3 presents the two actions that were suggested by his broker's trade desk.

I personally hate exposure, or nakedness in trading; hence, the first step does make sense to me. Yet, I completely disagree with the step two suggestion that he was given. The reason is simple; step two would equal a completely new trade which would produce not just maintenance on the one side, but double maintenance! Moreover, he would not be able to keep the maximum credit, for he would have to deal with this trade at expiry when he gets assigned on either his put or on his call. The sold call means that he would have to sell the stock which he does not have, and the sold put means that he would be obliged to buy the stock. The stock could keep going above the break even of $14.75 ($12.50 strike + $1.25 premium received) or below the breakeven of $11.25 ($12.50 strike - $1.25 premium received) thus leaving him with unlimited risk.

I asked him what his original intention was, and he explained that he exited the long stock thinking he had exited the whole trade. Hence, the broker's suggestion to perform only the first step in figure 3 makes sense, but the second suggestion of shorting a straddle does not. Opening a new position on the same underlying would equal revenge trading which is a big no-no.

In closing, this situation teaches us several lessons:

Know the mechanics of the instruments you are trading.

Watch your position sizing

Do not let the trade control you at any given time.

Keep an objective perspective on what is going on with your trade and with the market environment that you are in.

Have at least two exit plans, one for profit and the other for a small loss. Exiting an existing position will fit into one of these two scenarios.

If you find that you have made a mistake in your trade, be alert and analyze your trade in the context of the trading environment you find yourself in.

Exiting for a small loss is a rational, unemotional and intelligent solution.

Powerful Lesson of a Painful Trade Part 2

I will now share with readers an option/choice that a trader could have selected instead of going along with his broker's advice of selling a naked straddle.

As a quick review, our option trader from Part 1 of this article had exited his long stock position while leaving a short call completely naked. The broker had suggested buying back the obligation and then selling a naked straddle to make up for the loss on the short calls. This is incorrect logic, for this brings exposure, or nakedness in options trading. Loyal readers know that I am always beating the drum for hedged positions.

While conversing with the trader, I pointed out to him that there was more than one choice to unwind the trade that he had on hand. Together we looked for other options; when trading options, there are certainly multiple options/choices. In the situation that the trader had found himself in, it was clear to me that the position was too big and it was controlling him. In other words, he was no longer thinking straight; he was not controlling his position. He understood at the conscious level, that he had made a major mistake by exiting the long stock position while leaving the calls uncovered, but he could not come up with any other solution to exit the play that was closing in on him. In fact, it was surprising to him that he had not been assigned yet. The position had gone against him over two points and there were only four trading sessions left until Friday of November expiry. Once again, the underlying was a pharmaceutical stock that was quite volatile.

Had I been in his shoes, my first priority would have been the removal of the maintenance by simply buying back the short calls. The idea of buying back the obligation was already discussed and he was aware of it; so I presented another possibility which involved purchasing LEAPS (Long-term Equity Anticipation Securities). We pulled up all the listed option months for the underlying and noticed that the January (2011) $10 calls were trading at the Ask for only $4.00. Had he bought the stock back to cover his short calls at $12.38 where it was trading, it would have cost him $123,800 for 10,000 shares; instead, by buying the Jan 2011 LEAPS, he would save 2/3rds of the cost. Moreover, he would instantly lift the maintenance requirement. Once again, a simple outward purchase of the stock would cost him $123,800, while the cost of this (LEAPS) long-term option would have been only $40,000. If assignment were to take place, at least he was hedged with a long option. Purchasing the long-term option for January of 2011 would also buy him some time, just in case the underlying were to go lower over the next four trading sessions. The logic of this horizontal trade is that it is two dimensional; it is in the short-term bearish in its outlook, yet in the longer-term, it is bullish. For him, if the underlying dropped below $10 in the next four trading sessions, it would be perfect. The sold contracts would expire worthless and he would still have the LEAPS until Jan 2011.

As I presented this to him, he replied full of certainty that the underlying at this point, Monday before the expiry, would NOT go down below $10. The way in which he articulated these words made it clear to me that his opinions about what the market MUST do, are the same opinions which had brought him into this unfortunate situation.

