Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

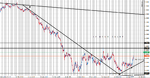

I am almost exclusively a TA trader. But I stay current on FA to correlate market sentiment with the TA. The purpose of this post is to solicit opinions on what is happening with the EurUsd pair. It makes no sense to me and perhaps I am overlooking something.

1. The ECB is continuing QE and even now, discussing a further rate cut (in the news this morning)

2. Europe's economy continues to show weakness

3. The US economy, while not sprinting out of the gate, shows mild stability

4. The Fed has raised rates and is speculated to continue, even if at a more subdued pace and perhaps later in the year

These factors alone should be keeping the pair in the range it was in at the end of 2015. Yes, oil, China and the stock markets, etc are wreaking havoc on all markets. But the recent push to 1.13 (today) just doesn't make any sense to me. Technically, it is defying overbought conditions. Divergences don't result in anything significant. Depending on the timeframe, price action seems to mean nothing, unless you're looking at weekly or daily charts - but then I go back to the FA for a reason and can't find one.

Huge short squeeze?

OR

A safe haven in these economic conditions? Really?

The EU has been my "go to" trade but I have not entered for caution that it could reverse at any time or just keep going up. I feel whatever position I would take would be too risky. Meanwhile, the Yen becomes a safe haven too? What?

I invite anyone to make sense of this. Please enlighten me and probably many others.

1. The ECB is continuing QE and even now, discussing a further rate cut (in the news this morning)

2. Europe's economy continues to show weakness

3. The US economy, while not sprinting out of the gate, shows mild stability

4. The Fed has raised rates and is speculated to continue, even if at a more subdued pace and perhaps later in the year

These factors alone should be keeping the pair in the range it was in at the end of 2015. Yes, oil, China and the stock markets, etc are wreaking havoc on all markets. But the recent push to 1.13 (today) just doesn't make any sense to me. Technically, it is defying overbought conditions. Divergences don't result in anything significant. Depending on the timeframe, price action seems to mean nothing, unless you're looking at weekly or daily charts - but then I go back to the FA for a reason and can't find one.

Huge short squeeze?

OR

A safe haven in these economic conditions? Really?

The EU has been my "go to" trade but I have not entered for caution that it could reverse at any time or just keep going up. I feel whatever position I would take would be too risky. Meanwhile, the Yen becomes a safe haven too? What?

I invite anyone to make sense of this. Please enlighten me and probably many others.