Week 8 Results

Hi everyone, I'd like to start this weeks roundup with an apology to Mike. As it was brought to my attention in another thread that I was going off on a tangent and focusing too much on the group results and trying to outperform the market instead of the individual competition, and because of this (although it was meant jokingly) I suggested to Mike to consider the group result if he didn't think he would be able to win last week. So I'm sorry for that as no one should try to influence another traders open position.

😱

I thought about this a lot yesterday and think I need to shift the focus back to the competition part of the thread, so it is fun for everyone and encourages new people to join in. As I think trying to outperform the market as a group is putting off new people. So from now on I won't mention the group performance vs the market, but I will still leave the market percentages in the spreadsheet so individuals can see how they are doing themselves.

Another new thing I would like to institute is to give the competition a overall timescale. My suggestion for this is quarterly, so next week would be the final week of this quarters competition and then everyone would start from 0% again for the next quarter? I will also probably start this in a new thread, so I can do a better opening post with instructions and an explanation of the ATR scoring method, as this was thought of as the thread developed so any new players have to wade through pages of posts to get to it currently, and also it will allow me to get rid of the flawed points scoring results.

Ok, back to week 8. It was a close one this week between myself and chilltrader. But chilltrader just edged it on Friday to make 1.64% ATR adjusted profit for his trade in Smiths News. I was pleased with my Crude Oil trade though, as I got out near the high of the week, so it was down to my bad entry why I lost this time (but I imagine Black Swan might have something to say about that after I read his good post last night

The Coke bottle trader and his messages from Mars..), but am happy with 254 points I got as it's not something I normally trade. Anyway, enough rambling here are league tables:

League Table

Name_________ATR Adjusted Percentage

chilltrader__________4.56%

TradeTheEasyWay____4.07%

isatrader___________1.86%

Black Swan_________1.83%

tar________________0.01%

Pat494____________-0.85%

wigtrade___________-1.88%

SlipperyC__________-1.97%

Name_________Points

chilltrader__________7

TradeTheEasyWay____6

Pat494____________4

Black Swan________4

isatrader__________3

SlipperyC__________1

wigtrade__________-1

tar_______________-2

So chilltrader takes the lead in percentage terms and on points as we go into the final week of this quarters competition. It's very close though and there could even be a big turn around if Mike and chill both have losing trades next week. So get your picks in as normal over the weekend and we'll see who takes the honours next weekend.

Remember to get your picks in for next weeks game by the end of Sunday, and that it starts at 12am (GMT) on Monday morning.

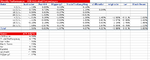

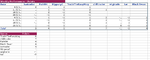

Last weeks results spreadsheet and league tables are attached.

Good luck everyone and thanks for taking part.

Cheers

David