I believe that there are basically two types of errors that a trader can make: A Decision Trading Error and a Data Error. The latter one simply means that, because of platform or some other mechanical failure, the trader at the moment of entry doesn't have sufficient data to make a correct decision. But in the first type of error, the trader has all the available data present at the time of entry, yet they fail to interpret the data accurately. It was clear that this trader had made a Decision Trading Error and that there was no Data Error. Being so strongly opinionated often works against the trader.

Below is the chart of the unnamed pharmaceutical stock. Observe the markings on the chart. The yellow rectangle is the Friday of expiry as shown:

Had he bought the $10 2011 LEAPS and held onto the short calls, they would have expired worthless. By the way, in hindsight vision is 20/20, yet on that fateful Monday, he had to decide what was more important to him: Lifting the maintenance or something else? He felt that he had to choose between selling the short straddle or buying the LEAPS. That reply sounded to me as if he only viewed the world in black or white. He could have also attempted to do half and half; instead of going into the short straddle with 100 contracts, he could have gone into it with 50; and with the other 50 contracts, he could have purchased the LEAPS. In such a case, he could have earned twice as much from the same trade and later on he could say with clarity which one had been the better choice. Either way, the choice had to be his and not mine. It was his trade. I made all the disclaimers to him beforehand.

In closing, this is what really happened to the trade. The following is an excerpt from his email to me, after the expiry. Some of the parts of the email were omitted so the trader and the underlying could remain anonymous.

"? thanks for taking the time to share your thoughts on how to could get out of the mess I created with the stock. You may recall that I had sold Calls with a Strike of 10.00 and the stock was currently selling at about 11.30. I had owned 10,000 shares but sold them so I was in a position where in a couple days I would have to buy them back at maybe 11.30 and sell them for 10.00. What I wound up doing was buying the Calls back at 1.10.

However, as luck would have it, the company announced either late Thursday or first thing Friday that they were going to sell 5 million shares at the price of 9.75. The stock tanked and closed at 9.53. As it turns out, I would have been fine had I done nothing. However, that's the way the market works. Thanks so much for your help."

In conclusion, this article has presented two different endings to a trade; one hypothetical and the other factual. The point is that even if money is lost on the trade, the powerful lessons that could be learned from it should not be lost. Watch your position sizing and do not let the trade control you at any given time. Stick to your rules and be open-minded to adjust to the trading environment that you find yourself in.

Josip Causic can be contacted through The Online Trading Adademy

At the end of one my classes at Irvine, an option trader stopped by for some small trading chit-chat. By the look in his eyes, I could tell that he had a large position that was eating away at his sleep as well as his finances. Without disclosing the trader's identity, I would like to describe the situation in which the trader had found himself. He owned 10,000 shares of an unnamed pharmaceutical underlying which, at the time of his entry was trading at $9.95 ($9.95 times 10,000 equals $99,500 in a single trade). Knowing as much as he did about options, he had chosen to sell credit calls on the shares that he owned. As a reminder, each contract controls 100 shares, so if a trader has 10,000 shares (divided by 100) he could sell 100 contracts of covered calls, which is exactly what he did. The strike that he selected was $10 and the stock was trading below $10 at the time of his transaction; $9.95 to be exact. The premium he received equalled $1.10 per contract, or $1.10 times 100 contracts times another 100 since each contract controls 100 shares. The possible maximum profit on the covered calls equalled $11,000 if the stock at expiry closed below $10. In such a scenario he would keep the shares of stock and see the sold calls expire worthless. (Many traders, including him, assume that the maximum profit is theirs to keep from the day they enter the trade. It is only after closing the trade or expiry that a trader knows how much profit he actually gets to keep, for at any given time the trader might have to give some of it back.) The recap of his position is explained visually below in Figure 1

The day he came to see me was Monday afternoon of November expiry week when there were only four trading sessions left. The price of the stock had rallied on good news and he exited his long stock position at approximately $11.75 while he remained short the calls. His calls were left uncovered (naked or exposed). I instantly knew that his broker had probably placed a huge maintenance requirement on his account due to this naked position of 100 short call contracts. We pulled up the option chain together and I observed that the underlying was trading above $12 and the call which he had sold was displaying the Asking price of $2.40. The most logical solution would be to buy back his obligation by repurchasing his sold calls. The illustration below explains the specifics of this scenario as shown in Figure 2

If one really looks at the facts soberly: he purchased the stock at $9.95 and sold it at $11.75, then it is clear that he was profitable on the stock portion of his trade. He bought the stock at $9.95 and sold it for $11.75, earning a profit of $1.80 per share.

