You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Took a short GBPUSD last night on the open at 1.31723 on the news of 40 MPs looking to sign a vote of no confidence in May.

out for 80 pips

out for 80 pips

Good catch.

Good catch.

hows it going your end?

GBPUSD looks good for another entry here for a test of 1.3

hows it going your end?

GBPUSD looks good for another entry here for a test of 1.3

I am still bearish on the GBPUSD pair with a target to at least $1.2950 but it needs to first break decisively $1.3040/30.

I am still bearish on the GBPUSD pair with a target to at least $1.2950 but it needs to first break decisively $1.3040/30.

10 year spread is on the trot, hoping it has legs. The uncertainty of news changing sentiment, i feel is adding risk to any swing trades. I am going to treat each opportunity as though its a single session trade in terms of targets. Tomorrow i think we are going to see some sentiment either way with major political events for brexit take place. There are rebel mps on both sides so its going to be interesting.

Attachments

The uncertainty of news changing sentiment, i feel is adding risk to any swing trades. I am going to treat each opportunity as though its a single session trade in terms of targets. Tomorrow i think we are going to see some sentiment either way with major political events for brexit take place. There are rebel mps on both sides so its going to be interesting.

I agree that political news tend to drive sentiments for just one session as with the recent event unlike tier one fundamentals. Brexit had been rather painful to trade GBP in many respects because of the swings in price movement that it generates be it negative or positive. Trading, unfortunately is never easy.

Out for just over 100 pips on this swing trade.NZB statement yesterday has given an opportunity to sell NZD. The forward guidance brought forward a rate hike to Q2 2019 from Q3 2019. This boosted the NZD but really nothing has changed and they are still divergent with other central banks tightening. Looking at USD which is on a tightening cycle I believe it will further strengthen against the NZD going forward (unless USA fundamentals change). The 4 hour chart is at a nice level for an entry and i have a target sitting in the area of 0.6700

My account is up £50 putting me 1/4 the way to my target (£200) from10 pence per pip on an initial £400 account size. Once I reach the target I have sufficient evidence that I am on the road to success and will begin injecting funds every month. The goal is to start building up the account size and get more experience trading larger sizes. This should put me in a position to gain at least 2 years of results which I can then use to start building a business and potentially get into a fund or similar to allow me to build up enough capital to go professional on my own. Looking forward to the next 6 months to see where I am then. I am starting to feel comfortable in the process and feeling very confident I am on the right track.

Here is my thoughts on the eu. That upper channel sits at the 1.9 handle which is also a double level of support (some nice confluence). If everything remains unchanged, this is the level I'll be looking to open a short.

I agree that the 1.9 handle is a good area to expect solid resistance but what is your fundamental driver to short? You are a fundamental trader, not a technical trader unless you are also exploring technical set ups.

My fundamental driver is that this move off the back of German Gdp is not enough to change central bank policy and that nothing has really changed. Underlying inflation is still flat and the ecb is not tightening while the fed are. Also, Germany is just one member in the euro area and other nations are not near as strong. Germany has been moaning about the ecb and stating they are at risk of overheating. No other members have this problem and some in fact can't afford a rate increase. So there it is, just an excuse to buy euro temporarily for a retrace into an area to sell again.I agree that the 1.9 handle is a good area to expect solid resistance but what is your fundamental driver to short? You are a fundamental trader, not a technical trader unless you are also exploring technical set ups.

My fundamental driver is that this move off the back of German Gdp is not enough to change central bank policy and that nothing has really changed. Underlying inflation is still flat and the ecb is not tightening while the fed are. Also, Germany is just one member in the euro area and other nations are not near as strong. Germany has been moaning about the ecb and stating they are at risk of overheating. No other members have this problem and some in fact can't afford a rate increase. So there it is, just an excuse to buy euro temporarily for a retrace into an area to sell again.

I think your biggest challenge will be timing and stop placement. If you are too early with your short, you might get stopped out before the reversal. That means you will still need to look for some fresh news to initiate the reversal.

Further technical analysis of the trade.

It is a good zone to short as support becomes resistance.

Took 50 pips off that level on EURUSD. Plan is to milk this piggy again when it has another go at the highs. This sentiment shouldn't last long and there is chatter on a December fed hike. How much of it is priced in I think is going to be coupled with the quality of the data being released. Any signs of acceleration in growth and inflation pressure is sure going to make the $ look a little cheap.

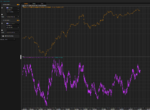

looking to open a swing on AUDNZD on diverging fundamentals and uncertainty in NZ gov policies and central bank. Also look at the yield spreads versus the pair (upper spread, lower pair). Chart looks at a good level also

Attachments

Similar threads

- Replies

- 6

- Views

- 3K

D

- Replies

- 39

- Views

- 7K

D