Hey everyone! I am 23 years old and I am 1 year into my first salary career with a chemical company and have no debt whatsoever. I budget my income fairly well and should have $7,000.00 saved up in the next couple months. I hate having my money sit in the bank and not investing it somewhere and let my money make more money.

Two months ago, I absolutely knew nothing about the stock market, literally nothing at all. However, beginning in January of 2016 I started paper trading stocks using $5,000.00 of "imaginary" money, an excel spreadsheet, and the Yahoo! interactive stock charts so I can monitor stock prices and opens/closes. I have real money to invest, but I wanted to get some kind of experience before possibly throwing my savings away. Throughout this experience, to my surprise I have really grown to enjoy day trading stocks and really think there is potential in this interest. So far, in the first 45 days of 2016 I have doubled my "imaginary" $5,000.00 and my balance sits at just over $10,000.00 with maybe 2 hours of effort per day.

I guess what brings me here to the forum is my skepticism that I am overlooking something that will sober my ideas to pursue day trading for a living. It seems too simple to buy 5,000 shares at $1.00, wait for the price to go up to $1.05 and sell the share for a profit of $230.00 ($250.00 less the $10 commission on the buy and sell).

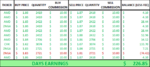

Like I mentioned at the beginning of the post, despite the countless articles and YouTube videos and conversations with my friends that invest, I would consider myself in the very infant stages of understanding the stock market and don't plan on pursuing any real action until I feel comfortable. I am just having trouble researching the "catches" to day trading and was hoping someone could point me in the right direction because I know they have to exist somewhere. I have included below an example of my current day trading activity. Feel free to laugh and criticize if there are flaws in my simplicity of buying/selling. I understand I have a lot to learn and thanks to my pops (love him to death), I have think skin and definitely learn the best by criticism (constructive criticism).

Thanks in advance for the input and all of the time for your responses. 👍

Two months ago, I absolutely knew nothing about the stock market, literally nothing at all. However, beginning in January of 2016 I started paper trading stocks using $5,000.00 of "imaginary" money, an excel spreadsheet, and the Yahoo! interactive stock charts so I can monitor stock prices and opens/closes. I have real money to invest, but I wanted to get some kind of experience before possibly throwing my savings away. Throughout this experience, to my surprise I have really grown to enjoy day trading stocks and really think there is potential in this interest. So far, in the first 45 days of 2016 I have doubled my "imaginary" $5,000.00 and my balance sits at just over $10,000.00 with maybe 2 hours of effort per day.

I guess what brings me here to the forum is my skepticism that I am overlooking something that will sober my ideas to pursue day trading for a living. It seems too simple to buy 5,000 shares at $1.00, wait for the price to go up to $1.05 and sell the share for a profit of $230.00 ($250.00 less the $10 commission on the buy and sell).

Like I mentioned at the beginning of the post, despite the countless articles and YouTube videos and conversations with my friends that invest, I would consider myself in the very infant stages of understanding the stock market and don't plan on pursuing any real action until I feel comfortable. I am just having trouble researching the "catches" to day trading and was hoping someone could point me in the right direction because I know they have to exist somewhere. I have included below an example of my current day trading activity. Feel free to laugh and criticize if there are flaws in my simplicity of buying/selling. I understand I have a lot to learn and thanks to my pops (love him to death), I have think skin and definitely learn the best by criticism (constructive criticism).

Thanks in advance for the input and all of the time for your responses. 👍