Next, the sold call which gave an initial credit of $1.10 per contract needs to be bought back plus an additional $1.30. The sold calls at $1.10 would be repurchased at $2.40 producing a loss of $1.30 per contract.

If the loss on the calls is subtracted from the profit on the stock, $1.80 - $1.30, this still equals a profit of $0.50 per share, which multiplied by 10,000 shares would equal the grand total profit of $5,000. By looking at the trade from this perspective, one could see that he was indeed profitable.

Yet in his opinion that is not how things happened. He viewed it quite differently, for he believed that the premium from the sold calls of $1.10 belonged to him no matter what and giving it back in its entirety was unacceptable to him. By contrast, in reality the $1.10 per contract was never his, for it is only after expiry that the sold premium really fully belongs to the trader. The condition for the entire premium to be kept is that the sold calls expire worthless.

In his case, he did not want to pony up the additional capital of $1.30 per contract to buy back the short calls, so he searched for a solution to at least break even without taking into account the profit he already made on the sale of the stock. He shared with me that his broker, specifically someone at the trade desk, had suggested that he cover his shorts and then sell a straddle at $12.50. We observed by looking at the option chain that the $12.50 calls for November would give him a credit of $0.45 per contract while the $12.50 put would credit him $0.80. When the two premiums were added, the total credit of the two naked positions would credit him $1.25.

I right away understood that this would just prolong the pain of a bad trade and I have previously written an article on that exact topic.

Anyhow, the logic behind this was faulty. When a short straddle is done, it is certain that the trade cannot be wrong on both ends, because one of the two sides would expire worthless while the other one would not. The seller would not be able to keep both premiums. Figure 3 presents the two actions that were suggested by his broker's trade desk.

I personally hate exposure, or nakedness in trading; hence, the first step does make sense to me. Yet, I completely disagree with the step two suggestion that he was given. The reason is simple; step two would equal a completely new trade which would produce not just maintenance on the one side, but double maintenance! Moreover, he would not be able to keep the maximum credit, for he would have to deal with this trade at expiry when he gets assigned on either his put or on his call. The sold call means that he would have to sell the stock which he does not have, and the sold put means that he would be obliged to buy the stock. The stock could keep going above the break even of $14.75 ($12.50 strike + $1.25 premium received) or below the breakeven of $11.25 ($12.50 strike - $1.25 premium received) thus leaving him with unlimited risk.

I asked him what his original intention was, and he explained that he exited the long stock thinking he had exited the whole trade. Hence, the broker's suggestion to perform only the first step in figure 3 makes sense, but the second suggestion of shorting a straddle does not. Opening a new position on the same underlying would equal revenge trading which is a big no-no.

In closing, this situation teaches us several lessons:

Know the mechanics of the instruments you are trading.

Watch your position sizing

Do not let the trade control you at any given time.

Keep an objective perspective on what is going on with your trade and with the market environment that you are in.

Have at least two exit plans, one for profit and the other for a small loss. Exiting an existing position will fit into one of these two scenarios.

If you find that you have made a mistake in your trade, be alert and analyze your trade in the context of the trading environment you find yourself in.

Exiting for a small loss is a rational, unemotional and intelligent solution.

Powerful Lesson of a Painful Trade Part 2

I will now share with readers an option/choice that a trader could have selected instead of going along with his broker's advice of selling a naked straddle.

As a quick review, our option trader from Part 1 of this article had exited his long stock position while leaving a short call completely naked. The broker had suggested buying back the obligation and then selling a naked straddle to make up for the loss on the short calls. This is incorrect logic, for this brings exposure, or nakedness in options trading. Loyal readers know that I am always beating the drum for hedged positions.

While conversing with the trader, I pointed out to him that there was more than one choice to unwind the trade that he had on hand. Together we looked for other options; when trading options, there are certainly multiple options/choices. In the situation that the trader had found himself in, it was clear to me that the position was too big and it was controlling him. In other words, he was no longer thinking straight; he was not controlling his position. He understood at the conscious level, that he had made a major mistake by exiting the long stock position while leaving the calls uncovered, but he could not come up with any other solution to exit the play that was closing in on him. In fact, it was surprising to him that he had not been assigned yet. The position had gone against him over two points and there were only four trading sessions left until Friday of November expiry. Once again, the underlying was a pharmaceutical stock that was quite volatile.

Had I been in his shoes, my first priority would have been the removal of the maintenance by simply buying back the short calls. The idea of buying back the obligation was already discussed and he was aware of it; so I presented another possibility which involved purchasing LEAPS (Long-term Equity Anticipation Securities). We pulled up all the listed option months for the underlying and noticed that the January (2011) $10 calls were trading at the Ask for only $4.00. Had he bought the stock back to cover his short calls at $12.38 where it was trading, it would have cost him $123,800 for 10,000 shares; instead, by buying the Jan 2011 LEAPS, he would save 2/3rds of the cost. Moreover, he would instantly lift the maintenance requirement. Once again, a simple outward purchase of the stock would cost him $123,800, while the cost of this (LEAPS) long-term option would have been only $40,000. If assignment were to take place, at least he was hedged with a long option. Purchasing the long-term option for January of 2011 would also buy him some time, just in case the underlying were to go lower over the next four trading sessions. The logic of this horizontal trade is that it is two dimensional; it is in the short-term bearish in its outlook, yet in the longer-term, it is bullish. For him, if the underlying dropped below $10 in the next four trading sessions, it would be perfect. The sold contracts would expire worthless and he would still have the LEAPS until Jan 2011.

As I presented this to him, he replied full of certainty that the underlying at this point, Monday before the expiry, would NOT go down below $10. The way in which he articulated these words made it clear to me that his opinions about what the market MUST do, are the same opinions which had brought him into this unfortunate situation.

I believe that there are basically two types of errors that a trader can make: A Decision Trading Error and a Data Error. The latter one simply means that, because of platform or some other mechanical failure, the trader at the moment of entry doesn't have sufficient data to make a correct decision. But in the first type of error, the trader has all the available data present at the time of entry, yet they fail to interpret the data accurately. It was clear that this trader had made a Decision Trading Error and that there was no Data Error. Being so strongly opinionated often works against the trader.

Below is the chart of the unnamed pharmaceutical stock. Observe the markings on the chart. The yellow rectangle is the Friday of expiry as shown:

Had he bought the $10 2011 LEAPS and held onto the short calls, they would have expired worthless. By the way, in hindsight vision is 20/20, yet on that fateful Monday, he had to decide what was more important to him: Lifting the maintenance or something else? He felt that he had to choose between selling the short straddle or buying the LEAPS. That reply sounded to me as if he only viewed the world in black or white. He could have also attempted to do half and half; instead of going into the short straddle with 100 contracts, he could have gone into it with 50; and with the other 50 contracts, he could have purchased the LEAPS. In such a case, he could have earned twice as much from the same trade and later on he could say with clarity which one had been the better choice. Either way, the choice had to be his and not mine. It was his trade. I made all the disclaimers to him beforehand.

In closing, this is what really happened to the trade. The following is an excerpt from his email to me, after the expiry. Some of the parts of the email were omitted so the trader and the underlying could remain anonymous.

"? thanks for taking the time to share your thoughts on how to could get out of the mess I created with the stock. You may recall that I had sold Calls with a Strike of 10.00 and the stock was currently selling at about 11.30. I had owned 10,000 shares but sold them so I was in a position where in a couple days I would have to buy them back at maybe 11.30 and sell them for 10.00. What I wound up doing was buying the Calls back at 1.10.

However, as luck would have it, the company announced either late Thursday or first thing Friday that they were going to sell 5 million shares at the price of 9.75. The stock tanked and closed at 9.53. As it turns out, I would have been fine had I done nothing. However, that's the way the market works. Thanks so much for your help."

In conclusion, this article has presented two different endings to a trade; one hypothetical and the other factual. The point is that even if money is lost on the trade, the powerful lessons that could be learned from it should not be lost. Watch your position sizing and do not let the trade control you at any given time. Stick to your rules and be open-minded to adjust to the trading environment that you find yourself in.

Josip Causic can be contacted through The Online Trading Adademy

Last edited by a moderator: